Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

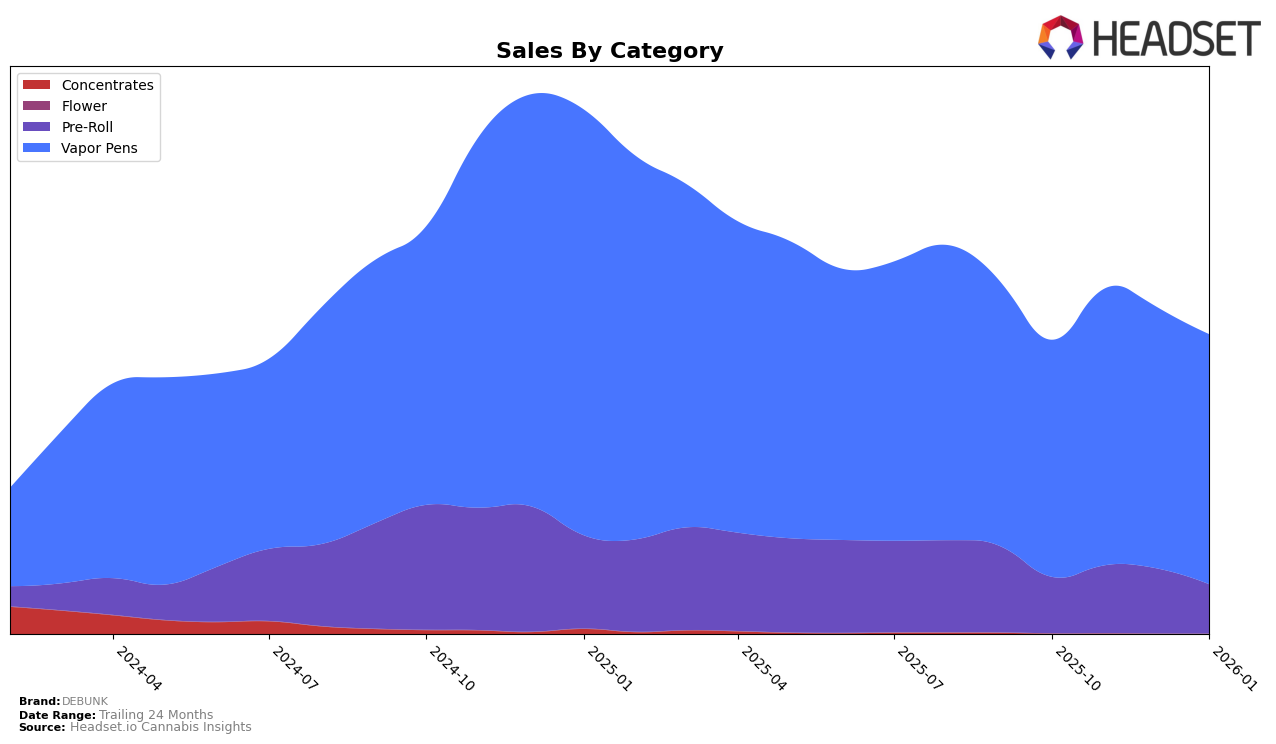

DEBUNK's performance across various states and categories presents a mixed picture of growth and challenges. In the Alberta market, DEBUNK's Pre-Roll category has seen a decline, with rankings slipping from 44th in October 2025 to 65th by January 2026, indicating a downward trend in popularity. This contrasts sharply with their Vapor Pens category in the same region, where they maintained a strong presence, consistently ranking 7th from November 2025 to January 2026. Meanwhile, in British Columbia, DEBUNK's Pre-Roll category saw a positive trend, entering the top 30 in December 2025 and maintaining a position close to it in January 2026. However, their Vapor Pens category performed even better, with rankings improving from 8th in October 2025 to 4th in December, before stabilizing at 5th in January 2026.

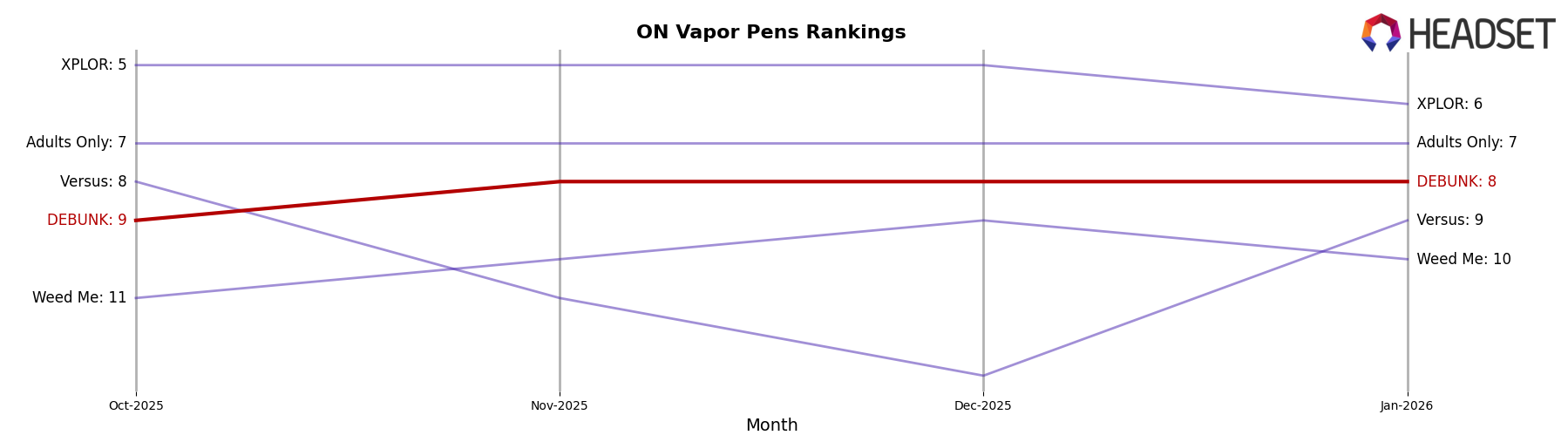

In Ontario, DEBUNK's Pre-Roll category struggled, consistently ranking outside the top 50, with its best position being 50th in October 2025. This suggests a need for strategic adjustments to capture more market share. On the other hand, the Vapor Pens category has been a strong performer, maintaining a steady 8th position from November 2025 through January 2026, even experiencing a sales increase during this period. In Saskatchewan, DEBUNK's Vapor Pens saw a slight improvement, moving up from 17th in October 2025 to 15th by January 2026, indicating potential for growth in this market. Overall, while DEBUNK faces challenges in certain categories, particularly with Pre-Rolls, their Vapor Pens continue to demonstrate resilience and potential for expansion across multiple regions.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, DEBUNK has shown consistent performance, maintaining its rank at 8th place from November 2025 through January 2026. This stability in ranking is noteworthy, especially as other brands like Weed Me and Versus experienced fluctuations, with Versus dropping to 13th place in December before recovering to 9th in January. DEBUNK's sales have been on an upward trajectory, surpassing the 1 million mark in January 2026, which suggests growing consumer preference and effective market strategies. Meanwhile, XPLOR consistently held a top 5 position, indicating a strong market presence, though its sales dipped significantly in January. DEBUNK's steady rank amidst these shifts highlights its resilience and potential for further growth in the Ontario vapor pen market.

Notable Products

In January 2026, DEBUNK's top-performing product was ICE - Moon Drops Liquid Diamonds Cartridge (1g), which regained its position at the top of the Vapor Pens category with sales of 12,002 units. The 24k Gold Infused Pre-Roll 5-Pack (2.5g) held steady in second place overall, maintaining its strong performance from previous months. Blackberry Haze Liquid Diamond Cartridge (1g) remained consistent at third place, showing a slight increase in sales compared to December 2025. ICE - Glass Apple Liquid Diamond Cartridge (1g) re-entered the rankings at fourth place, indicating a resurgence in popularity. Meanwhile, ICE - Melonade Liquid Diamond Cartridge (1g) dropped to fifth place, reflecting a notable decline in sales from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.