Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

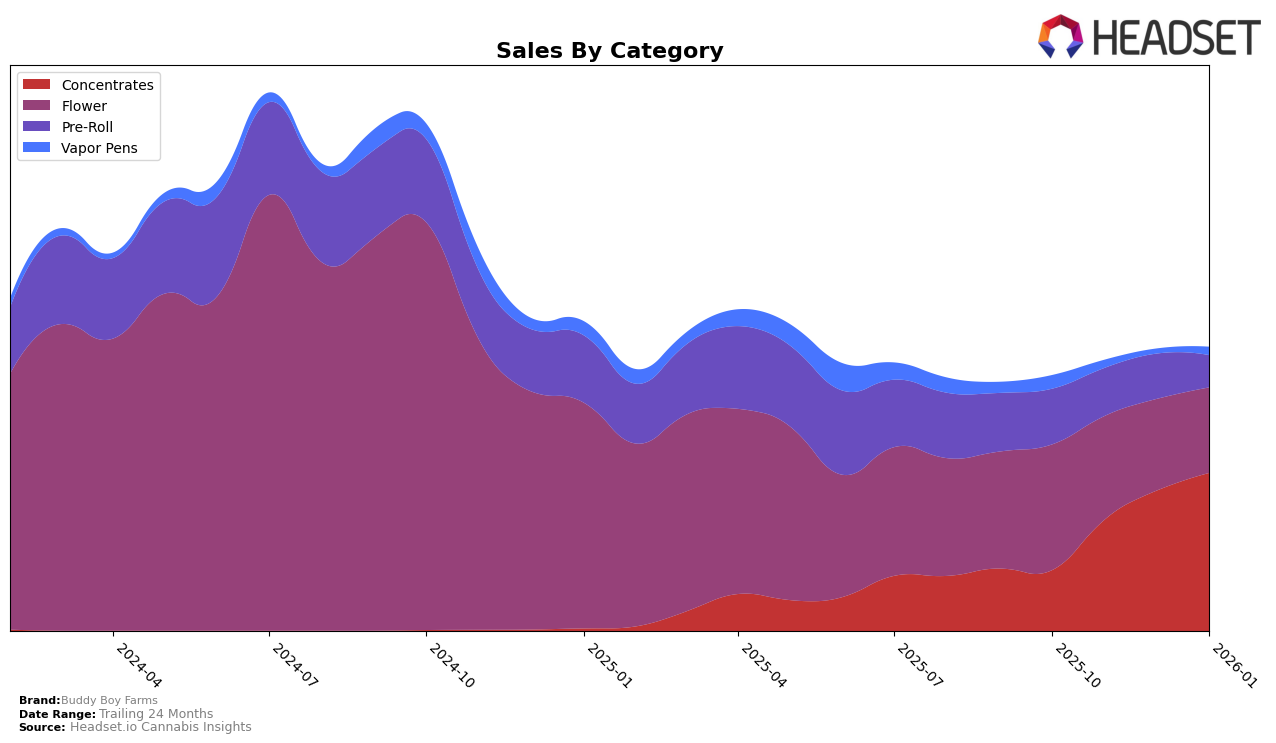

Buddy Boy Farms has demonstrated notable performance improvements in the Washington market, particularly within the Concentrates category. Starting from October 2025, the brand was ranked 53rd, but by January 2026, it had ascended to the 18th position. This upward trajectory indicates a strong growth trend, with sales more than doubling over this period. However, in the Flower category, Buddy Boy Farms did not maintain a top 30 rank in December 2025 and January 2026, which suggests challenges in maintaining competitive positioning or market share in this segment.

In the Pre-Roll category, Buddy Boy Farms was ranked 99th in October 2025, but it did not appear in the top 30 in subsequent months, indicating potential difficulties in gaining traction or consumer preference in this area. The absence from the top 30 rankings in Flower and Pre-Roll categories in the later months could highlight areas for strategic improvement or market focus. Overall, while the brand has shown impressive gains in Concentrates, its performance in other categories suggests a need for targeted strategies to enhance visibility and competitiveness across the board.

Competitive Landscape

In the Washington concentrates market, Buddy Boy Farms has shown a notable upward trajectory in its rankings and sales over the past few months. Starting from a rank of 53 in October 2025, Buddy Boy Farms impressively climbed to 18 by January 2026, indicating a significant improvement in market presence. This upward trend contrasts with brands like Dank Czar, which saw a slight decline from rank 14 to 20 in the same period, and Dabs 4 Less, which maintained a relatively stable position around the 18-19 range. Meanwhile, Full Spec also improved its rank, ending at 17, just ahead of Buddy Boy Farms. Despite this competition, Buddy Boy Farms' consistent increase in sales suggests a growing consumer preference, positioning it as a rising contender in the concentrates category. This positive momentum could potentially challenge the current leaders, such as Dabtastic, which remains strong but stable in its top-tier position.

Notable Products

In January 2026, the top-performing product for Buddy Boy Farms was Cheddar Cheese Hash Rosin (1g) in the Concentrates category, which climbed to the number one rank from third place in December 2025, achieving notable sales of 1,277 units. Following closely, Hash Burger Hash Rosin (1g) secured the second position, marking its first appearance in the rankings. Royal GSC Hash Rosin (1g) experienced a drop from first place in December 2025 to third in January 2026. Space Ape Hash Rosin (1g) made its debut in the rankings at fourth place. Lastly, Guava Cupcake Hash Rosin (1g) slipped from third to fifth place, indicating a slight decline in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.