Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

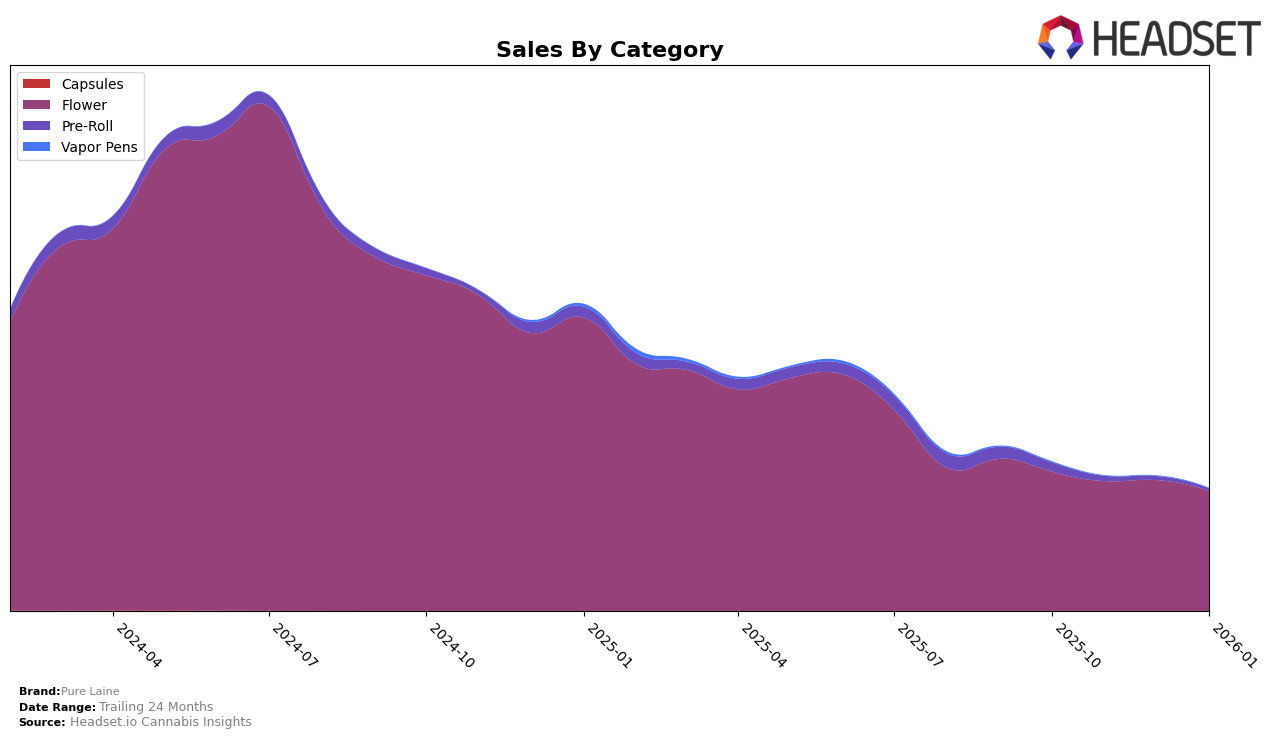

Pure Laine's performance in the Alberta market has shown a declining trend in the Flower category. Starting from a rank of 45 in October 2025, it slipped to 62 by January 2026. This downward trajectory is mirrored by a decrease in sales, which dropped significantly from October to January. In the Pre-Roll category, Pure Laine was ranked 83 in October, but the absence of subsequent rankings suggests that it fell out of the top 30, indicating a challenging market position. Meanwhile, in Ontario, Pure Laine maintained a relatively stable presence in the Flower category, fluctuating slightly but ultimately improving to a rank of 19 in January 2026. This could signal a stronger brand recognition or market strategy in Ontario compared to Alberta.

In Saskatchewan, Pure Laine's Flower category saw some positive momentum. The brand improved its rank from 30 in October to 26 in January, despite some fluctuations in the intervening months. This improvement is noteworthy given the competitive nature of the market. However, the absence of rankings in other categories across these provinces suggests that Pure Laine may not have a diversified product presence or that it is facing stiff competition. The variations in performance across provinces underscore the importance of regional market strategies and consumer preferences, which can significantly impact brand rankings and sales trajectories.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Pure Laine has shown a noteworthy upward movement in rank, climbing from 22nd place in December 2025 to 19th in January 2026. This improvement indicates a positive trend for Pure Laine, despite its sales figures being lower than some of its competitors. For instance, MTL Cannabis consistently ranked within the top 20, maintaining a steady position from 18th in October 2025 to 17th in January 2026, with sales figures notably higher than Pure Laine's. Similarly, Potluck remained stable at 17th place for three consecutive months before slightly dropping to 18th in January 2026, also outperforming Pure Laine in sales. Meanwhile, The Loud Plug experienced a decline, falling out of the top 20 by January 2026, which could present an opportunity for Pure Laine to capture some of its market share. Lastly, LowKey consistently held the 20th spot, indicating a stable but modest performance. Pure Laine's recent rank improvement suggests potential for growth, especially if it can leverage the downward trends of some competitors.

Notable Products

In January 2026, Pure Laine's top-performing product was Original Kush (3.5g) in the Flower category, maintaining its number one rank consistently over the past months with a sales figure of 8,163. Special Haze (3.5g) held steady at the second position, showing consistent performance across the months. Big Pleasures (28g) remained third, although its sales have shown a gradual decline since October 2025. Super Skunk (3.5g) also retained its fourth rank while experiencing a slight dip in sales. Notably, Original Kush (14g) reappeared in the rankings at fifth place, having been absent in November and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.