Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Pinpoint has demonstrated a notable presence in the Missouri market, particularly within the Concentrates category. Over the observed months, the brand has shown a consistent upward trajectory, moving from the 17th position in November 2025 to the 13th position by February 2026. This improvement in ranking is indicative of a strategic focus or successful marketing efforts within this category. The brand's growth in sales from $103,611 in November to $184,564 in February further underscores this positive trend, highlighting Pinpoint's increasing appeal and market penetration in Missouri's concentrates sector.

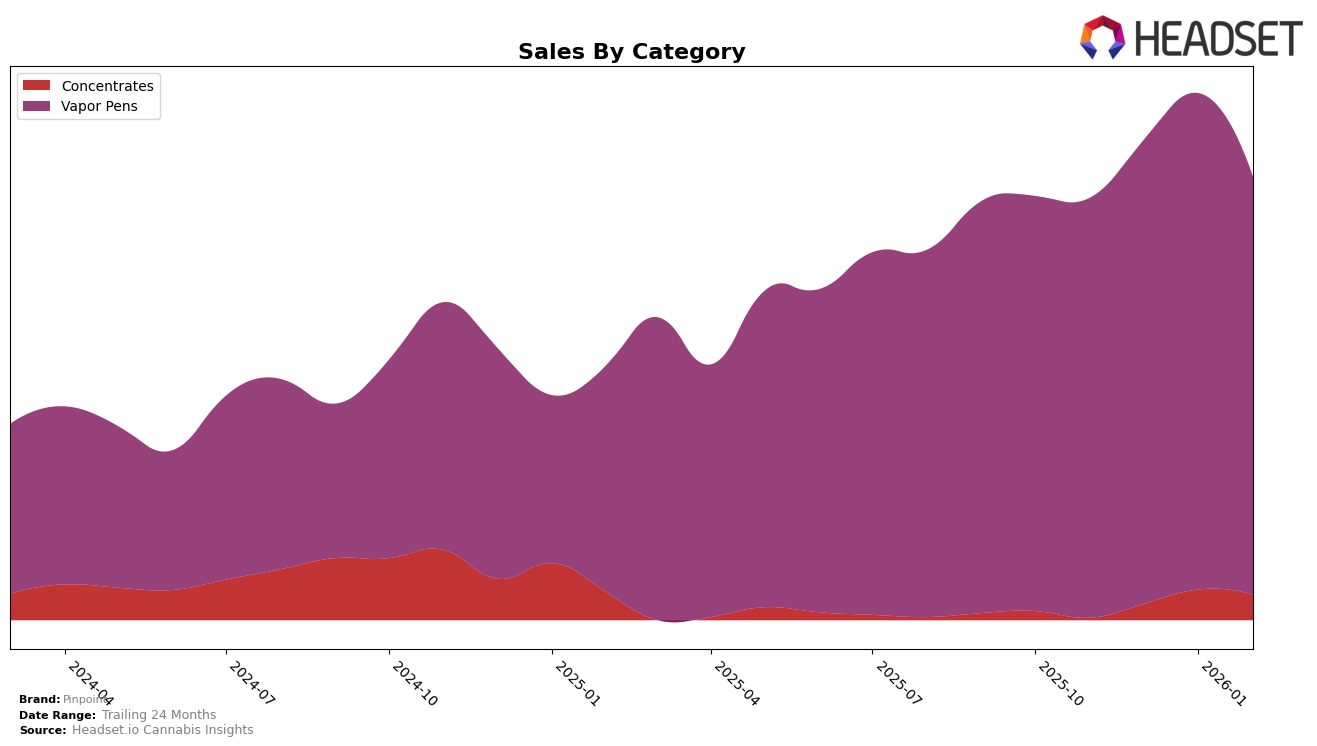

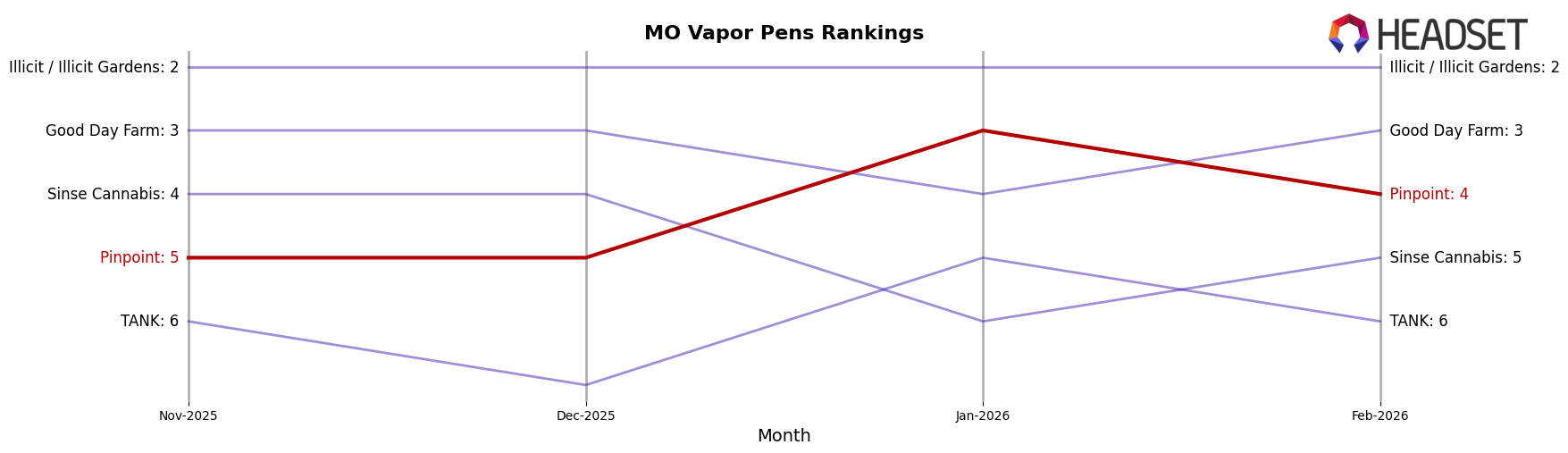

In the Vapor Pens category, Pinpoint has maintained a strong foothold in Missouri, consistently ranking within the top five. The brand held the 5th position in both November and December 2025, moved up to the 3rd position in January 2026, and slightly dropped to 4th in February 2026. Despite this minor fluctuation, Pinpoint's performance remains robust, with sales peaking in January at $1,836,099. This consistent high ranking signifies a strong consumer base and brand loyalty in the vapor pens market. However, the slight dip in February may suggest emerging competition or market dynamics that could be worth monitoring for future trends.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Pinpoint has shown notable fluctuations in its market position over recent months. Starting from a consistent 5th rank in November and December 2025, Pinpoint climbed to 3rd place in January 2026, only to drop to 4th in February 2026. This rise and fall in rank highlight a dynamic competitive environment. Notably, Illicit / Illicit Gardens maintained a steady 2nd position throughout the period, indicating strong brand loyalty or market presence. Meanwhile, Good Day Farm consistently held the 3rd spot, except for January when Pinpoint briefly overtook it. Sinse Cannabis and TANK exhibited more variability, with Sinse dropping from 4th to 6th in January before recovering slightly, and TANK moving between 5th and 7th ranks. Pinpoint's ability to ascend to 3rd place in January suggests a potential for growth and increased consumer interest, although sustaining this momentum against established competitors remains a challenge.

Notable Products

In February 2026, Northern Lights Distillate Cartridge (1g) emerged as the top-performing product for Pinpoint, climbing to the first position with sales of 6,160 units. Slurricane Distillate Cartridge (1g) followed closely in second place, maintaining its rank from previous months. Banana Runtz Distillate Cartridge (1g) held the third position, although it experienced a drop from its previous second place in January. Rainbow Belts Distillate Cartridge (1g) slipped to fourth place after leading in January, indicating a notable shift in customer preference. Clementine Distillate Cartridge (1g) consistently remained in fifth place, showing stable performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.