Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

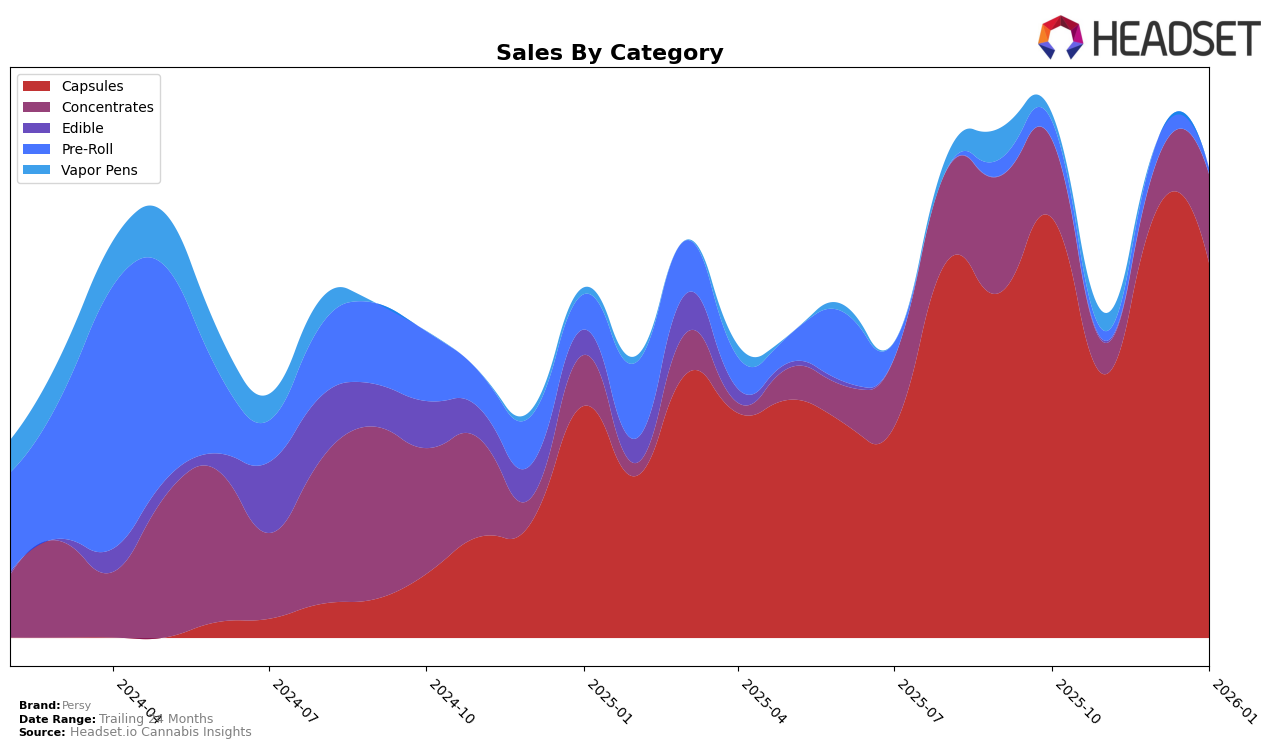

Persy's performance in the Ontario market, particularly in the Capsules category, has shown some interesting dynamics over the last few months. In October 2025, Persy was ranked 16th, and while it dropped out of the top 30 in November, it reemerged at 17th in December and climbed back to 16th in January 2026. This fluctuation indicates a level of volatility in their market position, suggesting either a competitive landscape or variability in consumer demand. Despite these ranking shifts, the brand's sales numbers show a slight decline from October to January, hinting at potential challenges in maintaining consistent sales growth.

The absence of a ranking in November 2025 could be perceived as a setback for Persy, highlighting a period where the brand struggled to maintain its presence among the top competitors in the Capsules category in Ontario. However, their ability to rebound in December and January suggests resilience and potential strategic adjustments that may have been implemented to regain their standing. Such movements underscore the importance of understanding market trends and consumer preferences, as brands like Persy navigate the complexities of the cannabis industry. Further insights into their strategies and adaptations could provide valuable lessons for other brands operating in similar markets.

Competitive Landscape

In the competitive landscape of the Ontario capsules market, Persy has shown a fluctuating presence, with its rank oscillating between 16th and 17th place from October 2025 to January 2026. Despite this variability, Persy managed to maintain its position within the top 20, indicating a stable yet competitive stance. Notably, Pennies consistently outperformed Persy, maintaining a rank of 15th for most months, except December 2025 when it briefly slipped to 16th. This suggests that while Persy is close in competition, it has yet to surpass Pennies in terms of market performance. Additionally, Rosin Heads demonstrated a significant lead, holding a top 10 position until January 2026, when it dropped to 14th, still well ahead of Persy. This indicates a potential opportunity for Persy to capitalize on any shifts in consumer preferences or market dynamics to improve its standing. Meanwhile, Mood Ring only appeared in the rankings in November 2025, suggesting it may not be a consistent threat to Persy's market share at this time.

Notable Products

In January 2026, the top-performing product for Persy remained the Strain Specific Full Spectrum Live Rosin Capsules 30-Pack (300mg) in the Capsules category, maintaining its consistent rank of 1 since October 2025, with sales reaching 485 units. The Full Spectrum Cold Cured Live Rosin Batter (1g) in the Concentrates category improved to the second position, showing a notable increase from its third position in the previous two months. The Lot420 Infused Pre-Roll (1g) dropped to third place, despite being consistently second in the prior months. The Hybrid Melt Hash (1g) entered the rankings for the first time in January 2026, securing the fourth position in the Concentrates category. The Gelato 33 Full Spectrum Soft Chew 2-Pack (10mg) did not rank in January, after previously appearing in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.