Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

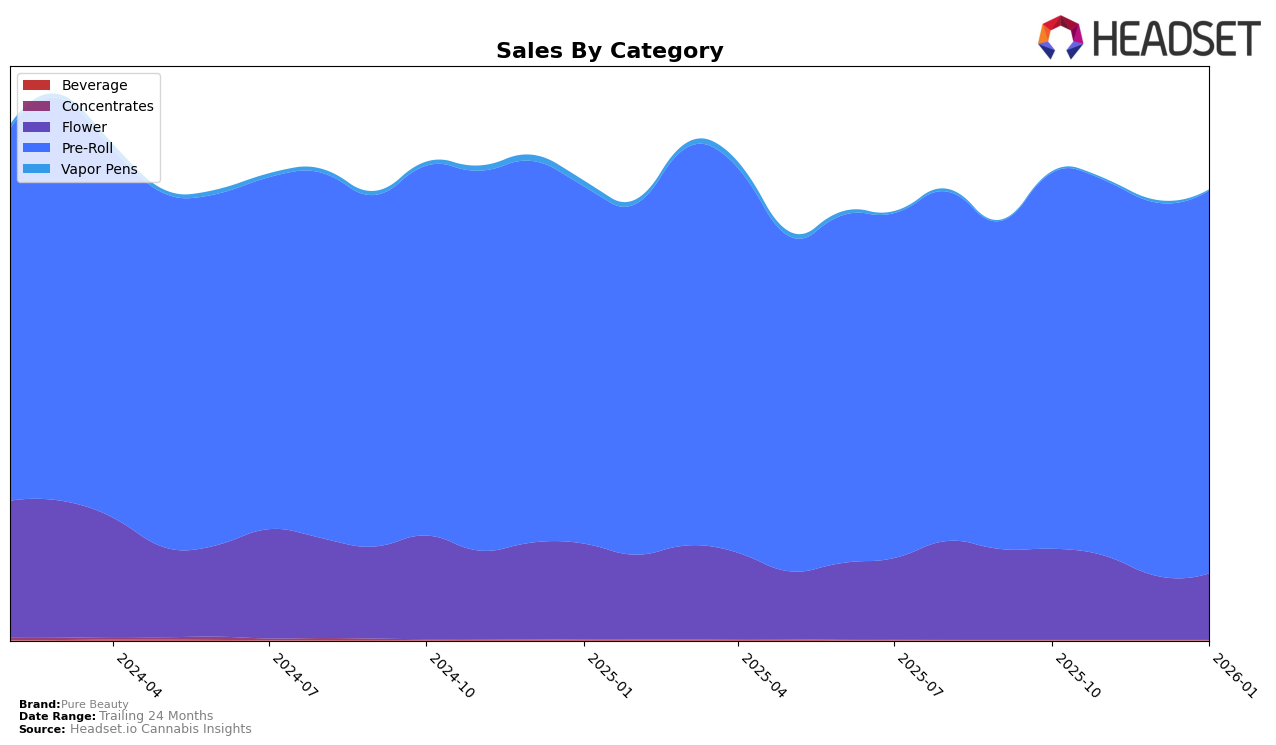

Pure Beauty's performance across different categories and states showcases a mixed bag of results. In the California market, the brand's Flower category did not make it into the top 30 rankings over the past several months, with rankings fluctuating between 59th and 79th position. This indicates a challenging competitive landscape for Pure Beauty in this category, potentially suggesting a need for strategic adjustments to improve their standing. Despite this, there is a slight uptick in sales from December 2025 to January 2026, which could be a positive sign of recovery or effective marketing strategies taking hold.

Conversely, Pure Beauty's Pre-Roll category has consistently performed well in California, maintaining a strong presence within the top 10 rankings. Notably, the brand improved its position from 9th in December 2025 to 6th in January 2026, indicating a robust demand and likely consumer preference for their pre-roll offerings. This upward movement is accompanied by an increase in sales, suggesting effective market penetration and possibly successful promotional efforts. Such performance highlights the brand's strength and potential growth opportunities within the Pre-Roll category in California.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Pure Beauty experienced notable shifts in its ranking and sales performance from October 2025 to January 2026. Initially ranked 8th in October and November 2025, Pure Beauty saw a slight dip to 9th place in December before climbing to 6th place in January 2026. This upward movement suggests a positive reception to its offerings or strategic market maneuvers, despite the competitive pressure from brands like Pacific Stone, which maintained a steady position just above Pure Beauty in most months. Meanwhile, Presidential and Sluggers Hit consistently held higher ranks, indicating strong brand loyalty or superior market strategies. Notably, CannaBiotix (CBX) dropped from 6th to 8th place by January 2026, which may have contributed to Pure Beauty's improved rank. These dynamics highlight the competitive nature of the market and underscore the importance of strategic positioning for Pure Beauty to enhance its market share further.

Notable Products

In January 2026, the top-performing product for Pure Beauty was Black Box Babies - Hybrid Blend Mini Pre-Roll 10-Pack, which climbed to the first position with sales reaching 11,525 units. Yellow Box Babies - Sativa Blend Mini Pre-Roll 10-Pack, which previously held the top spot for three consecutive months, slipped to second place. Pink Box Babies - Indica Blend Mini Pre-Roll 10-Pack maintained its steady performance, holding onto the third rank consistently from October 2025 through January 2026. Yellow Box - Sativa Blend Pre-Roll 5-Pack improved its standing, moving up from fifth to fourth place compared to December 2025. White Box - Pure Beauty Babies - CBD Blend Mini Pre-Roll 10-Pack experienced a slight decline, dropping to fifth place in January 2026 from its fourth-place rank in the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.