Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

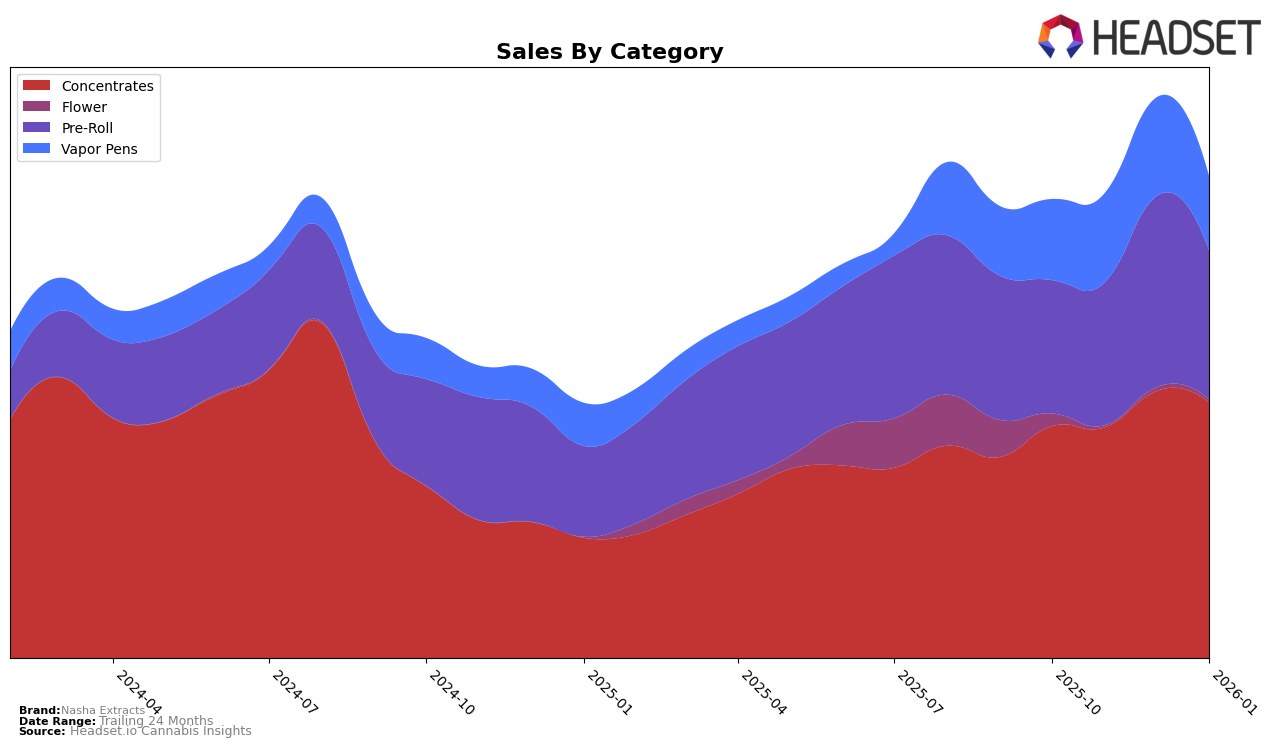

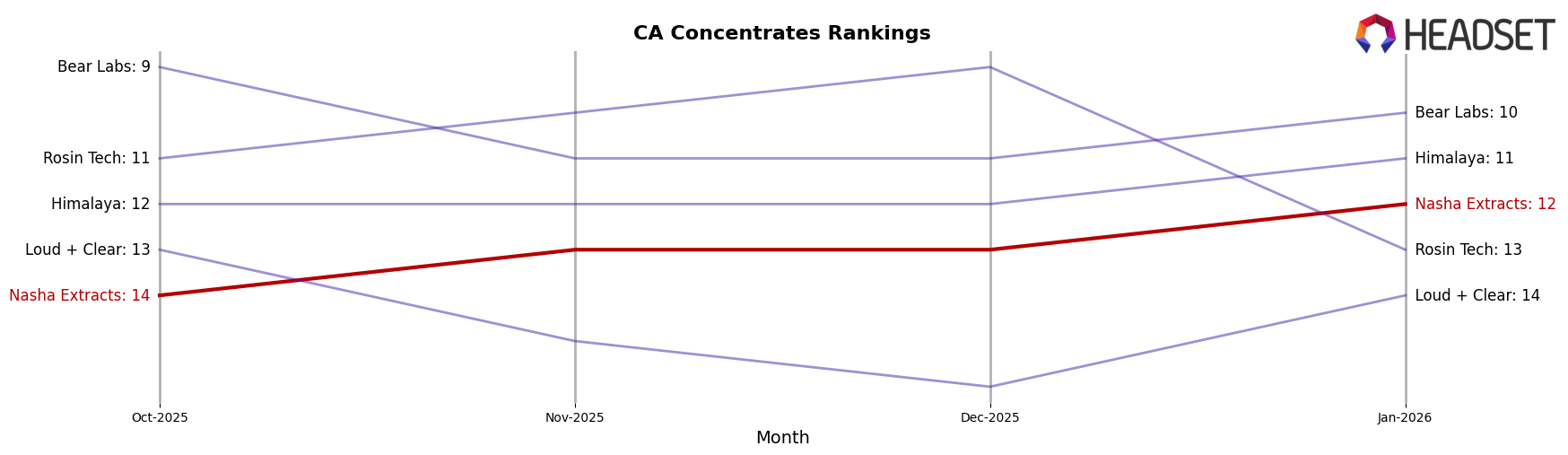

Nasha Extracts has shown a consistent upward trend in the Concentrates category in California. Starting at rank 14 in October 2025, the brand climbed to 12th place by January 2026. This steady improvement is indicative of their growing popularity and market presence in this category. The sales figures also reflect this positive trend, with a notable increase from October to December before a slight dip in January. However, it's worth mentioning that Nasha Extracts did not make it into the top 30 brands in any other state or province for Concentrates, which could be seen as a limitation in their geographical reach.

In contrast, their performance in the Pre-Roll and Vapor Pens categories in California has been more volatile. For Pre-Rolls, Nasha Extracts improved their ranking from 77th in October to 58th in December, before slightly dropping to 59th in January. This fluctuation suggests a competitive market where maintaining a steady position can be challenging. The Vapor Pens category shows a similar pattern, with the brand peaking at 83rd in December but falling back to 94th by January. This inconsistency might point to challenges in product differentiation or consumer preference shifts. Again, the absence of rankings in other states or provinces for these categories highlights potential areas for expansion or improvement.

Competitive Landscape

In the competitive landscape of California's concentrates market, Nasha Extracts has shown a steady improvement in its rankings from October 2025 to January 2026, moving from 14th to 12th place. This upward trend is notable, especially when compared to competitors like Himalaya, which maintained a consistent rank of 12th before rising to 11th in January 2026, and Bear Labs, which fluctuated but remained in the top 10. Despite a dip in sales in January 2026, Nasha Extracts' overall sales trajectory remained relatively stable, contrasting with Rosin Tech, which experienced a significant drop in rank from 9th to 13th in the same period. Meanwhile, Loud + Clear saw a decline in rank, indicating potential market share opportunities for Nasha Extracts. These dynamics suggest that Nasha Extracts is effectively navigating the competitive pressures in the California concentrates market, positioning itself for potential growth against its peers.

Notable Products

In January 2026, Topper Bubble Hash (1g) from Nasha Extracts maintained its position as the top-performing product, holding the number one rank consistently since October 2025 with a sales figure of 4,307 units. Altitude - Sour Diesel x Strawberry Bomb Hash Infused Pre-Roll (1g) remained steady at the second position since its introduction in December 2025. Altitude Hash Infused Pre-Roll (1g) climbed from fourth place in December to third in January, showcasing a positive trend. Meanwhile, Altitude - Blue Dream x Madd Fruit Hash Infused Pre-Roll (1g) debuted at the fourth position in January. Altitude - Guava Gift x Strawberry Bomb Infused Pre-Roll (1g) experienced a slight drop, moving from third in December to fifth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.