Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

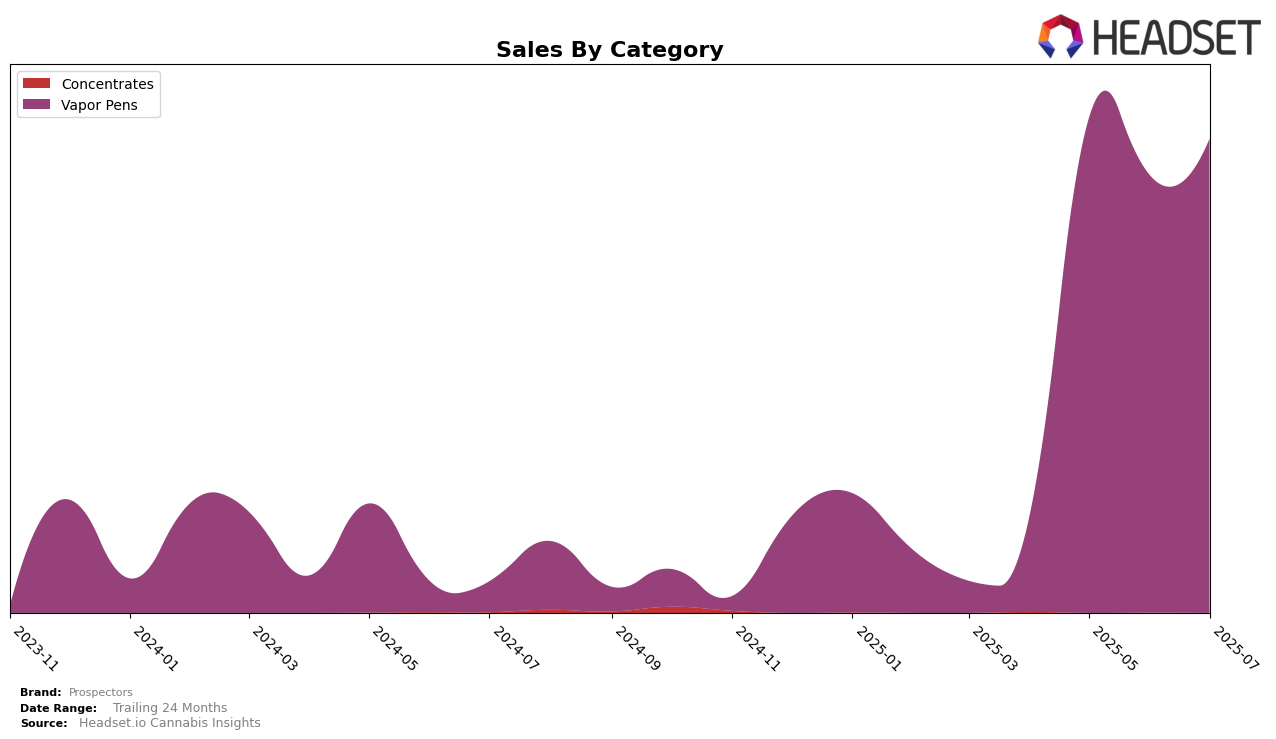

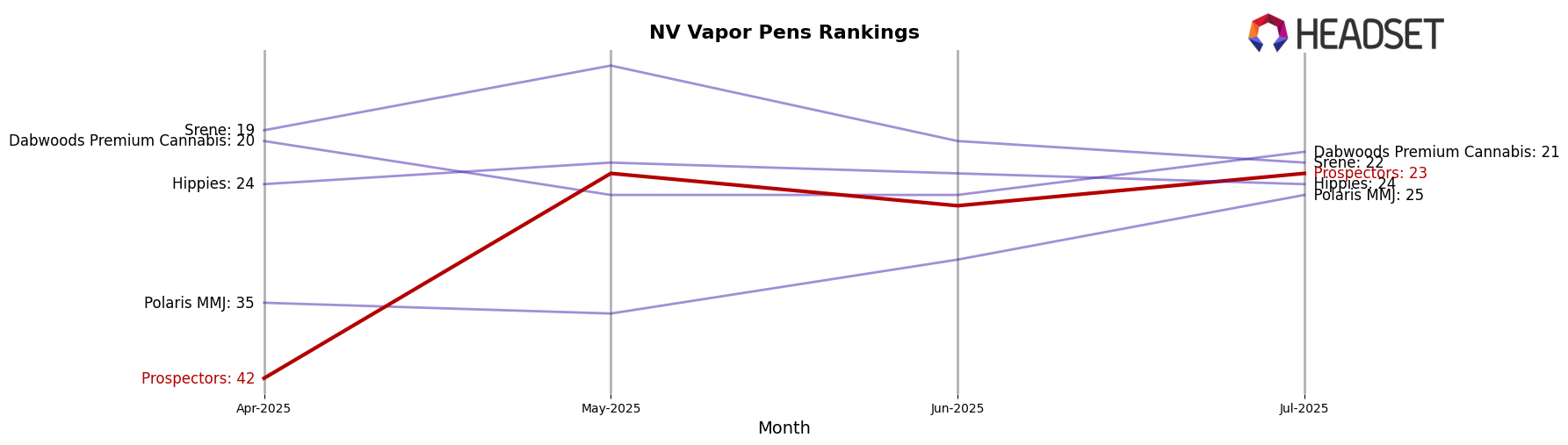

In the state of Nevada, Prospectors has shown a notable performance in the Vapor Pens category over the past few months. Starting from a position outside the top 30 in April 2025, the brand made a significant leap to 23rd place by May. This upward trend continued as they maintained a stable presence within the top 30, holding onto the 23rd position again in July. This consistent ranking indicates a strong recovery and growth in market presence within Nevada's competitive landscape for Vapor Pens. The sales data reflects this positive trend, with a remarkable increase from April to May, suggesting successful strategies or perhaps new product releases that resonated well with consumers.

While the performance in Nevada is encouraging, it's important to note that Prospectors' absence from the top 30 rankings in April indicates challenges in gaining initial traction. However, their ability to break into and maintain a position within the top 30 by May suggests effective market penetration strategies. The fluctuations in their rankings between May and July, while maintaining a position in the top 30, highlight the competitive nature of the Vapor Pens category. This dynamic performance could imply ongoing adjustments and strategic shifts by Prospectors to optimize their market positioning and capture a larger share of consumer attention in Nevada.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Prospectors has shown a notable improvement in its market position over the months from April to July 2025. Initially ranked 42nd in April, Prospectors made a significant leap to 23rd in May, maintaining a relatively stable position through July. This upward trend in rank is indicative of a positive reception and increased sales, which have more than quadrupled from April to May. Despite this progress, Prospectors faces stiff competition from brands like Srene, which consistently ranks higher, peaking at 13th in May, and Dabwoods Premium Cannabis, which shows a strong recovery in July. Meanwhile, Hippies maintains a steady presence slightly above Prospectors, suggesting a competitive but stable market environment. The data highlights the dynamic nature of the vapor pen category in Nevada, with Prospectors needing to sustain its growth to climb further up the ranks.

Notable Products

In July 2025, the top-performing product for Prospectors was the Mimosa Distillate Cartridge (0.5g) in the Vapor Pens category, which jumped to the number one rank with impressive sales of 4595 units. The Slurricane Distillate Cartridge (1g) secured the second position, improving from its third place in June. Rainbow Runtz Distillate Cartridge (1g) dropped from its top rank in June to third place in July. Strawberry Sour Diesel Distillate Cartridge (0.5g) maintained a steady performance, ranking fourth after being second in June. Watermelon Zlushie Distillate Cartridge (1g) made its first appearance in the rankings, entering at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.