Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

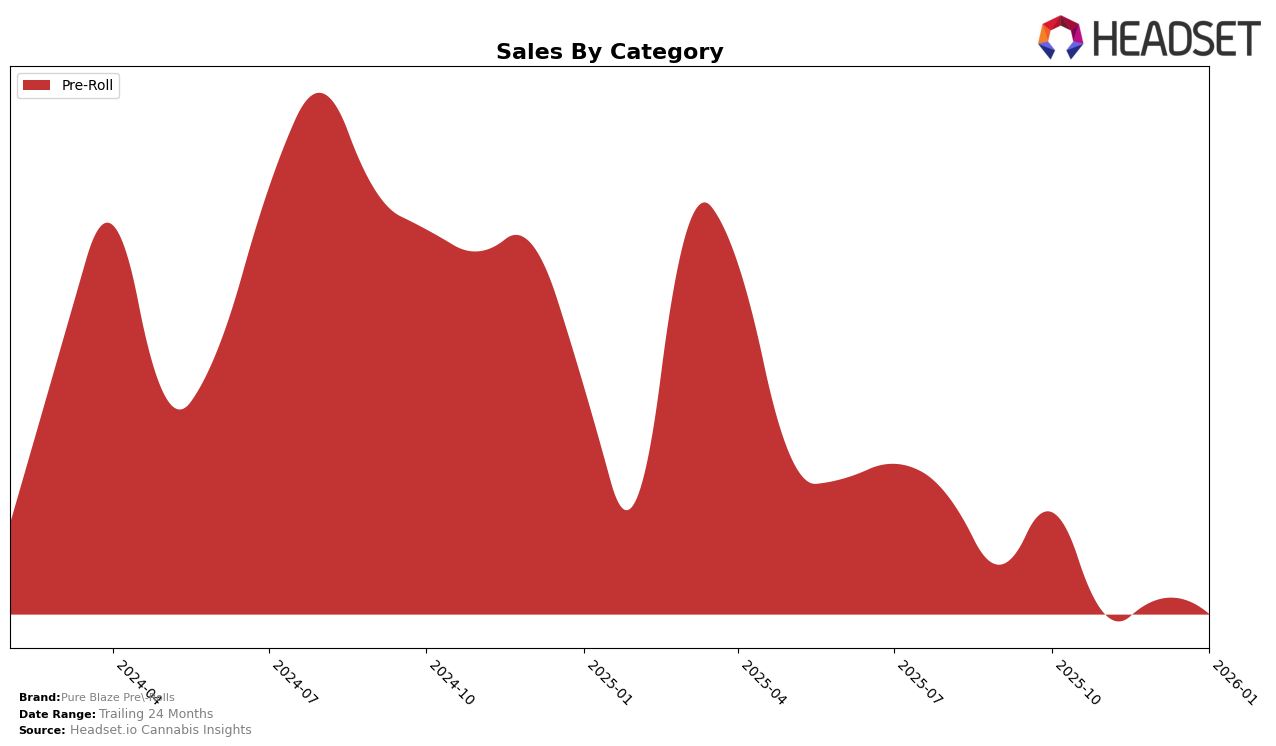

In the pre-roll category, Pure Blaze Pre-Rolls demonstrated notable fluctuations in its market performance across different states. In Colorado, the brand's ranking shifted from 8th in October 2025 to 11th in November, before recovering to 9th in both December and January 2026. This indicates a slight volatility in its market position, yet it managed to regain some ground by the end of the period. The decline in sales from October to November suggests a potential seasonal dip or increased competition, but the subsequent stabilization in December and January may reflect effective strategic adjustments or a consistent consumer base. Such movements highlight the importance of closely monitoring market dynamics and consumer preferences to maintain competitiveness.

Notably, Pure Blaze Pre-Rolls did not appear in the top 30 rankings for some states, which could be seen as a missed opportunity to capture market share in those regions. This absence underscores the challenges brands face when trying to penetrate new markets or maintain a strong presence amidst varying local competition and consumer trends. By examining these state-specific performances, stakeholders can identify areas for growth and potential market entry strategies. Additionally, understanding these dynamics can help pinpoint where the brand's resources might be best allocated to optimize market presence and drive sales in the future.

Competitive Landscape

In the competitive landscape of pre-rolls in Colorado, Pure Blaze Pre-Rolls has experienced some fluctuations in its market position from October 2025 to January 2026. Initially ranked 8th in October, the brand saw a dip to 11th in November before recovering to 9th place in December and maintaining that position in January. This shift in ranking is notable when compared to competitors like Bloom County, which consistently held higher ranks, starting at 4th and gradually moving to 7th. Meanwhile, Spectra maintained a stable presence around the 8th and 9th positions, closely competing with Pure Blaze. Despite these rank changes, Pure Blaze's sales figures remained relatively stable, indicating a resilient market presence amidst competitive pressures. Brands such as Old Pal and Good Chemistry Nurseries also posed competition, with Old Pal consistently ranking just above or alongside Pure Blaze. These dynamics suggest that while Pure Blaze Pre-Rolls faces stiff competition, it remains a strong contender in the Colorado pre-roll market.

Notable Products

In January 2026, the top-performing product for Pure Blaze Pre-Rolls was Pachamama Pre-Roll (1g), which climbed to the number one rank from second place in December 2025, achieving sales of 8076 units. Strawnana Magic Pre-Roll (1g), which had consistently held the top position from October to December 2025, fell to second place. Mac & Cheese Pre-Roll (1g) maintained its third-place position from December 2025, despite a steady decline in sales over the months. Orange Cookie Kush Pre-Roll (1g) remained stable in fourth position, showing a slight increase in sales compared to the previous month. New to the rankings, Apple Fritter Pre-Roll (1g) entered the list at fifth place, marking its debut in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.