Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

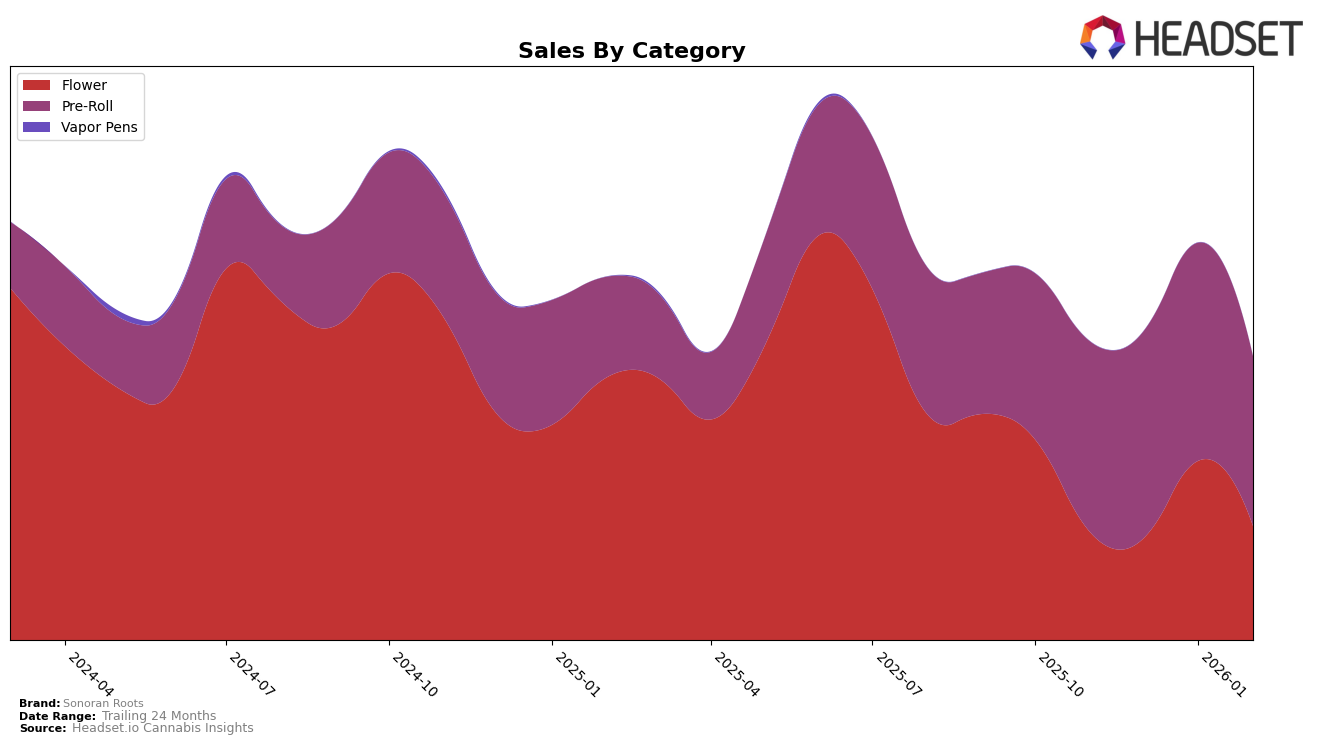

In the Arizona market, Sonoran Roots has demonstrated varied performance across different product categories. In the Flower category, the brand's ranking showed some fluctuation, moving from 38th in November 2025 to 39th by February 2026, with a brief peak at 32nd in January 2026. This indicates a struggle to maintain a steady presence in the top 30, reflecting competitive pressures or possibly shifting consumer preferences. Despite this, the Flower category saw a notable sales increase in January, suggesting a potential area of opportunity if the brand can capitalize on whatever drove that spike.

Conversely, in the Pre-Roll category, Sonoran Roots has maintained a stronger position, consistently ranking within the top 15. The brand held the 12th spot in both November and December 2025, improved to 10th in January 2026, but slipped slightly to 13th in February 2026. These rankings suggest a relatively stable demand for their Pre-Roll offerings, despite a decrease in sales from January to February. The ability to remain within the top ranks suggests that Sonoran Roots has a solid foothold in this category, potentially due to product quality or brand loyalty. Understanding these dynamics could be crucial for strategic planning and resource allocation moving forward.

Competitive Landscape

In the competitive landscape of the Arizona pre-roll category, Sonoran Roots has demonstrated a dynamic performance over recent months. As of February 2026, Sonoran Roots holds the 13th rank, a slight decline from its peak at 10th in January 2026. This fluctuation in rank is juxtaposed against competitors such as FENO, which consistently maintained a higher position, ranking 12th in February 2026 after a brief dip to 12th in January. Meanwhile, Fenix experienced a more significant drop from 7th in November 2025 to 11th in February 2026, indicating potential volatility. Despite these shifts, Sonoran Roots has shown resilience in sales, with a notable peak in January 2026, surpassing Birdies and DTF - Downtown Flower during this period. This suggests that while Sonoran Roots faces strong competition, its ability to achieve higher sales during peak months positions it as a formidable player in the market.

Notable Products

In February 2026, Marmalade Pre-Roll (1g) maintained its top position among Sonoran Roots products, achieving a sales figure of 7,058. Mintz Pre-Roll (1g) emerged as the second-best performer, followed by Jealousy Pre-Roll (1g) in third place. Marshmallow Mountains Pre-Roll (1g) and Sonoran Reserve OG Pre-Roll (1g) rounded out the top five, ranking fourth and fifth, respectively. Notably, Marmalade Pre-Roll (1g) retained its number one ranking from December 2025, while the other products made their debut in the top five this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.