Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

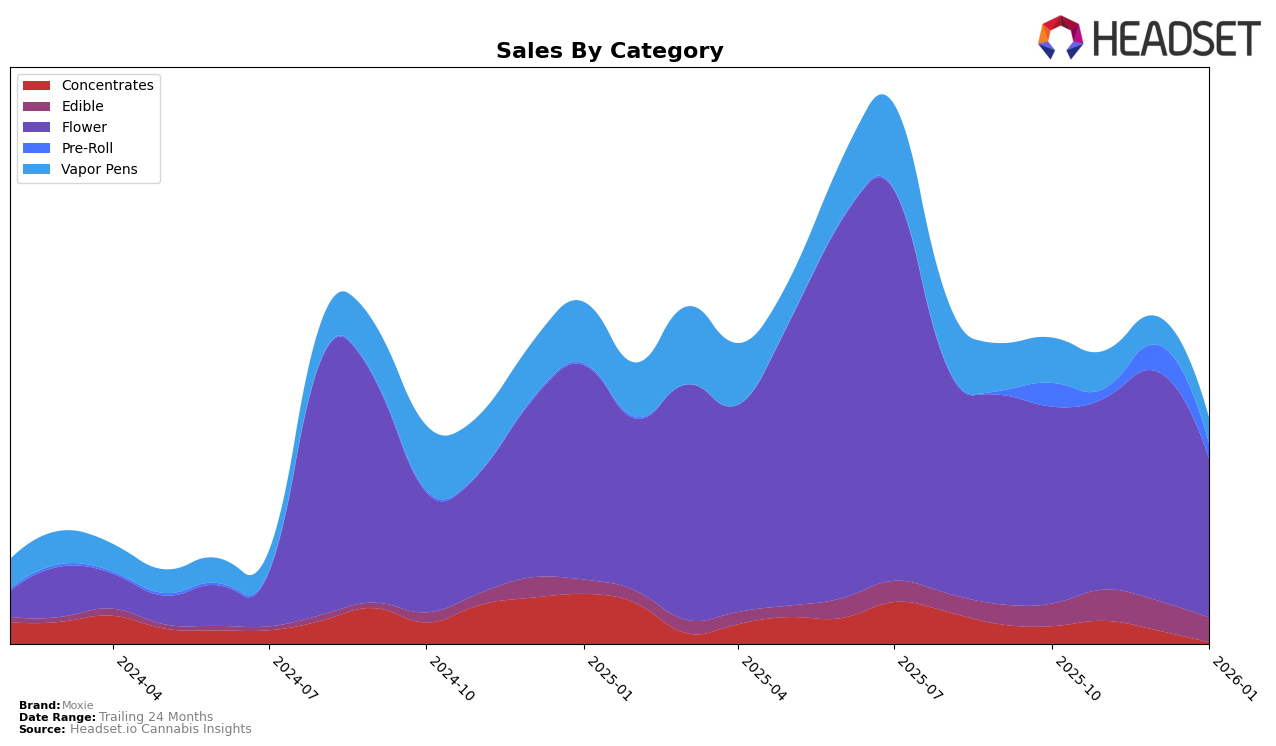

Moxie's performance in Ohio across various categories demonstrates both stability and volatility. In the Concentrates category, Moxie maintained a presence within the top 30 brands, ranking 17th in October 2025 and slightly improving to 16th in November before dropping to 20th in December. However, by January 2026, Moxie was no longer in the top 30, indicating a potential challenge in maintaining market share. The Flower category showed consistent performance, with Moxie holding the 22nd position from October through December before slipping to 24th in January. This stability suggests a steady demand for their Flower products, even as sales fluctuated.

In the Edible category, Moxie displayed some resilience by maintaining its presence in the top 30, albeit at the lower end, moving from 27th in October to 30th in January. This consistent ranking highlights a sustained, though modest, market presence. The Pre-Roll category saw more variability, with rankings swinging from 16th in October to 27th in January, reflecting a fluctuating consumer interest or competitive pressure. Notably, Moxie's Vapor Pens did not make it into the top 30 in any of the months, suggesting significant room for growth or a need for strategic adjustments in this category. Overall, while Moxie has maintained a foothold in certain categories, there are clear areas for improvement to bolster their market position in Ohio.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Moxie has experienced fluctuations in its rank and sales, indicating a dynamic market presence. Throughout the months from October 2025 to January 2026, Moxie's rank hovered around the 22nd position, slipping slightly to 24th in January. This suggests a stable yet slightly declining position in the top 20 brands. In contrast, High Supply / Supply showed a more volatile trajectory, starting at 17th and dropping to 27th in November before recovering to 22nd by January, indicating competitive pressure. Meanwhile, Common Citizen and Galenas remained outside the top 20, with ranks fluctuating in the mid-20s to 30s range, suggesting they are not immediate threats to Moxie's position. Interestingly, Woodward Fine Cannabis showed a positive trend, improving its rank from 29th to 23rd, potentially challenging Moxie's standing. Overall, Moxie's sales peaked in December 2025 but saw a decline in January 2026, highlighting the need for strategic adjustments to maintain and improve its competitive edge in the Ohio flower market.

Notable Products

In January 2026, Moxie's top-performing product was Wingsuit (2.83g) in the Flower category, maintaining its number one rank since October 2025 with sales of 6139 units. Gelato Cookies (2.83g) rose to the second position in the Flower category, improving from its third-place rank in November 2025. The GG4 Pre-Roll 2-Pack (1g) notably climbed to the third position, up from fourth in December 2025. Strawberry Banana Gummies 10-Pack (100mg) debuted in the rankings at fourth place in the Edible category. Lastly, GG4 Popcorn (14.15g) entered the rankings in fifth place, highlighting a growing interest in larger Flower offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.