Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

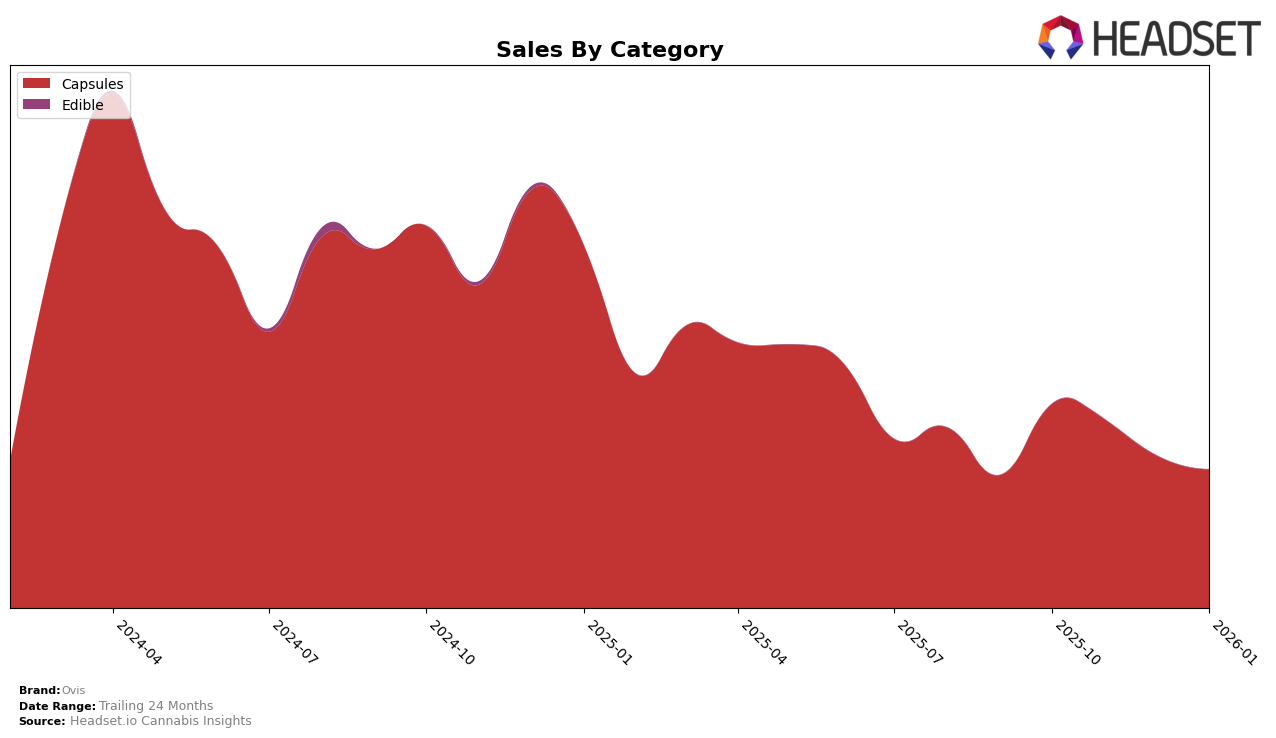

Ovis has demonstrated a consistent performance in the Capsules category within Alberta. For three consecutive months, from October to December 2025, Ovis maintained a steady 10th place ranking. However, there was a slight dip in January 2026, where the brand fell to 11th place. This shift might indicate increased competition or a seasonal fluctuation in consumer preferences. Despite this minor drop in ranking, the brand's sales figures suggest a stable market presence, with a noticeable decline in December, which could be attributed to typical end-of-year trends or specific market dynamics in Alberta.

It's important to note that Ovis's presence in the top 30 brands in other states or provinces and categories is not highlighted, suggesting that the brand may not be as competitive or widely recognized outside Alberta's Capsules category. This limitation could either be a strategic focus on a particular market or a potential area for growth and expansion. The absence from other rankings might be seen as a drawback, but it also presents an opportunity for Ovis to explore and penetrate new markets or categories where they are currently not represented in the top 30. This focused approach in Alberta could be a stepping stone for broader regional or category success in the future.

Competitive Landscape

In the Alberta capsules market, Ovis has experienced a slight decline in its competitive standing, moving from a consistent 10th place from October to December 2025 to 11th place in January 2026. This shift is notable as it coincides with a decrease in sales from November to December, followed by a minor recovery in January. Meanwhile, Indiva maintained a stable position at 9th place, despite a gradual decrease in sales over the same period. Simply Bare showed a strong performance, ranking 5th in December, although their rank was missing in November and January, indicating potential fluctuations in their market presence. Dosecann remained at 11th place in October and November, but their absence from the rankings in December and January suggests a potential decline or strategic withdrawal. The entry of FRANK into the top 10 in January could have contributed to Ovis's drop in rank, highlighting the dynamic and competitive nature of the Alberta capsules market.

Notable Products

In January 2026, the top-performing product for Ovis was Blue THC Softgel 15-Pack (150mg), maintaining its first-place ranking from previous months with sales of 500 units. The Blue THC Softgel 50-Pack (125mg) held steady in the second position, unchanged from November and December 2025. The CBG/CBD/THC 1:1:1 Softgels 15-Pack (75mg CBG, 75mg CBD, 75mg THC) remained in third place, consistent with its ranking in the last two months of 2025. The CBN Goftgels 10-Pack (200mg CBN) re-entered the rankings in fourth place, having not ranked in December. The CBD Softgels 30-Pack (1500mg CBD) dropped to fifth place, a slight decline from its fourth-place position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.