Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

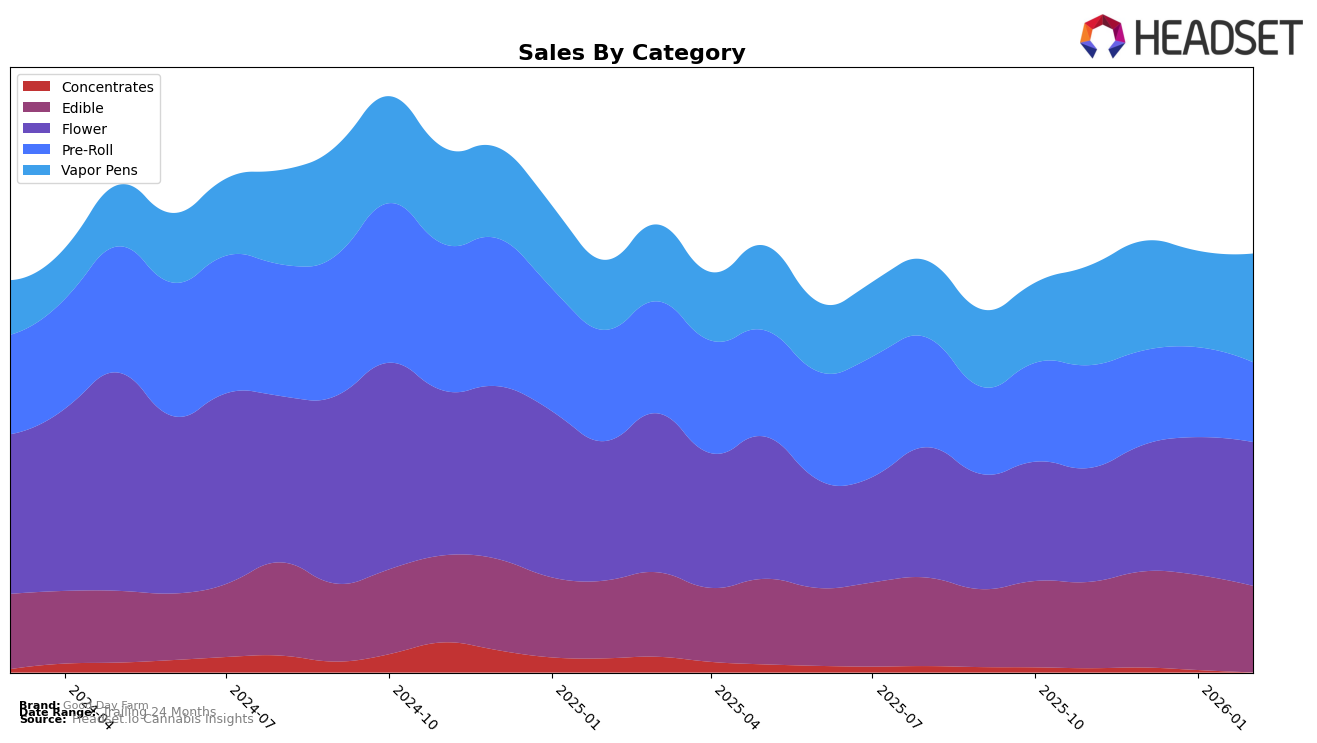

Good Day Farm has shown a consistent performance in the Missouri market, particularly in the Edible and Pre-Roll categories. Their Edible products have maintained a steady rank of 2nd from November 2025 through February 2026, indicating a strong hold in this category. The Pre-Roll category is even more impressive, with Good Day Farm consistently holding the top position throughout the same period. This dominance in Pre-Rolls suggests that the brand has effectively captured consumer preference in this segment. However, it's worth noting that while the sales figures for Edibles saw a slight decrease from December 2025 to February 2026, the brand's ranking remained unaffected, underscoring their robust position in the market.

In the Flower category, Good Day Farm has demonstrated notable upward mobility, improving its rank from 8th in November 2025 to 5th by February 2026. This upward trend highlights the brand's growing appeal and market penetration in this competitive segment. Conversely, the Vapor Pens category showed some fluctuations, with the brand maintaining a 3rd place rank for most months, except in January 2026 when it briefly dropped to 4th. Despite this minor dip, their ability to rebound to 3rd place by February 2026 suggests resilience and adaptability in response to market dynamics. It's important to observe these movements as they reflect the brand's strategic positioning and potential areas for growth or consolidation.

Competitive Landscape

In the competitive landscape of the Missouri flower market, Good Day Farm has demonstrated a notable upward trajectory in its rankings and sales over recent months. Starting from the 8th position in November 2025, Good Day Farm has steadily climbed to secure the 5th spot by February 2026. This ascent is particularly significant when compared to competitors such as Amaze Cannabis, which maintained a consistent 5th rank before dropping to 6th in February 2026. Meanwhile, Illicit / Illicit Gardens and Sinse Cannabis have held their positions at 3rd and 4th, respectively, indicating a stable presence in the market. Good Day Farm's rise in rank is mirrored by its sales growth, which increased from November 2025 to February 2026, contrasting with the declining sales of Amaze Cannabis during the same period. This positive trend for Good Day Farm suggests a growing consumer preference and market share, positioning it as a formidable player in the Missouri flower category.

Notable Products

In February 2026, the top-performing product for Good Day Farm was Big AF - Strawberry Pineapple Gummy (100mg) in the Edible category, which climbed to the number one spot from third place in January. Following closely, Big AF - Cranberry Grape Gummy (100mg) maintained its second-place position, showing consistent popularity. Tire Fire (3.5g) in the Flower category, which had been the leader in previous months, fell to third place. Notably, Blue Raspberry Smash Distillate Cartridge (1g) made its debut in the rankings at fourth place, indicating a strong entry in the Vapor Pens category. Nano - Sour Blue Raspberry Gummies 10-Pack (100mg) held steady at fifth place, showing stable sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.