Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

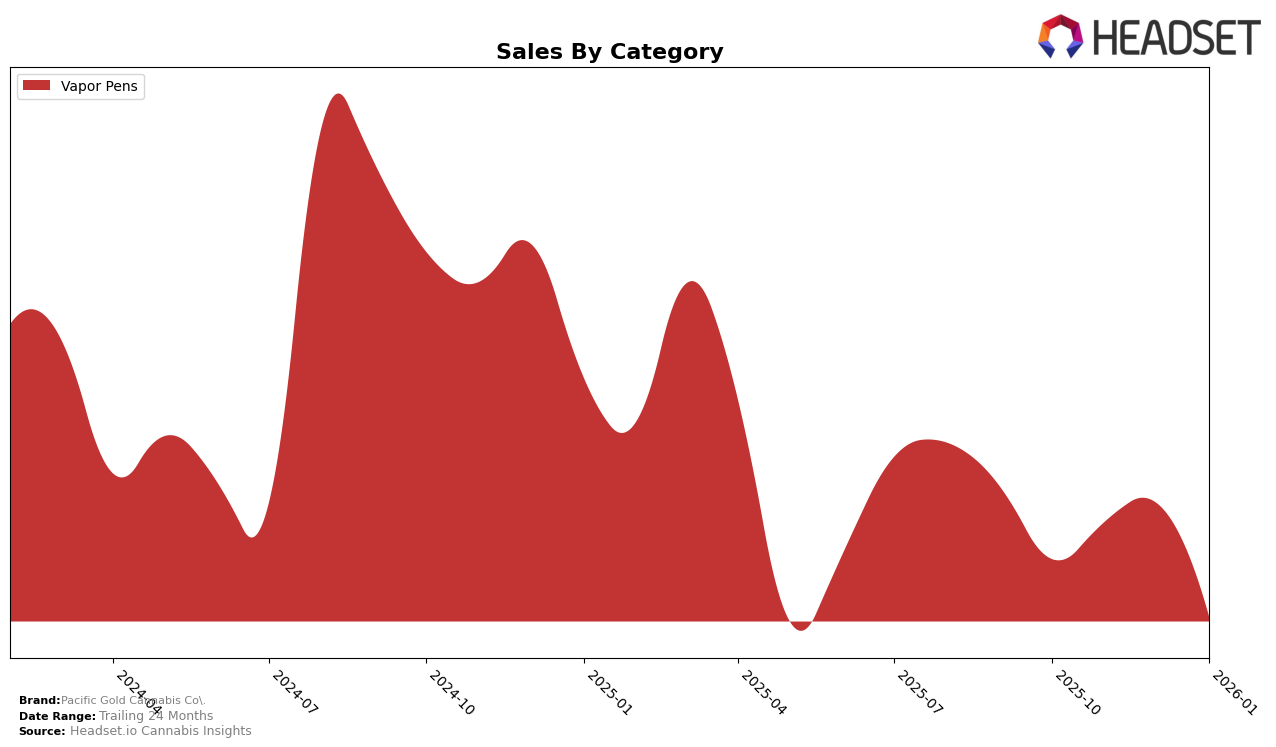

Pacific Gold Cannabis Co. has shown a varied performance across different states and product categories. In the Vapor Pens category in Ohio, the brand has maintained a presence within the top 30 rankings over the past few months. Notably, their position improved from 30th in October 2025 to 25th in December 2025, before dropping back to 30th in January 2026. This fluctuation in rankings suggests a competitive market environment where maintaining a steady position is challenging. Despite the drop in January, the brand's ability to remain in the top 30 indicates a consistent consumer base in Ohio's vapor pen market.

Interestingly, Pacific Gold Cannabis Co.'s sales figures in Ohio show an upward trend from October to December 2025, with a notable peak in December. However, January 2026 witnessed a decline in sales, which could be attributed to various factors such as seasonal demand shifts or increased competition. The absence of Pacific Gold Cannabis Co. from the top 30 in other states or categories is a point of concern, highlighting areas where the brand could potentially expand or improve its market penetration. This data provides a glimpse into the brand's performance but leaves room for further exploration into other states and categories where Pacific Gold Cannabis Co. might be making strategic moves.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, Pacific Gold Cannabis Co. has experienced fluctuating rankings, indicating a dynamic market position. From October 2025 to January 2026, Pacific Gold Cannabis Co. saw its rank improve from 30th to 25th in December, before dropping back to 30th in January. This fluctuation contrasts with Pure Ohio Wellness, which consistently stayed within the top 30, peaking at 25th in November. Meanwhile, Good Green emerged in January 2026 at 28th, suggesting a new competitive presence. Meigs County Grown showed a steady climb, reaching 31st in January from 43rd in October, while The Solid also improved its position from 50th to 34th over the same period. These trends highlight the competitive pressure on Pacific Gold Cannabis Co. to maintain and enhance its market share amidst emerging and improving brands.

Notable Products

In January 2026, the top-performing product for Pacific Gold Cannabis Co. was Strawberry Diesel Cookies Distillate Disposable (1g) in the Vapor Pens category, reclaiming the number one rank with sales of 898 units. Purple Urkle Distillate Disposable (1g) closely followed in second place, having improved from its fifth position in November 2025. Pineapple Express Distillate Disposable (1g) maintained a strong presence at third, though it experienced a slight drop from its second-place ranking in December 2025. Blueberry Distillate Disposable (1g) continued to perform well, securing the fourth position. Super Lemon Haze Distillate Disposable (1g) remained consistent in the fifth spot, mirroring its ranking from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.