Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

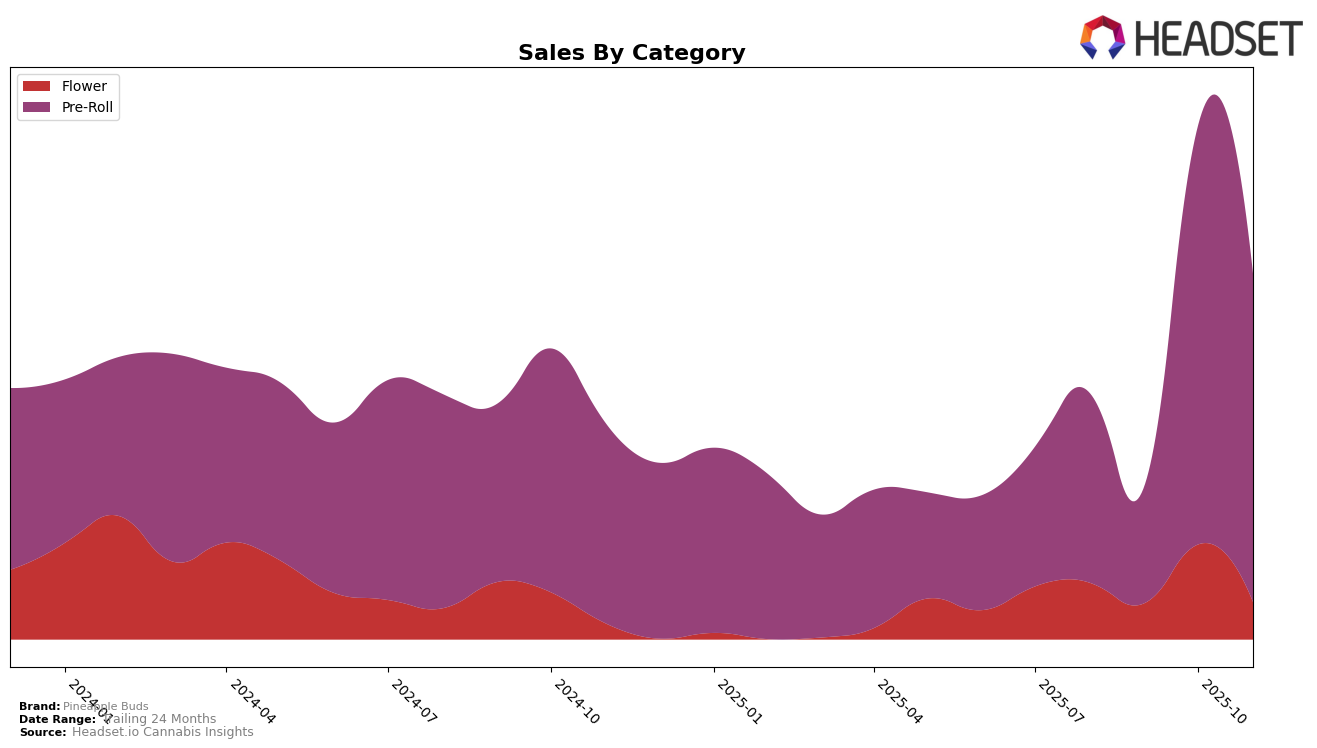

In the realm of cannabis products, Pineapple Buds has shown varied performance across different categories and regions. In the British Columbia market, their Flower category saw a fluctuating presence, with rankings oscillating from 63 in August 2025, improving slightly to 57 in October, but then dropping to 67 by November. This suggests some volatility in consumer preference or market competition. Despite these fluctuations, October was a standout month for Flower sales, indicating a potential seasonal or promotional influence that could have driven the spike. However, the absence from the top 30 brands in this category across all months highlights a significant challenge for Pineapple Buds in maintaining a consistent top-tier presence.

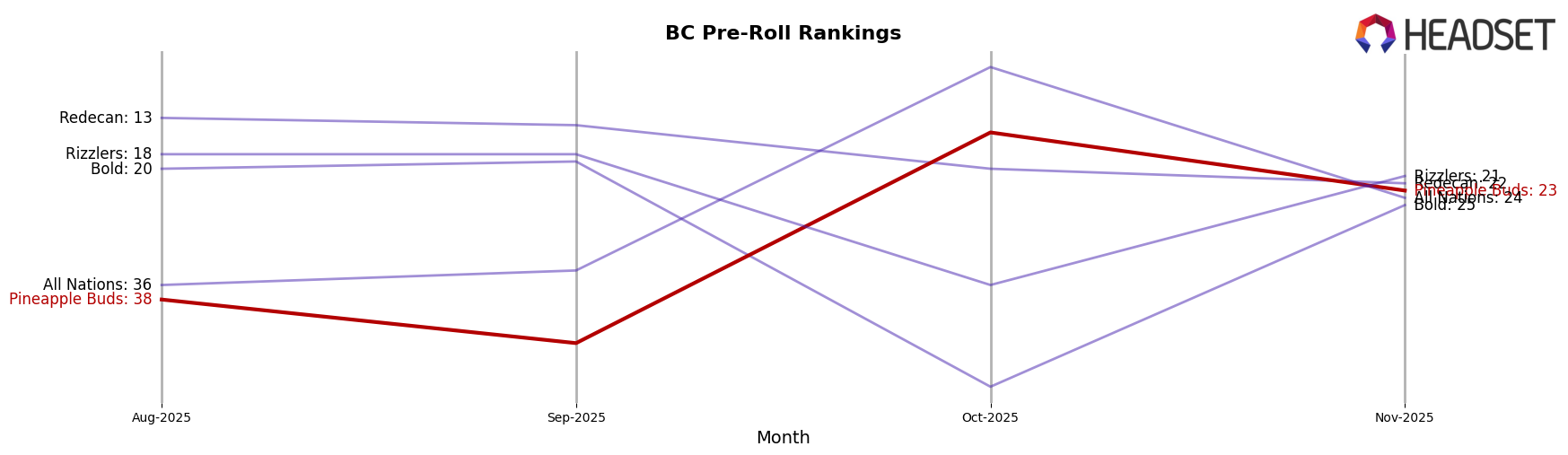

Conversely, the Pre-Roll category in British Columbia has been a more promising arena for Pineapple Buds. The brand made a notable leap from a rank of 38 in August to 15 in October, before settling at 23 in November. This upward trend suggests a strengthening foothold in the Pre-Roll market, potentially driven by product innovation or effective marketing strategies. The significant sales figures in October further underscore this category's importance to the brand's overall performance. However, the fact that they were not consistently in the top 30 in other months indicates there is still room for growth and stabilization in this category.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Pineapple Buds has demonstrated a dynamic shift in its market position over the past few months. Starting from a rank of 38 in August 2025, Pineapple Buds made a significant leap to 15th place by October, before settling at 23rd in November. This fluctuation indicates a strong but volatile presence in the market. In comparison, Redecan experienced a steady decline, dropping out of the top 20 by November, while Bold showed a similar pattern of volatility, initially improving its rank before falling back to 25th. Meanwhile, All Nations surged to 6th place in October, highlighting a peak in sales performance, but then dropped to 24th in November, suggesting a potential market correction. Rizzlers maintained a relatively stable presence, with a slight dip in October but recovering to 21st in November. These insights suggest that while Pineapple Buds has shown potential for rapid growth, it faces stiff competition from brands like All Nations and Rizzlers, which have also demonstrated strong sales capabilities in this market.

Notable Products

In November 2025, the Hawaiian Pineapple Pre-Roll 3-Pack (1.5g) emerged as the top-performing product for Pineapple Buds, maintaining its number one ranking from September 2025 with sales of 3170 units. Volcanic Haze Pre-Roll 3-Pack (1.5g) rose to second place, improving from fifth place in October, showcasing a strong upward trend. Pineapple Soda Pre-Roll 3-Pack (1.5g) secured the third position, marking its return to the top three after a brief absence in October. Purple Gushers Pre-Roll 5-Pack (2.5g) slipped to fourth place, down from its second-place ranking in October, indicating a decline in its relative performance. Lastly, Pineapple Haze Pre-Roll (0.5g) dropped to fifth place after leading in October, suggesting a significant shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.