Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

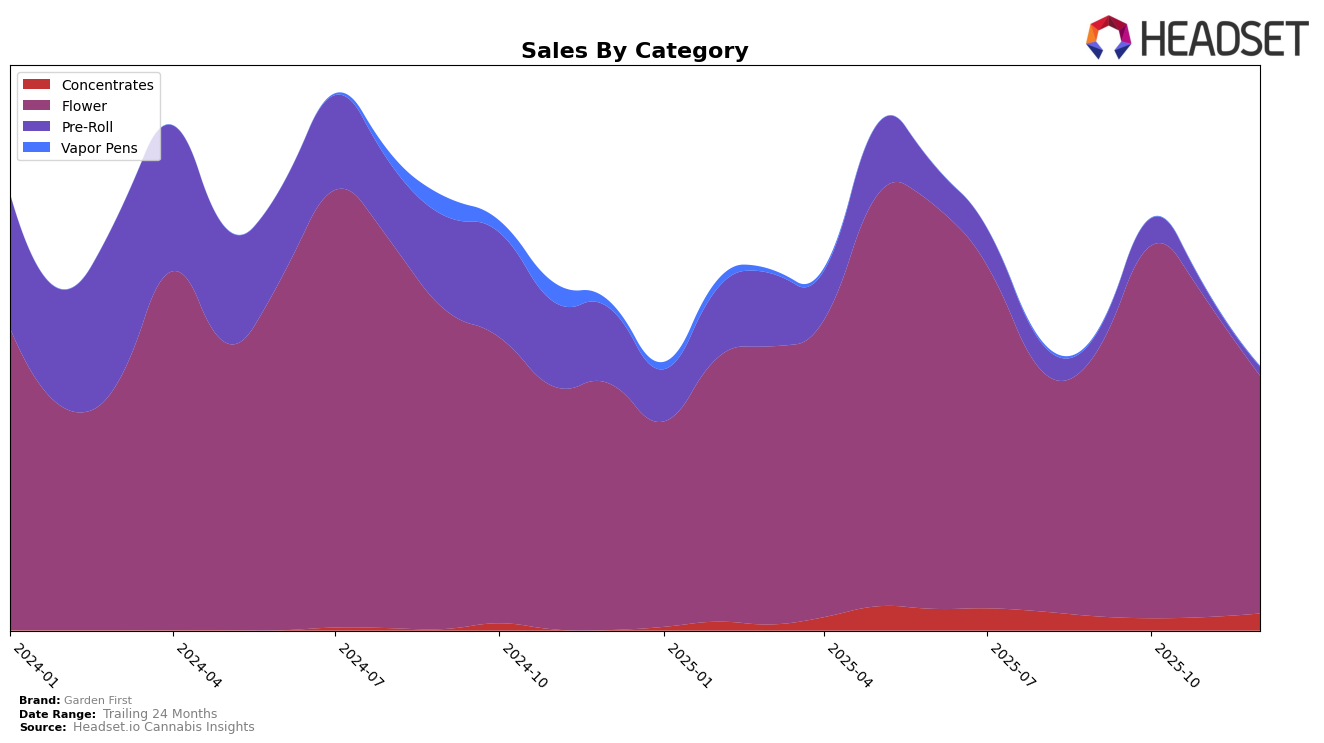

Garden First has shown a mixed performance across different product categories in Oregon. In the Flower category, the brand experienced a notable fluctuation, starting at rank 25 in September 2025, rising to 18 in October, and then dropping back to 29 by December. This indicates some volatility in their Flower sales, which peaked in October before declining towards the end of the year. On the other hand, their presence in the Concentrates category was less stable, with rankings outside the top 30 in October but returning to 67 by December. This suggests a rebound in sales, following a dip in November.

For Pre-Rolls, Garden First has had a less consistent trajectory, with rankings only available for September and October 2025, where they saw improvement from 84 to 68. This upward movement indicates a positive reception during those months, although the absence of rankings for November and December implies they fell out of the top 30, highlighting a potential area for growth. The varied performance across categories suggests that while Garden First has strong points, particularly in Flower, there are opportunities to strengthen their market presence in Concentrates and Pre-Rolls in Oregon.

Competitive Landscape

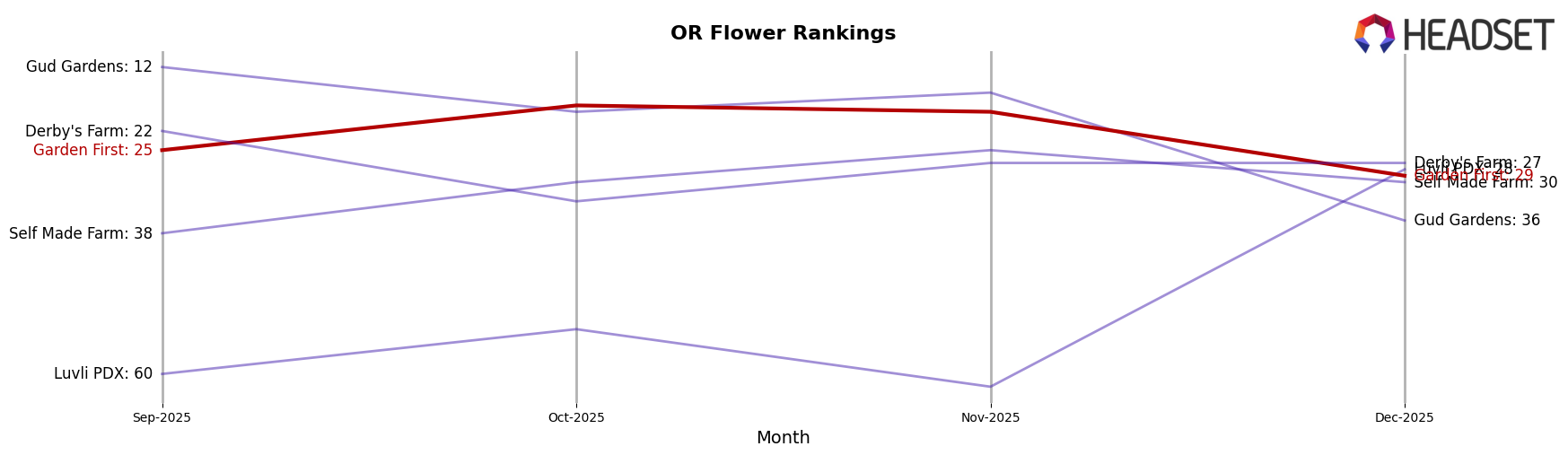

In the competitive landscape of the Oregon flower market, Garden First has experienced notable fluctuations in its ranking over the last few months. In September 2025, Garden First was ranked 25th, climbing to 18th in October, maintaining a strong position at 19th in November, but dropping to 29th in December. This decline in December aligns with a general decrease in sales, suggesting potential challenges in maintaining market share. Meanwhile, Self Made Farm showed a positive trajectory, improving from 38th in September to 30th in December, while Luvli PDX made a significant leap from 62nd in November to 28th in December, indicating a strong end-of-year performance. Gud Gardens, however, saw a decline from 12th in September to 36th in December, which could suggest a shift in consumer preferences or competitive pressures. Derby's Farm remained relatively stable, ending December at 27th. These dynamics highlight the competitive pressures Garden First faces, emphasizing the need for strategic adjustments to regain and sustain higher rankings and sales momentum in the Oregon flower market.

Notable Products

In December 2025, Golden Goat (1g) led the sales for Garden First, reclaiming its top position after a brief dip to fourth in November, with a notable sales figure of 1195 units. 818 Headband (1g) secured the second spot, dropping from its first position in November, with sales slightly lower at 796 units. Rocky Mountain Moonshine (1g) made a comeback to third place, despite not being ranked in the previous months, showing strong sales recovery. Lime Dawg (Bulk) maintained a steady presence, ranking fourth with consistent sales figures from the prior month. Lime Dawg (1g) rounded out the top five, showing little change in rank and sales from November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.