Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

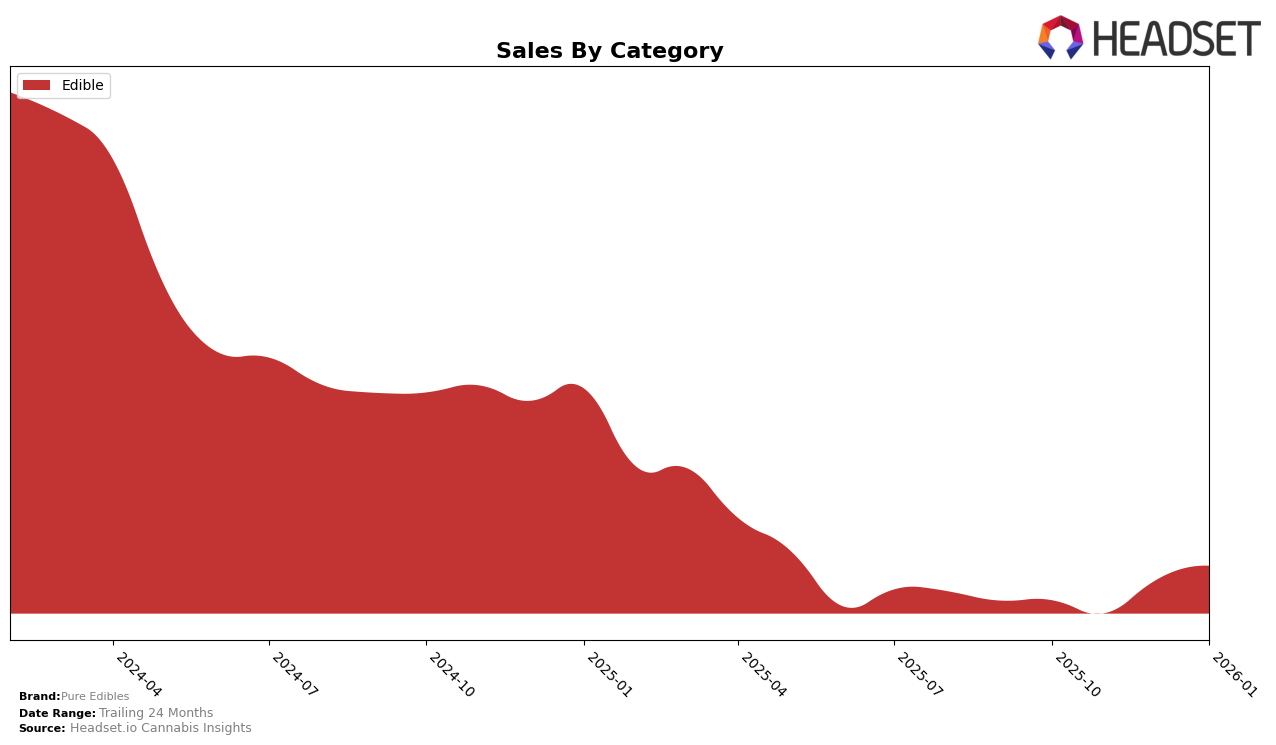

Pure Edibles has shown a consistent presence in the Arizona market, particularly in the Edible category. Over the months from October 2025 to January 2026, the brand has maintained a top 11 ranking, demonstrating resilience and a steady consumer base. Notably, there was a slight dip in November 2025 where the brand fell to the 10th position from the 9th in October, but it quickly rebounded back to 9th in January 2026. This indicates a strong brand presence and the ability to recover quickly from minor fluctuations in market position.

Despite the slight fluctuations in rankings, Pure Edibles has experienced an upward trend in sales figures, with a notable increase from November to January, culminating in over $269,000 in sales by January 2026. This growth trajectory suggests that the brand is effectively capitalizing on consumer demand and possibly expanding its reach within the state. However, it's important to note that Pure Edibles did not appear in the top 30 brands in any other state or category during this period, which could be seen as a limitation in their market penetration strategy outside of Arizona.

Competitive Landscape

In the competitive landscape of the Arizona edible market, Pure Edibles experienced fluctuating rankings from October 2025 to January 2026, indicating a dynamic market presence. Initially ranked 9th in October 2025, Pure Edibles dropped to 10th in November and 11th in December, before rebounding to 9th in January 2026. This variability suggests a competitive pressure from brands like Flav and brix (AZ), which consistently maintained higher ranks. Notably, brix (AZ) held a steady 7th position throughout this period, indicating strong market performance. Meanwhile, Vital showed significant improvement, climbing from 11th to 8th in December, surpassing Pure Edibles temporarily. Despite these challenges, Pure Edibles demonstrated resilience with a sales increase from November to January, reflecting a positive trend in consumer demand. This analysis underscores the importance for Pure Edibles to strategize effectively against top competitors to enhance market share and stabilize its ranking.

Notable Products

In January 2026, the top-performing product for Pure Edibles was the THC/CBN 2:1 Indica Berry Sleepy Gummies 10-Pack, maintaining its number one rank from December 2025 with sales reaching 4094 units. The Indica Watermelon Gummies 10-Pack held steady at the second position, showing consistent performance over the past months. Indica Fruit Punch Gummies 10-Pack climbed back to third place, recovering from a fourth-place finish in December. Sativa Watermelon Gummies 10-Pack, although decreasing in rank from third in December to fourth in January, still showed strong sales. The newly ranked Sativa Fruit Punch Gummies 10-Pack maintained its fifth position since December, indicating stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.