Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

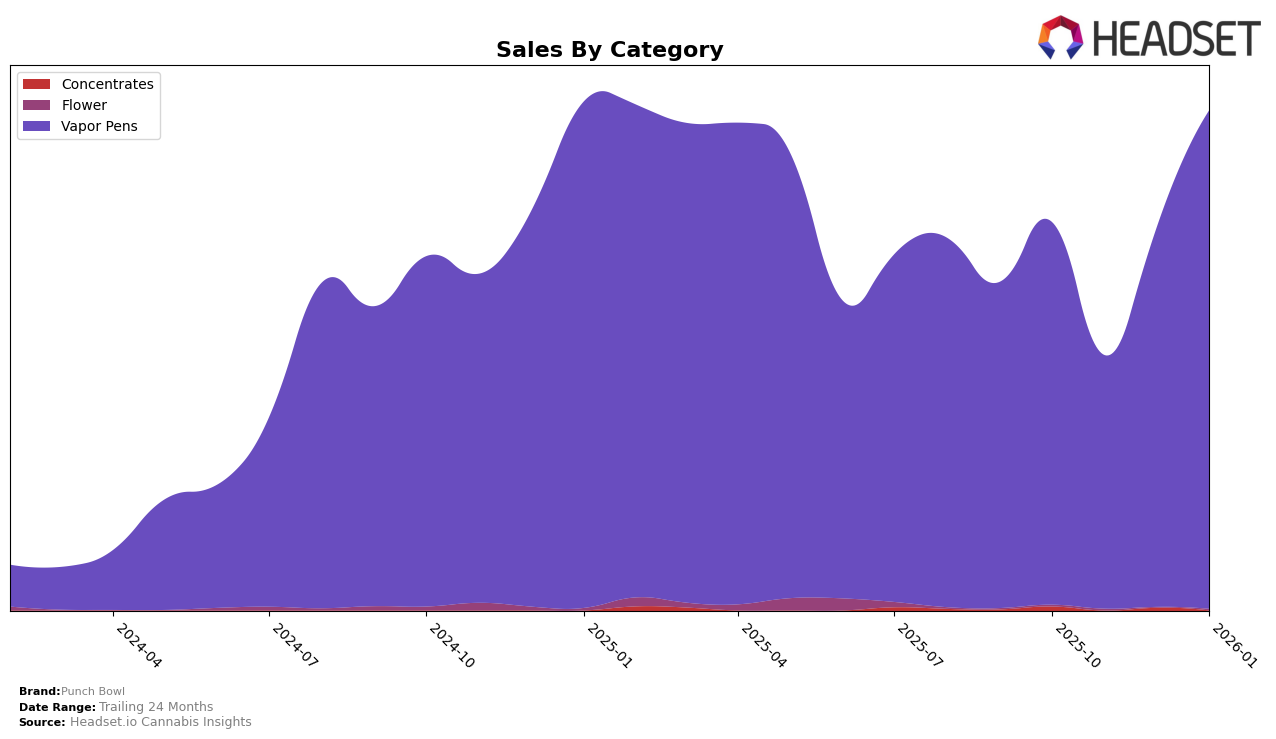

Punch Bowl has shown a notable performance in the Vapor Pens category within the state of Oregon. Over the span from October 2025 to January 2026, the brand has demonstrated an upward trend in its rankings. Starting from a rank of 26 in October, it slipped to 30 in November but quickly rebounded to 27 in December, and further improved to 22 by January. This recovery and subsequent improvement in rankings suggest a positive reception of their products in the Oregon market, potentially driven by strategic adjustments or new product offerings that resonated well with consumers.

In terms of sales performance, Punch Bowl experienced fluctuations that align with their ranking changes. Notably, there was a significant increase in sales from November to January, indicating a strong finish to the period. Despite the dip in November, where they were barely holding onto a top 30 position, the brand managed to not only recover but also enhance its market presence by January. This suggests that Punch Bowl's strategies to boost visibility and consumer engagement in Oregon have been effective, although their absence from the top 30 in any other state or category might indicate areas for potential growth and expansion.

Competitive Landscape

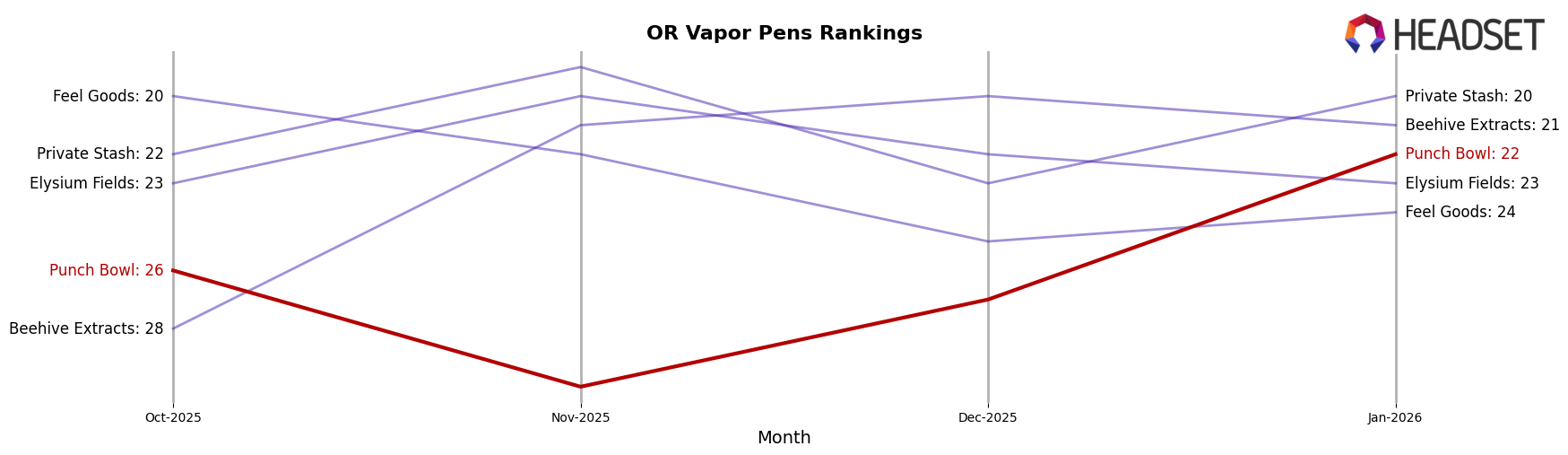

In the competitive landscape of vapor pens in Oregon, Punch Bowl has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 26th in October, Punch Bowl saw a decline to 30th in November, before recovering to 27th in December and achieving a significant leap to 22nd in January. This upward trajectory in January suggests a positive response to strategic adjustments or market conditions. In contrast, competitors like Beehive Extracts and Private Stash maintained more stable rankings, with Private Stash consistently outperforming Punch Bowl in sales. Notably, Elysium Fields and Feel Goods also experienced rank fluctuations, indicating a dynamic and competitive market environment. Punch Bowl's sales figures, although lower than some competitors, showed a promising increase in January, suggesting potential for further growth if current strategies are maintained or enhanced.

Notable Products

In January 2026, the top-performing product for Punch Bowl was the Apricot Sunday Flavored Distillate Disposable (1g) in the Vapor Pens category, securing the number one rank with sales of 786 units. This was followed by the Maui Wowie Flavored Distillate Disposable (1g), which climbed from fifth place in November 2025 to second place in January 2026. The Maui Wowie Flavored Distillate Cartridge (1g) secured the third position, marking its first appearance in the top rankings. Blue Raspberry Lemonade Flavored Distillate Disposable (2g) held the fourth spot, while Pineapple Express Flavored Distillate Disposable (1g) rounded out the top five. Notably, the rankings for these products indicate a strong preference for flavored distillate disposables, with significant shifts in consumer demand since previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.