Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

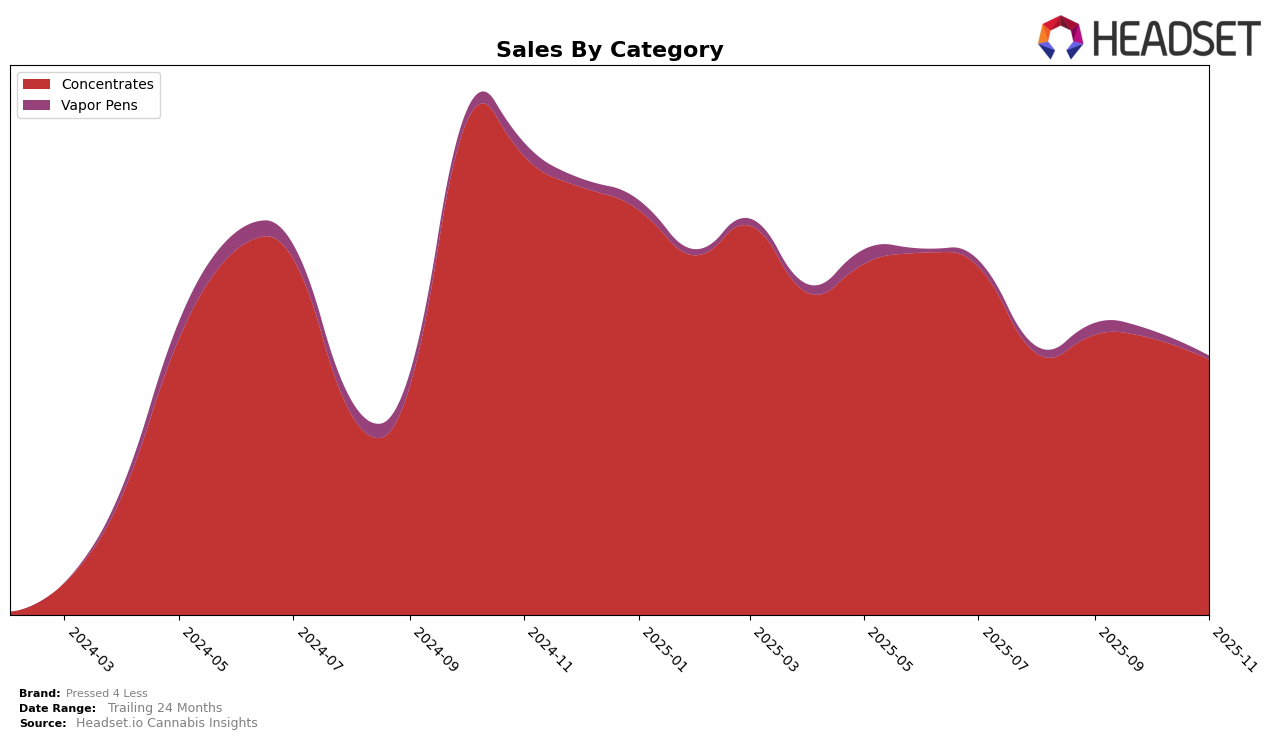

Pressed 4 Less has shown fluctuating performance in the Concentrates category in Washington over the past few months. Starting in August 2025, the brand was ranked 28th, moving up to 21st in September, which indicates a positive trend during that period. However, after reaching this peak, the brand's ranking slipped to 24th in October and further down to 30th in November. This decline suggests potential challenges or increased competition within the market. Despite these ranking changes, the brand's sales figures reveal a slight decline from $80,838 in September to $73,630 in November, reflecting the need for strategic adjustments to regain momentum.

The presence of Pressed 4 Less in the top 30 brands in Washington's Concentrates category is noteworthy, especially considering the competitive nature of the market. However, the drop in rankings by November highlights the volatility and challenges the brand faces. The fact that Pressed 4 Less remained within the top 30 throughout these months is a testament to its established market presence, yet the downward trend in rankings suggests that there is room for improvement. Understanding the factors behind these movements could provide valuable insights for stakeholders looking to optimize brand performance in the future.

Competitive Landscape

In the Washington concentrates market, Pressed 4 Less has experienced notable fluctuations in its ranking over the past few months, indicating a dynamic competitive landscape. In August 2025, Pressed 4 Less was ranked 28th, improving to 21st in September, but then slipping to 24th in October and further to 30th in November. This downward trend in ranking suggests increased competition from brands such as Mama J's, which consistently maintained a strong position, ranking 23rd in August and 27th in November, and SubX, which showed a steady improvement, moving from 36th in August to 31st in November. Additionally, Buddy Boy Farms demonstrated a significant rise, jumping from 54th in August to 28th in November, potentially impacting Pressed 4 Less's market share. Despite these challenges, Pressed 4 Less's sales figures remained relatively stable, suggesting a loyal customer base, but the brand may need to strategize to regain its competitive edge and improve its ranking amidst the evolving market dynamics.

Notable Products

In November 2025, the top-performing product from Pressed 4 Less was Scooby Snacks Rosin (1g) in the Concentrates category, climbing to the number one rank with impressive sales of 961 units. Cherry Fuel Rosin (1g) emerged as the second-highest seller, making its debut in the rankings this month. Bisco Z Rosin (1g) and Gelato Rosin (1g) both held the third position, with Gelato Rosin dropping from its previous top spot in October. Cake Crasher Rosin (1g) improved its position slightly, moving up to fourth place from fifth. The rankings show a dynamic shift, with Scooby Snacks Rosin (1g) making a significant leap from third to first place, showcasing a strong sales performance compared to October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.