Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

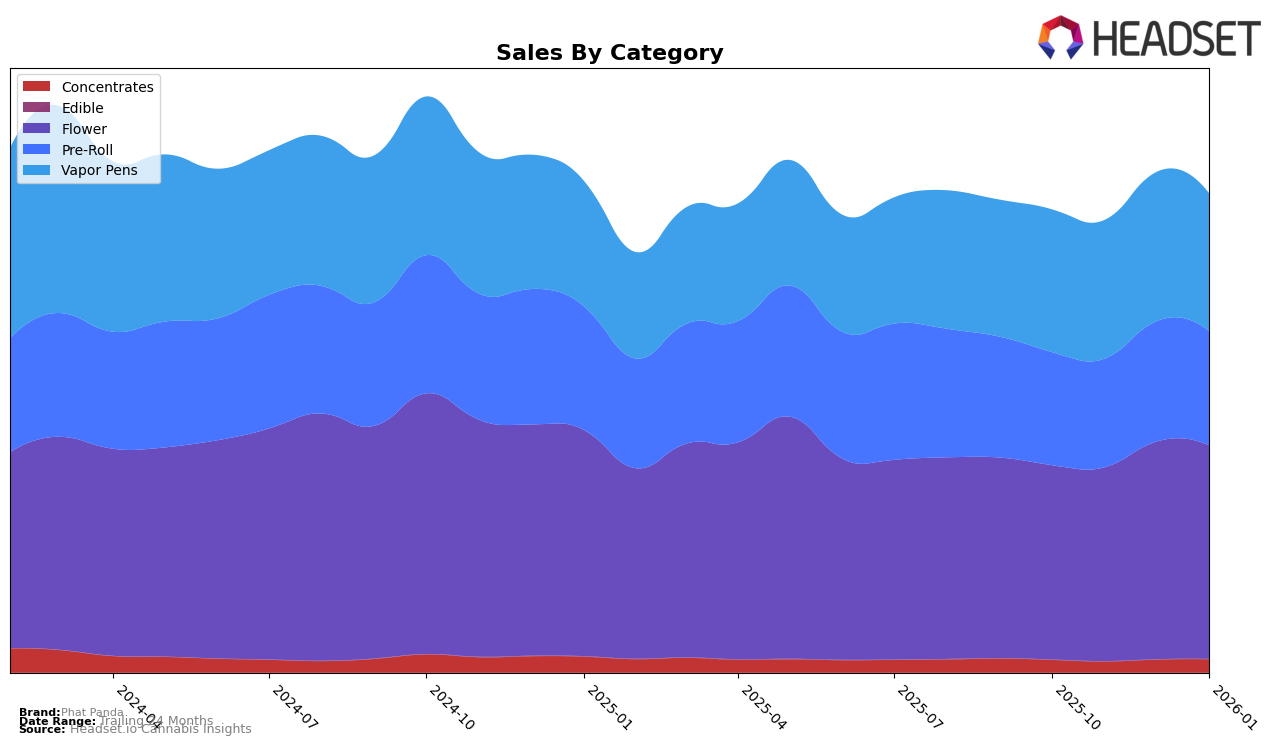

Phat Panda has demonstrated notable consistency and strength in the Washington cannabis market, particularly in the Flower category where they have maintained the top position from October 2025 through January 2026. This uninterrupted dominance suggests a strong consumer preference and brand loyalty in this segment. In the Pre-Roll category, Phat Panda has also sustained a solid performance, holding the second rank consistently over the same period. This stability indicates a robust market presence, although there is room for growth to capture the top spot. The brand's performance in Concentrates has been more variable, with rankings fluctuating between eighth and tenth place, reflecting a more competitive landscape or potential areas for improvement in this category.

In the Vapor Pens category, Phat Panda experienced a slight dip from second to third rank in January 2026, which could suggest increased competition or shifting consumer preferences. Despite this minor setback, Phat Panda's ability to maintain a top-three position across several categories highlights its comprehensive appeal and market penetration in Washington. However, the absence of Phat Panda in the top 30 brands in other states or provinces could indicate limited geographic expansion or market penetration outside of Washington. This presents both a challenge and an opportunity for the brand to explore new markets and diversify its presence beyond its stronghold.

Competitive Landscape

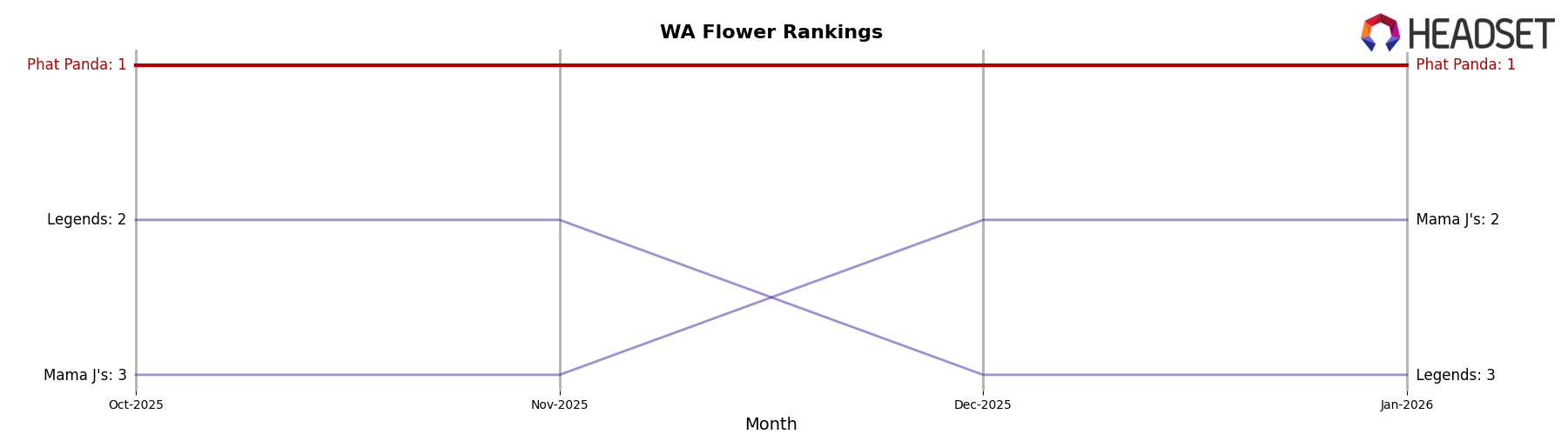

In the Washington flower category, Phat Panda has consistently maintained its top position from October 2025 through January 2026, showcasing its dominance in the market. Despite fluctuations in sales figures, Phat Panda's leadership remains unchallenged, with competitors like Legends and Mama J's trailing behind. Notably, Mama J's has shown a slight improvement, moving up to the second rank in December 2025 and January 2026, while Legends experienced a decline during the same period. This shift indicates a competitive landscape where Phat Panda's consistent performance and brand loyalty are key factors in maintaining its leading position, despite the dynamic movements of its closest rivals.

Notable Products

In January 2026, Phat Panda's top-performing product was the OG Chem Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank consistently from October 2025 with sales of 23,346 units. The Platinum - Trophy Wife Pre-Roll (1g) held steady at the second position across the months, showcasing consistent demand. Bangers - Golden Pineapple Pre-Roll 2-Pack (1g) also maintained its third-place rank but experienced a notable decrease in sales compared to previous months. The Platinum - Kauai Pre-Roll (1g) rose to fourth place, improving from its initial fifth-place rank in November 2025. Lastly, the Platinum Line - Trophy Wife Pre-Roll 28-Pack (28g) returned to the rankings at fifth place after fluctuating in previous months, indicating a resurgence in interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.