Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

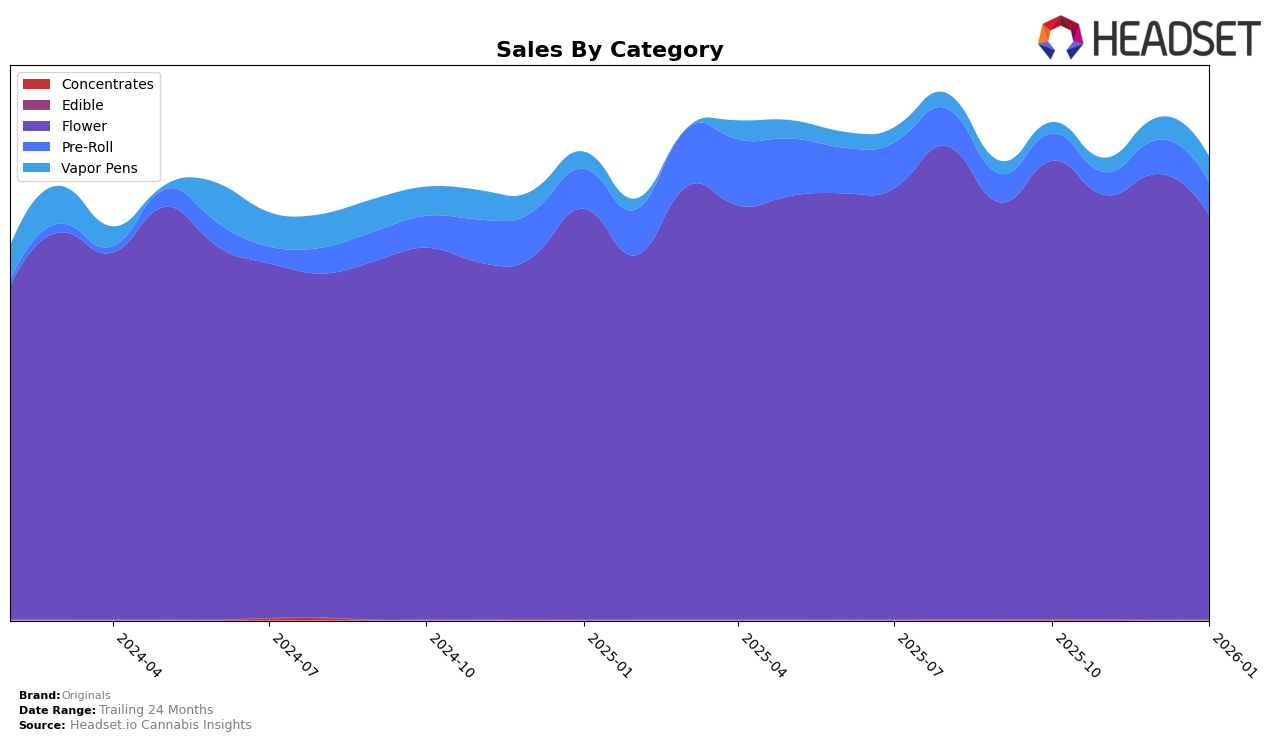

Originals has shown a fluctuating performance in the California market, particularly in the Flower category. Over the span from October 2025 to January 2026, the brand's ranking has experienced a slight decline. Starting at 19th place in October, Originals slipped to 22nd in both November and December, and further down to 25th in January. This downward trajectory in rankings suggests increased competition or potential market challenges in California's Flower category. Notably, Originals managed to maintain its presence within the top 30, yet the decline in rankings could indicate a need for strategic adjustments to regain higher positions.

In terms of sales, Originals experienced a decrease from October to January, with sales figures dropping from over a million dollars to under a million by January. This reduction in sales aligns with the drop in rankings, reflecting potential market pressures or shifts in consumer preferences. The absence of Originals from the top 30 in any other state or category during this period highlights a concentrated market presence primarily in California. This focus might offer opportunities for expansion into other states, but also underscores the importance of strengthening their position within California to counteract current downward trends.

Competitive Landscape

In the competitive landscape of the California flower category, Originals has experienced a notable shift in its market position from October 2025 to January 2026. Initially ranked 19th, Originals saw a decline to 25th by January 2026. This downward trend in rank is accompanied by a decrease in sales, indicating potential challenges in maintaining market share. Meanwhile, competitors such as LAX Packs have shown resilience, climbing from 26th to 23rd, with a noticeable increase in sales during December 2025. Similarly, Traditional Co. improved its rank from 29th to 26th, suggesting a strengthening position in the market. These dynamics highlight the competitive pressures Originals faces, with brands like Eighth Brother, Inc. and Soma Rosa Farms also maintaining consistent sales figures, underscoring the need for Originals to strategize effectively to reclaim its competitive edge.

Notable Products

In January 2026, King Louis (3.5g) emerged as the top-performing product for Originals, climbing from the third position in December 2025 to first place with notable sales of 6968 units. Skywalker (3.5g), which had consistently held the top spot from October to December 2025, moved to second place. Oakstradam OG (3.5g) maintained its steady performance, ranking third, as it did in November 2025. A new entry, Oaksterdam OG Distillate Disposable (1g) in the Vapor Pens category, debuted at fourth place. SFV OG (3.5g) returned to the rankings in fifth place, showing a resurgence from its absence in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.