Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

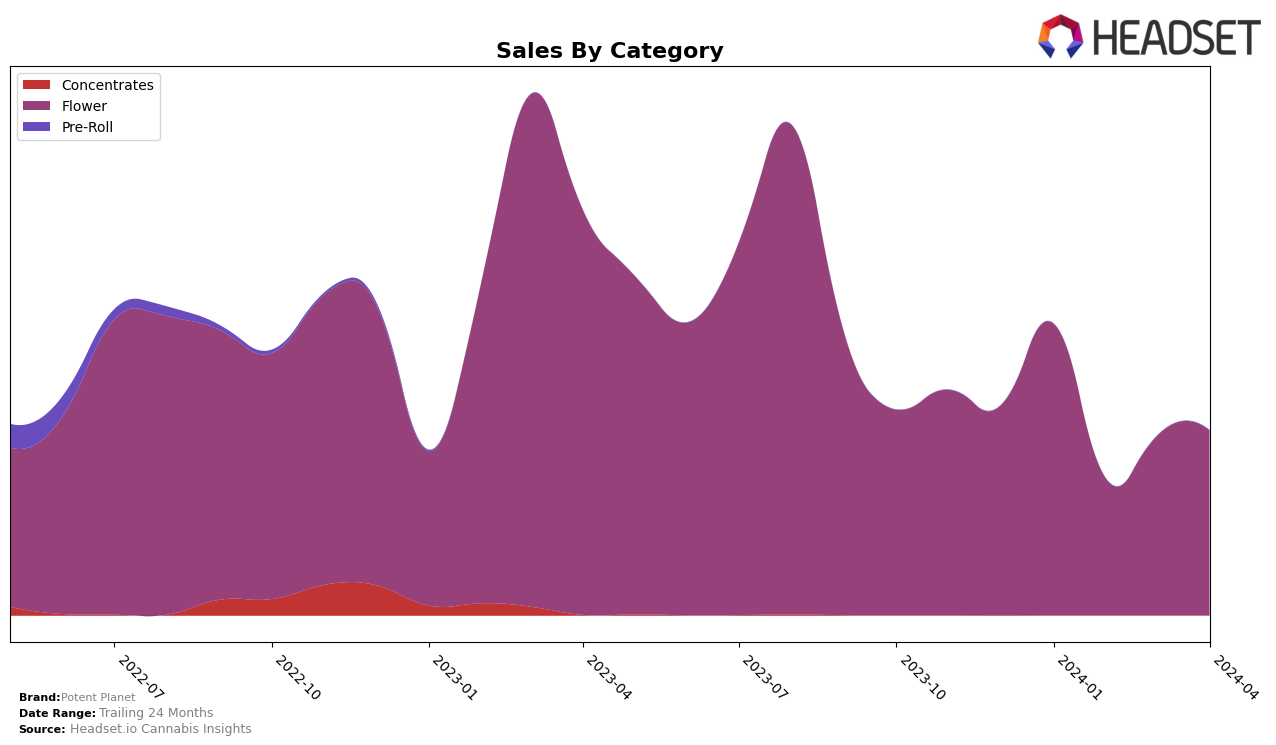

In the competitive cannabis market of Arizona, Potent Planet has shown a fluctuating but overall promising performance in the Flower category. Starting the year at rank 24 in January 2024, with sales figures peaking at 321,228 dollars, they experienced a slight dip moving out of the top 30 in February, only to make a comeback in March and April, securing ranks 33 and 29, respectively. This trajectory indicates a resilience and potential for growth within the Arizona market, despite facing challenges that momentarily pushed them out of the top 30. The sales figures, while experiencing a dip in February, gradually increased in the following months, suggesting a recovery and possibly, a strengthening of their market position.

While the raw sales detail for February shows a significant drop, the subsequent recovery in both rankings and sales figures from March to April is noteworthy. This resilience is crucial in the fast-paced and highly competitive cannabis industry, where brand visibility and consumer preference can shift rapidly. Potent Planet's ability to climb back up in rankings, especially in a state like Arizona with a burgeoning cannabis market, speaks to their strategic efforts and the quality of their Flower products. The absence from the top 30 rankings in February could be seen as a setback, but their performance in the following months suggests a positive momentum. However, the specifics behind their strategies for recovery and growth are not detailed here, which could involve marketing efforts, product diversification, or improvements in distribution and retail partnerships.

Competitive Landscape

In the competitive landscape of the Arizona flower market, Potent Planet has experienced fluctuations in its ranking over the first four months of 2024, indicating a volatile position within the top-tier brands. Starting at 24th in January, it fell to 36th in February, then slightly improved to 33rd in March, and finally to 29th in April. This trend suggests a struggle to maintain a consistent market share against its competitors, such as HiBuddy, which showed more stability by moving from 19th to 27th place, and Sonoran Roots, which also experienced a decline but remained ahead of Potent Planet in April, ranking 28th. Notably, both HiBuddy and Sonoran Roots demonstrated higher sales figures compared to Potent Planet, indicating stronger market performance. On the other hand, brands like FENO and Genesis Bioceuticals ranked lower than Potent Planet in April, with FENO at 31st and Genesis Bioceuticals not making it into the top 30, which could offer Potent Planet an opportunity to capitalize on their positions. The data suggests that while Potent Planet is facing challenges, there are opportunities for growth and improvement in its market position relative to both higher and lower-ranked competitors.

Notable Products

In April 2024, Potent Planet saw Cherry Tree (3.5g) as its top-selling product with an impressive sales figure of 1733 units, climbing from the fourth position in March to the top spot. Odo Juan #50 (3.5g) followed as the second-best performer, showing significant growth by moving from the fifth position in March to second, indicating a strong market acceptance. White Truffle (3.5g) secured the third rank, despite being the top seller in March, which signifies a slight decrease in its sales momentum. Golden Apples 2 (3.5g) and Meat Breath (3.5g) were ranked fourth and fifth, respectively, with Golden Apples 2 (3.5g) dropping from second in March, showcasing a competitive shift in consumer preferences. These rankings highlight dynamic changes in sales performances and consumer interests within Potent Planet's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.