Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

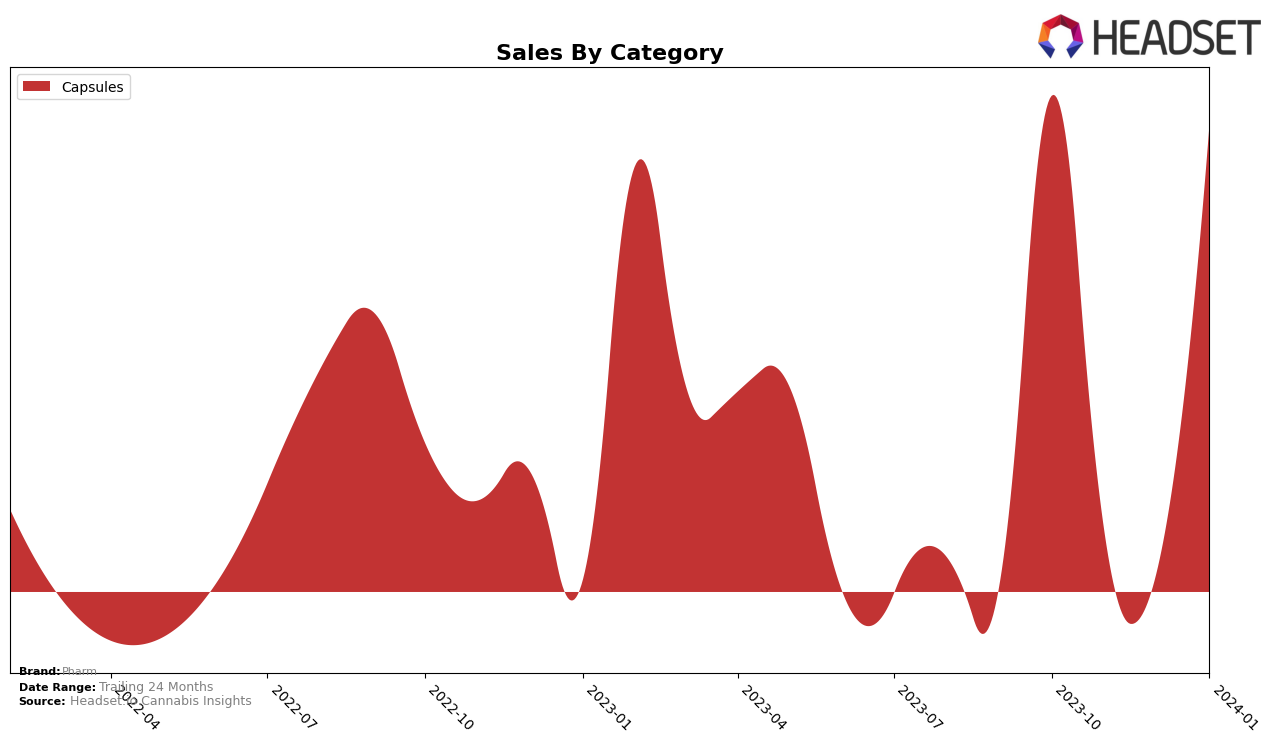

In the realm of cannabis capsules, Pharm has exhibited a diverse performance across different provinces, with notable movements in both Ontario and Saskatchewan. In Ontario, Pharm's capsule category showed a fluctuating presence in the rankings, absent in October and December 2023, but making a notable appearance at rank 34 in November 2023 and improving to rank 31 by January 2024. This inconsistency in ranking highlights a potential area for growth or concern, as being out of the top 20 in any given month suggests a struggle to maintain a strong market presence. However, the upward movement from November 2023 to January 2024, coupled with sales increasing from 106 units in November to 130 units in January, suggests a positive trend that could indicate growing consumer interest or successful marketing efforts in Ontario.

Contrastingly, in Saskatchewan, Pharm's performance in the capsules category has been more consistent and stronger overall. The brand maintained a position within the top 20 from October 2023 through January 2024, showcasing a solid market presence. Starting at rank 13 in October, experiencing a slight dip in the following months to ranks 17 and 16, and then climbing back to rank 13 by January 2024, indicates a resilient and potentially growing interest in Pharm's offerings within this province. Especially noteworthy is the sales figure in October 2023, with 1463 units sold, which dwarfs the sales figures in the following months but rebounds significantly by January 2024 to 1254 units. This volatility in sales, yet consistent ranking, suggests that while Pharm faces competition, it remains a preferred choice among a stable consumer base in Saskatchewan's capsule market.

Competitive Landscape

In the competitive landscape of the cannabis capsule market in Saskatchewan, Pharm has experienced a notable fluctuation in its ranking over the recent months, indicating a volatile position amidst its competitors. Initially ranked 13th in October 2023, Pharm saw a significant drop to 17th in November, before slightly recovering to 16th in December and then improving to 13th by January 2024. This trajectory suggests a recovery in Pharm's market position, likely influenced by a substantial increase in sales from November to January. Competing brands such as Solei and Impromptu have shown more stability but also experienced their own shifts in rank, with Solei notably dropping from 5th to 11th and Impromptu moving between ranks 12 and 14 in the same period. Indiva and NightNight have remained more consistent in their lower-tier positions but have not shown significant improvement or decline. The dynamic changes in Pharm's rankings and the competitive movements among these brands highlight the competitive volatility within the Saskatchewan cannabis capsule market, suggesting that brand positioning can change rapidly in response to market dynamics and consumer preferences.

Notable Products

In January 2024, Pharm's top-performing product was CBD Sea Buckthorn Capsules 30-Pack (300mg CBD) within the Capsules category, maintaining its number one ranking consistently from October 2023 through January 2024. This product saw a notable increase in sales, jumping to 42 units in January from lower sales in the preceding months. This consistent performance and significant sales recovery highlight its strong market presence and customer preference. There were no other products mentioned to compare rankings or sales figures for a broader analysis. The data suggests a stable demand for this product, making it a key offering from Pharm in the Capsules category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.