Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

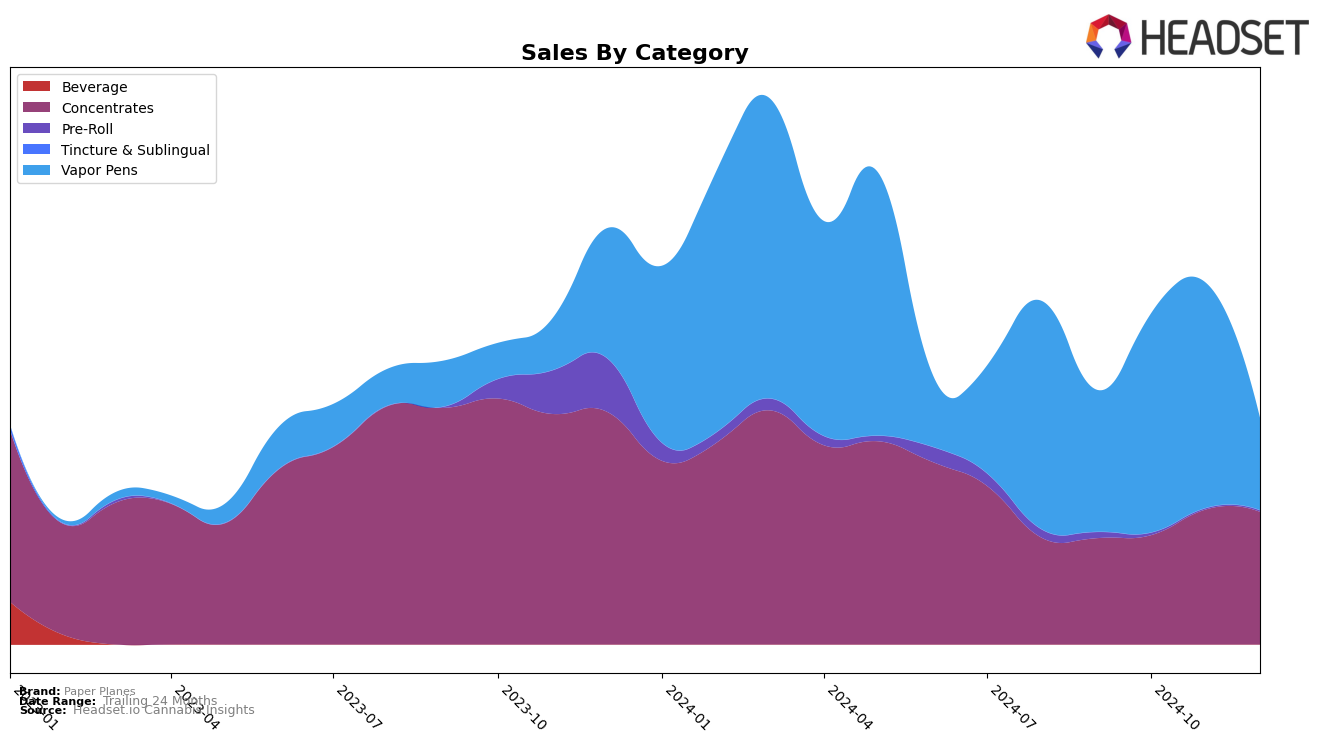

Paper Planes has shown notable performance in the California market, particularly in the Concentrates category. Over the period from September to December 2024, the brand has maintained a presence within the top 30, with rankings fluctuating slightly between 18th and 21st place. This consistent presence highlights a stable demand for their concentrates, with a peak in sales observed in November. However, the slight drop from 18th to 20th place in December suggests a competitive landscape that could be impacting their ranking despite strong sales figures.

In contrast, Paper Planes' performance in the Vapor Pens category in California has been more volatile. While they improved their ranking from 67th in September to 50th in November, a significant drop to 82nd in December indicates a challenging market environment or potential shifts in consumer preferences. This decrease in rank, despite a strong showing in October and November, underscores the competitive nature of the vapor pen market. The brand's inability to maintain a top 30 position by December suggests a need for strategic adjustments to regain market traction in this category.

Competitive Landscape

In the competitive landscape of the California concentrates market, Paper Planes has shown a steady presence, with its rank fluctuating between 18th and 21st place from September to December 2024. Despite not breaking into the top 10, Paper Planes' sales have demonstrated a positive trend, peaking in November before a slight dip in December. This indicates a resilient performance amidst strong competition. For instance, Nasha Extracts experienced a significant drop from 12th to 19th place, reflecting a notable decline in sales, while Creme De Canna fell out of the top 20 in December after maintaining a higher rank earlier in the year. Meanwhile, Bear Labs maintained a stronger position, although it too saw a decline in December. The competitive shifts suggest that while Paper Planes faces challenges in climbing the ranks, its consistent sales performance positions it as a stable player in the market, potentially appealing to consumers seeking reliability amidst fluctuating brand performances.

Notable Products

In December 2024, Paper Planes' top-performing product was Grape Biscotti Shatter (1g) in the Concentrates category, which climbed from third place in November to first place with sales hitting 1764 units. Gelato Zkittlez Shatter (1g) maintained its position as the second-best seller, showing consistent performance from the previous month. Girl Scout Cookies Premier Nug Run Shatter (1g) entered the rankings in December, taking the third spot. London Jelly Shatter (1g) and Blueberry Pancakes Shatter (1g) rounded out the top five at fourth and fifth positions, respectively, both making their debut in the rankings. The notable shift in December was the rise of Grape Biscotti Shatter (1g), as it overtook its competitors to become the top seller.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.