Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

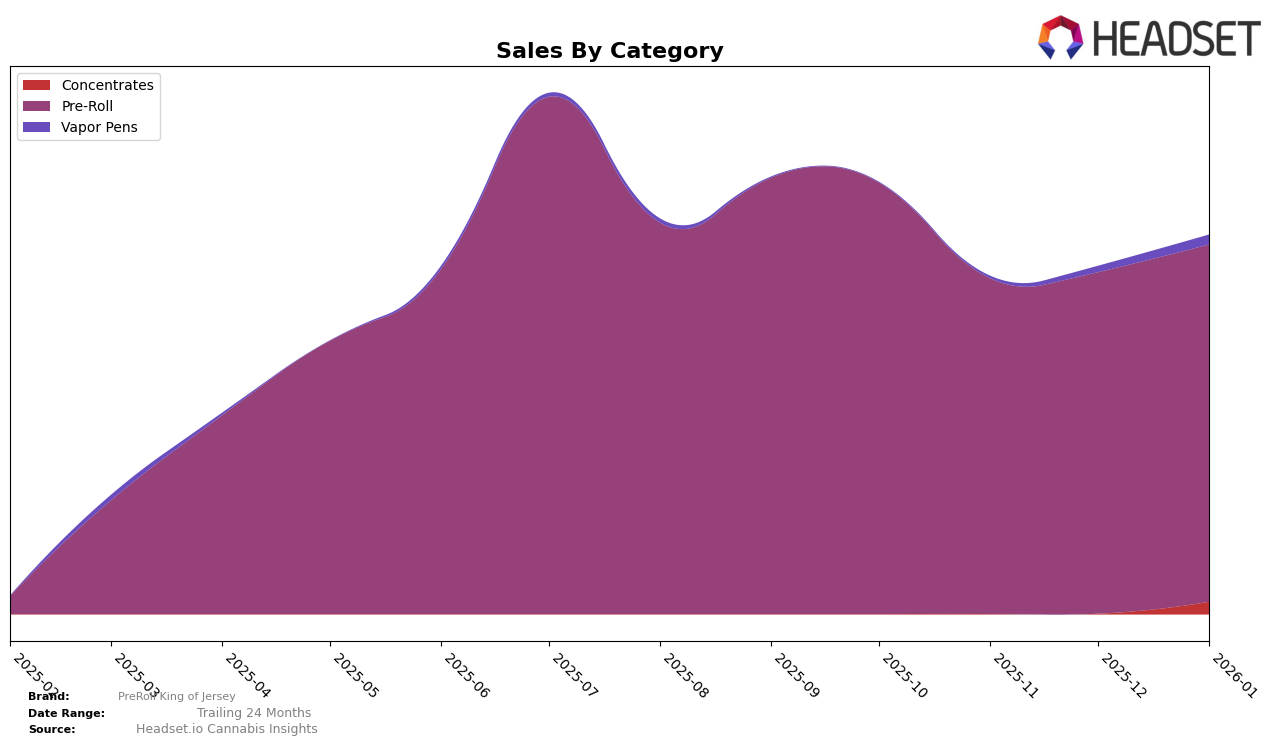

PreRoll King of Jersey has shown notable fluctuations in its performance across the pre-roll category in New Jersey over the last few months. Starting in October 2025, the brand was ranked 16th, but experienced a decline in November, dropping to 18th place. December saw a further dip to 22nd, suggesting potential challenges during the holiday season. However, the brand made a comeback in January 2026, regaining its 18th position. This kind of movement is indicative of a brand that is navigating a competitive landscape, possibly adjusting its strategies to maintain relevance and appeal in the market.

Interestingly, despite these fluctuations in rankings, PreRoll King of Jersey's sales figures show a somewhat stable trend, with a minor dip in November followed by a gradual recovery in the subsequent months. Their sales in January 2026 were higher than in December, indicating a positive trajectory as the new year commenced. The absence of PreRoll King of Jersey from the top 30 in any other states or categories underscores the brand's localized strength in New Jersey, but also suggests room for growth and expansion beyond its current market. This data offers a glimpse into the brand's current standing and potential areas for strategic development.

Competitive Landscape

In the competitive landscape of the New Jersey pre-roll market, PreRoll King of Jersey has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Despite a dip in rank from 16th in October to 22nd in December, PreRoll King of Jersey rebounded to 18th by January 2026. This recovery in rank is accompanied by a steady increase in sales, suggesting a potential upward trend. In contrast, TWAX saw a significant improvement in rank from 31st in November to 18th in December, but its sales figures indicate a less consistent trajectory. Meanwhile, Goodies demonstrated a remarkable climb from 60th in October to 17th by January, with a corresponding rise in sales, posing a competitive challenge. Legend experienced a volatile ranking, dropping to 27th in December before recovering to 19th in January, while The Growfather maintained a relatively stable position in the top 20, consistently outperforming PreRoll King of Jersey in sales. These dynamics highlight the competitive pressures and opportunities for PreRoll King of Jersey as it navigates the evolving pre-roll market in New Jersey.

Notable Products

In January 2026, PreRoll King of Jersey saw Fuhgeddaboudit! - Papaya Crush x Papaya Crush Dirty Diamonds Infused Pre-Roll (1g) rise to the top as the number one product, marking its debut in the rankings with a notable sales figure of 617 units. Pork Rollz - Slurricane Pre-Roll (1g) climbed from fifth to third place, showing increased popularity with 603 units sold. Pork Rollz - Copper Chem Pre-Roll (1g) entered the rankings at fourth place, while Boardwalkers - Valley Chem Pre-Roll 5-Pack (2g) secured the fifth spot with 333 units sold. The previously top-ranked Boardwalkers - Copper Chem Pre-Roll 5-Pack (2g) did not appear in the January rankings, indicating a shift in consumer preferences. Overall, the changes in rankings highlight a dynamic market with new products gaining traction and altering the sales landscape for PreRoll King of Jersey.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.