Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

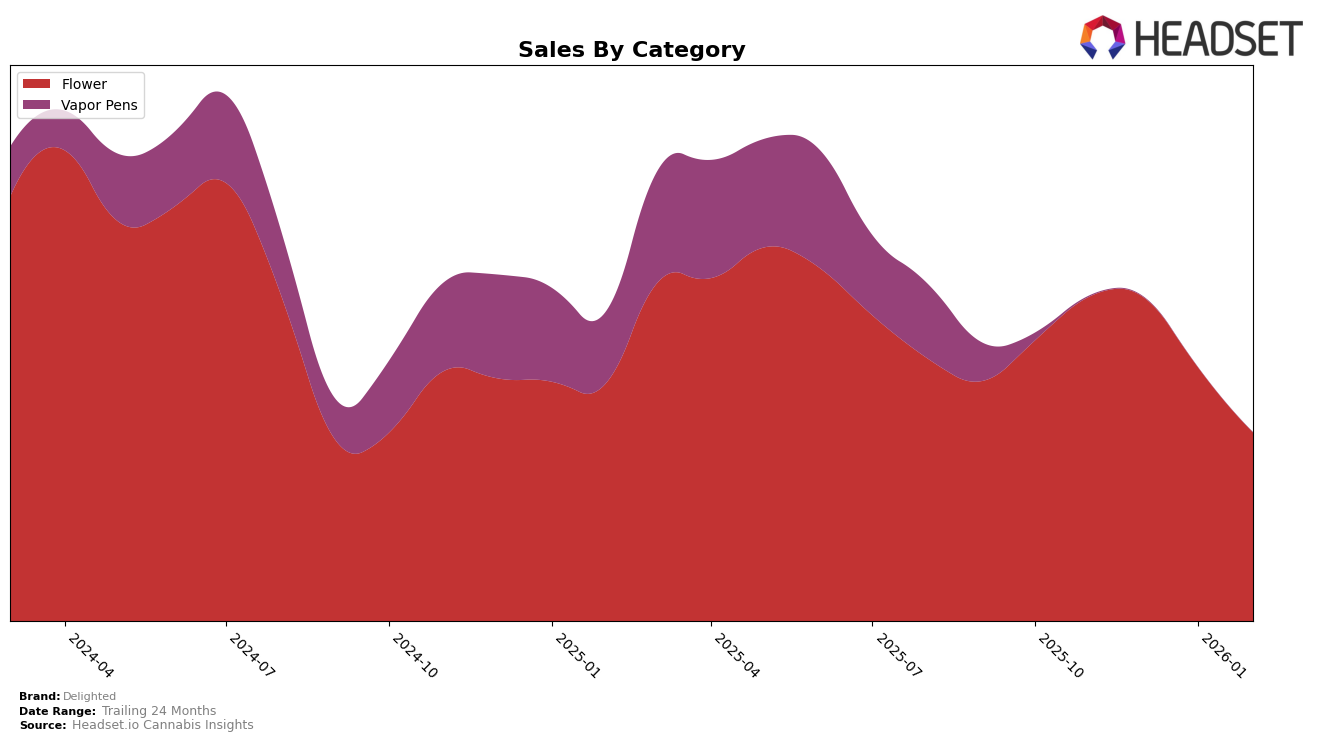

Delighted's performance in the California market for the Flower category has seen some fluctuations over the past few months. In November 2025, the brand was ranked 19th, which slightly improved to 18th in December. However, the beginning of 2026 marked a downward trend as Delighted dropped to 22nd in January and further to 27th by February. This decline in ranking is coupled with a noticeable decrease in sales, from over $1.26 million in November to approximately $734,797 by February. Such a trend might suggest challenges in maintaining market share or increased competition within the category.

It is notable that Delighted managed to stay within the top 30 brands in the Flower category in California, even as their ranking slipped. This consistency indicates a continued presence in a competitive market, though the drop in rankings and sales could be a signal for the brand to reassess their strategies. The absence of Delighted in the top 30 of any other state or province during this period could be seen as a missed opportunity for expansion or a reflection of strategic focus on the California market. This performance invites further analysis into the brand's approach and potential areas for growth or improvement.

Competitive Landscape

In the competitive landscape of the California flower category, Delighted has experienced notable fluctuations in its rank and sales over the past few months. Starting from a strong position in November 2025 at rank 19, Delighted saw a gradual decline, dropping to rank 27 by February 2026. This downward trend in rank is mirrored by a significant decrease in sales, from a high in November 2025 to a lower figure in February 2026. In contrast, Eighth Brother, Inc. maintained a relatively stable position, hovering around the mid-20s in rank, while Daze Off showed an upward trajectory, improving from rank 35 to 29. Meanwhile, Mr. Zips demonstrated a remarkable climb from rank 47 to 28, suggesting a strong competitive push. Smoken Promises also showed resilience, improving its rank slightly by February 2026. These dynamics indicate a competitive pressure on Delighted, necessitating strategic adjustments to regain its earlier market position and sales momentum.

Notable Products

In February 2026, Moon Zyrup 3.5g from Delighted retained its top position in the Flower category, despite a decrease in sales to 3703 units. Velvet Glove 3.5g made a notable entry into the rankings, securing the second spot with impressive sales figures. Alien Kush 3.5g slipped to third place from its previous second position in January, indicating a downward trend. Lemon Lavender 3.5g maintained a steady presence, moving up to fourth place from fifth in January. Lemon Cherry Runtz 3.5g entered the rankings in fifth place, highlighting its growing popularity among consumers.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.