Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

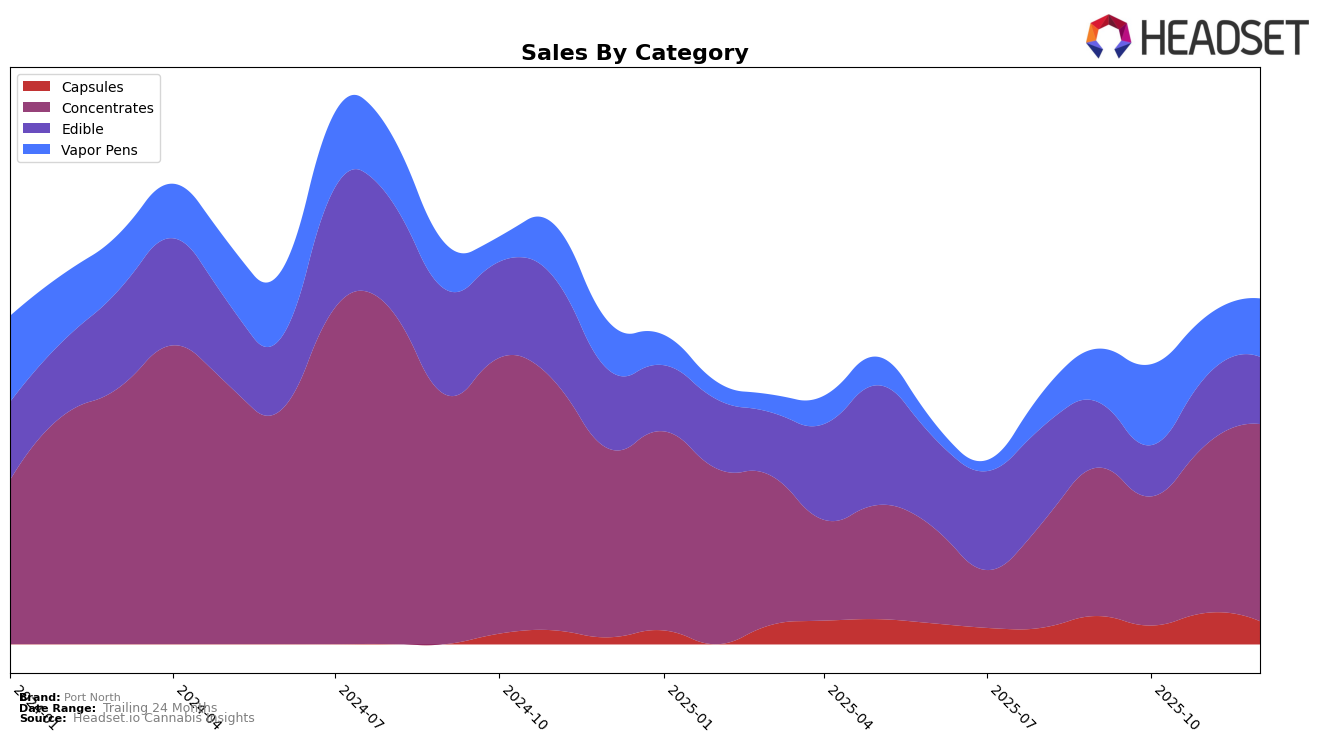

Port North has shown a consistent presence in the Ontario market, particularly within the Concentrates category. Despite not breaking into the top 30 rankings, the brand has maintained a steady position in the mid-40s, indicating a stable consumer base. Notably, there was a slight improvement in November 2025, where the brand moved up to the 47th position, suggesting a potential positive reception to new product offerings or marketing strategies. The steady rank in December, despite a significant increase in sales, could imply that other brands in the category also experienced growth, maintaining the competitive landscape.

Across the months from September to December 2025, Port North's sales trajectory in Ontario's Concentrates category has been upward, with December seeing the highest sales figures. This trend suggests a growing consumer interest or effective seasonal promotions. However, the inability to break into the top 30 rankings may indicate a need for strategic adjustments to capture a larger market share. While the sales growth is encouraging, the brand's performance outside the top 30 suggests there could be untapped potential or areas for improvement in brand positioning or product differentiation.

Competitive Landscape

In the competitive landscape of the concentrates category in Ontario, Port North has shown a consistent presence with a rank of 48 in September, October, and December 2025, and a slight improvement to 47 in November 2025. Despite this stability, Port North faces stiff competition from brands like Tuck Shop, which consistently ranks higher, peaking at 38 in October and November before dropping to 42 in December. Meanwhile, Happy & Stoned maintains a steady rank of 46, indicating a close competition with Port North. Phant shows fluctuating ranks, missing from the top 20 in November, yet still poses a competitive threat with a rank of 49 in October and 55 in December. The emergence of Dom Jackson in December with a rank of 50 suggests new entrants are also vying for market share. Port North's sales trajectory, with a notable increase from October to December, indicates a positive trend, but the brand must strategize to improve its rank and capitalize on its upward sales momentum amidst this competitive environment.

Notable Products

In December 2025, Jolly Hashers Soft Chews 2-Pack (10mg) reclaimed the top spot in the Port North lineup with sales reaching 972 units. This marks a return to first place after having been ranked second for the previous two months. Apricot Kush Full Spectrum Hash Soft Chews 2-Pack (10mg) slipped to second place despite strong sales throughout the year. Full Spectrum Cold Cured Live Rosin Batter (1g) maintained its third position, consistent with its ranking in November. Sour Cherry Hashers Soft Chews 2-Pack (10mg) held steady at fourth place, showing little change in its ranking over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.