Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

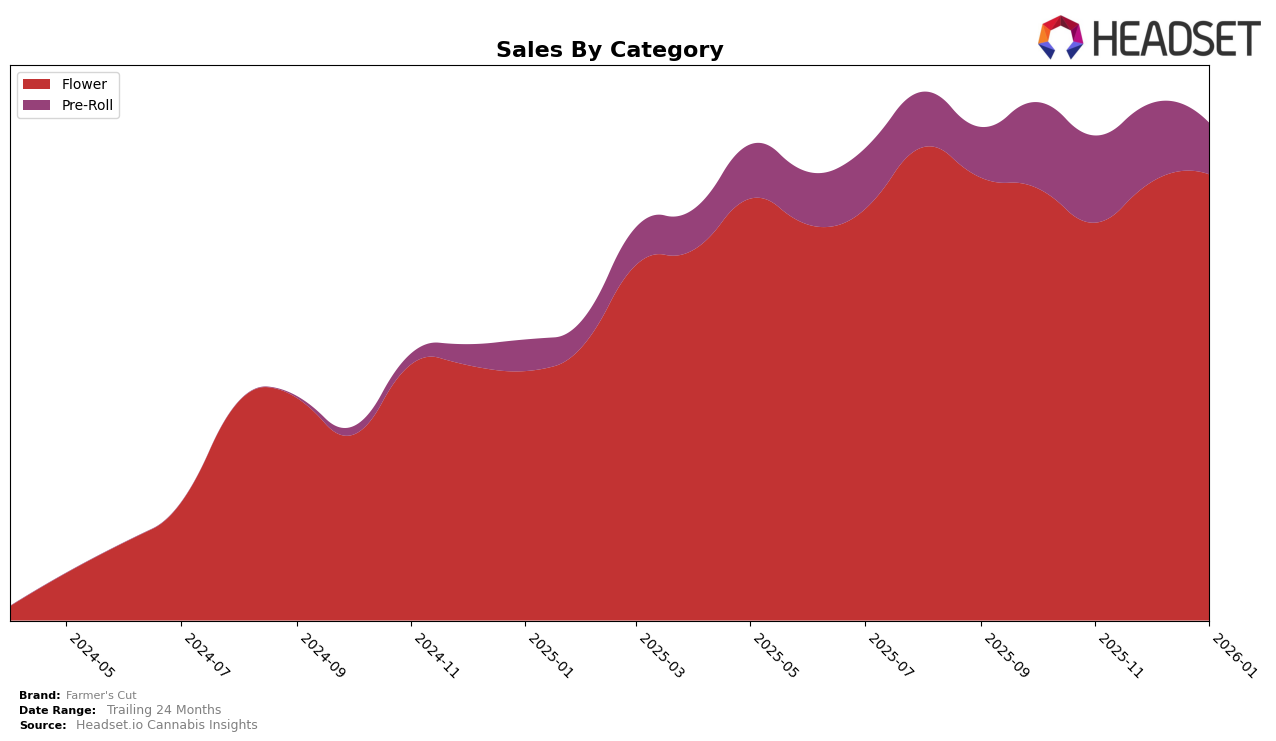

Farmer's Cut has shown a consistent performance in the Massachusetts flower category, maintaining a strong position within the top 5 brands over the past few months. Starting at rank 3 in October 2025, they briefly slipped to rank 4 in November but quickly regained their position by December, ultimately climbing to rank 2 by January 2026. This upward movement indicates a positive trend and suggests a growing consumer preference for their flower products. The sales figures reflect this trend, with a steady increase from approximately $2.2 million in October to over $2.2 million by January. Such performance highlights Farmer's Cut's competitive edge in the flower category within Massachusetts.

In contrast, the pre-roll category in Massachusetts presents a more challenging landscape for Farmer's Cut. Despite starting at rank 12 in October and maintaining this position in November, the brand experienced a decline to rank 16 in December and further slipped to rank 26 by January 2026. This downward trajectory indicates potential challenges in maintaining market share within the pre-roll segment. The sales decline from approximately $440,000 in November to around $262,000 in January further underscores the competitive pressures Farmer's Cut faces in this category. The brand's absence from the top 30 in other states or categories suggests areas for potential growth or strategic realignment.

Competitive Landscape

In the Massachusetts flower category, Farmer's Cut has demonstrated a notable shift in its competitive positioning over the past few months. Starting in October 2025, Farmer's Cut held the third rank, but experienced a slight dip to fourth in November. However, by January 2026, it had climbed to second place, showcasing a positive trajectory in terms of rank. This upward movement is significant, especially considering the consistent top position of Simply Herb, which maintained its number one rank throughout this period. Meanwhile, High Supply experienced a decline from second to fourth place by January 2026, which may have contributed to Farmer's Cut's improved ranking. Additionally, Perpetual Harvest showed some fluctuations but remained a strong contender, ending January in third place. Farmer's Cut's sales figures also reflect this positive trend, with a notable increase from November to January, suggesting effective strategies in capturing market share and consumer preference in a competitive landscape.

Notable Products

For January 2026, Marshmallow Pave Pre-Roll (1g) emerged as the top-performing product for Farmer's Cut, boasting sales of 6,926 units. Following closely, Mystic Mountain Blueberry Pre-Roll (1g) secured the second position, although it dropped from its previous first-place rank in October 2025. Churro Drop (3.5g) entered the rankings at third place, marking a strong debut. Gas O Lina (3.5g) fell to fourth place after leading in November 2025, while Pink Lemonade X Gelato (3.5g) rounded out the top five. This shift in rankings highlights a dynamic market where new entries and fluctuating consumer preferences impact product performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.