Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

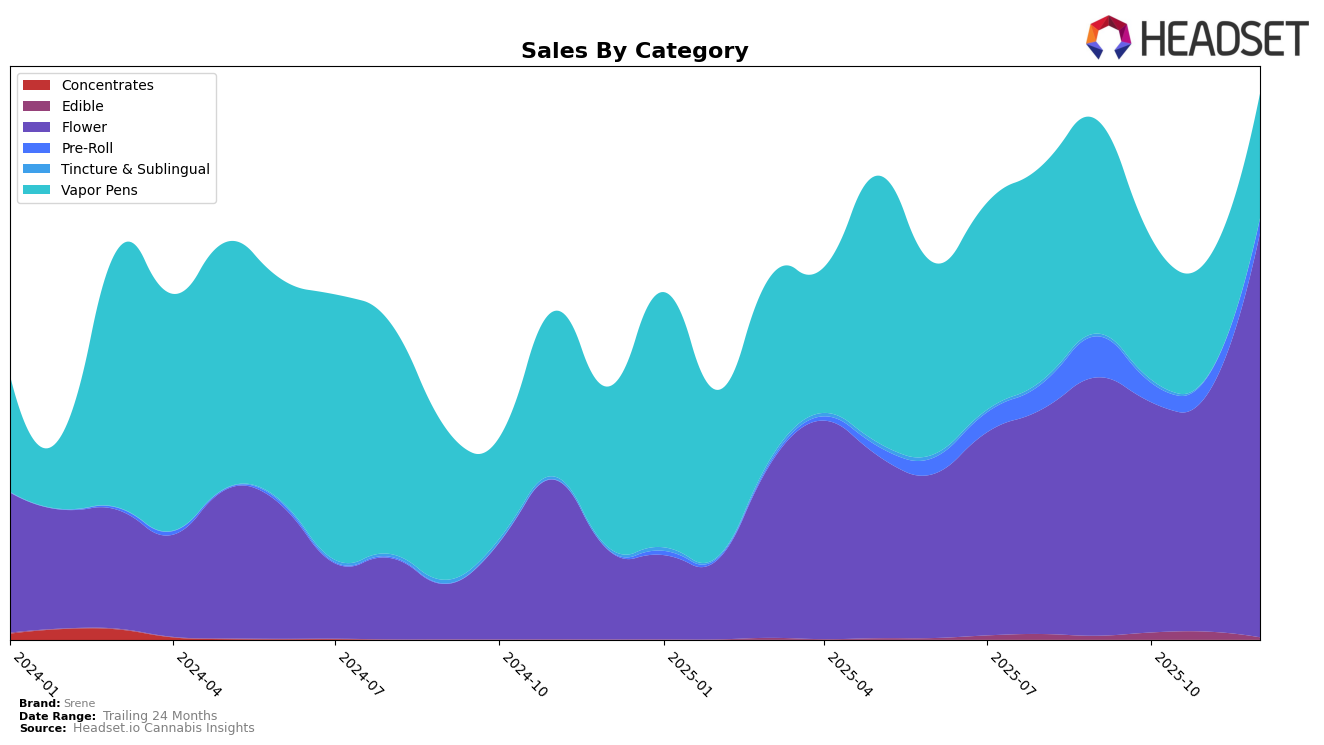

Srene has shown a notable performance across different categories in Nevada, particularly in the Flower category. In December 2025, Srene climbed to the 7th position, a significant improvement from its consistent 21st rank in October and November. This upward movement is underscored by a substantial increase in sales, with December figures nearly doubling those of the previous months. Such a leap in ranking and sales suggests a strong market presence and growing consumer preference in this category. However, the brand's performance in the Pre-Roll category tells a different story, as it did not make the top 30 brands in December, indicating potential challenges or shifting consumer interests in this segment.

In the Vapor Pens category, Srene's performance in Nevada remained relatively stable, maintaining a rank around the 18th position in December after a brief improvement to 17th in November. This steadiness, despite a decrease in sales from September to October, suggests a loyal consumer base or consistent product quality that keeps it within reach of the top 20. While this category shows less dramatic movement compared to Flower, the ability to hold a stable rank amidst fluctuating sales volumes could indicate a balanced market strategy. The absence of Srene in certain rankings across categories might point to areas for potential growth or reevaluation of market strategies to enhance their presence in the competitive landscape.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Srene has experienced notable fluctuations in its market position over the last few months of 2025. Starting in September, Srene was ranked 18th, but it fell out of the top 20 in October and November before making a significant comeback to 7th place in December. This resurgence in December is particularly impressive given the competitive pressure from brands like Solaris, which also improved its rank from 20th in September to 9th in December, and Grassroots, which consistently maintained a strong presence, reaching 6th place in December. Meanwhile, Good Green saw a decline from 3rd in September to 8th in December, indicating a shift in consumer preferences or competitive dynamics. Find. remained a formidable competitor, consistently ranking in the top 10 and securing 5th place in December. Srene's December sales surge suggests a successful strategic pivot or promotional effort, allowing it to outperform several competitors and regain a strong market position.

Notable Products

In December 2025, Srene's top-performing product was Daystripper (3.5g) in the Flower category, securing the number one rank with sales of 1901 units. Space Junky Pre-Roll (1g) maintained its position at rank two from November to December, showing consistent performance with slight sales growth. Strange Haze #8 Pre-Roll (1g) dropped to the third position, despite a strong showing earlier in September when it was ranked second. DayStripper (14g) in the Flower category saw a decrease in rank from third in November to fourth in December. The 747 Distillate Cartridge (1g) entered the top five for the first time in December, showing promising sales of 1327 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.