Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

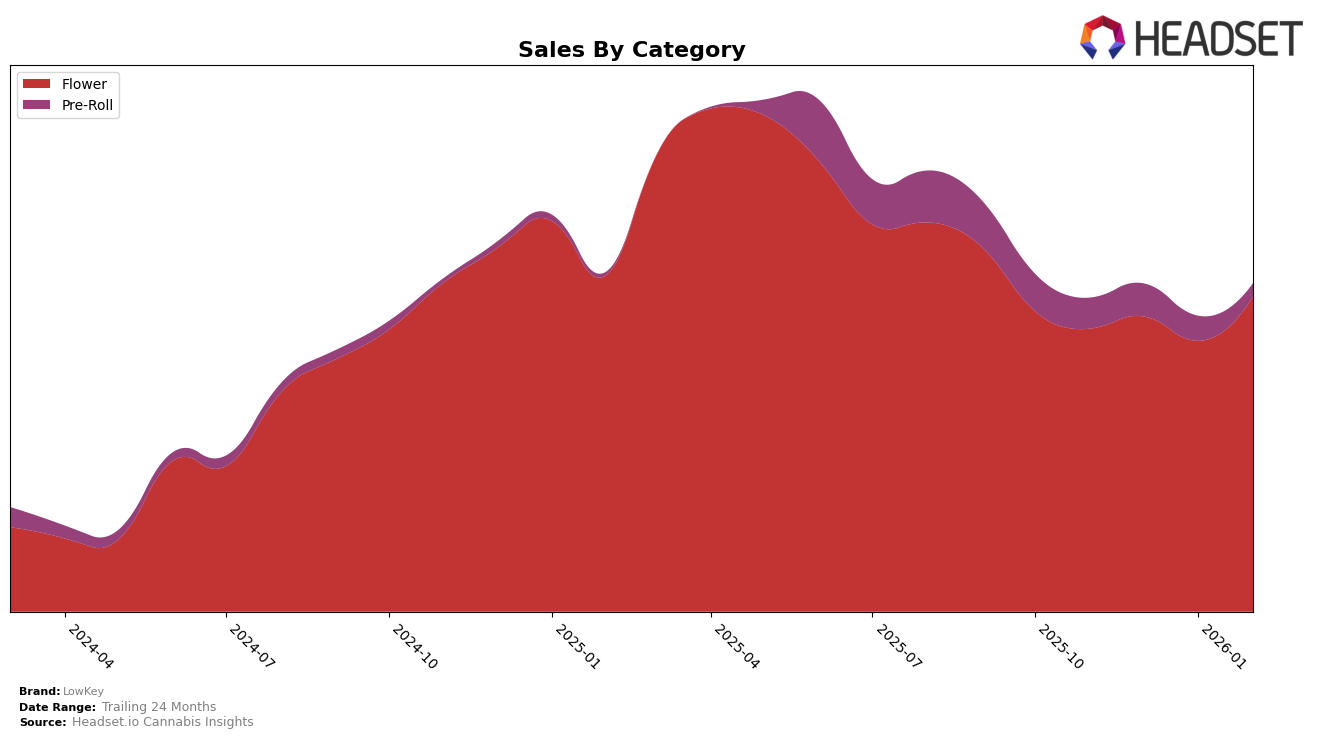

LowKey's performance in the Flower category across Canadian provinces has shown varying trends. In Alberta, the brand experienced fluctuations, with rankings moving from 48th in November 2025 to 53rd by February 2026, indicating challenges in maintaining a top position. Meanwhile, in British Columbia, LowKey's rank hovered around the 40s, showing a slight decline from 38th to 44th over the same period. However, in Ontario, LowKey demonstrated a strong presence, improving from 20th to 14th place, which suggests a growing acceptance and popularity in this key market. This upward movement in Ontario might be attributed to strategic initiatives or consumer preference shifts, though it remains a point of interest for further exploration.

In the Pre-Roll category within Ontario, LowKey's performance has been less consistent. The brand was ranked 98th in both November 2025 and January 2026, with a slight improvement to 90th in December 2025. However, by February 2026, LowKey did not make it into the top 30, indicating a significant drop in its competitive standing within this category. This absence from the top 30 could point to intensified competition or a shift in market dynamics that could be impacting their sales. The contrasting trends between the Flower and Pre-Roll categories in Ontario highlight the diverse challenges and opportunities LowKey faces across different product lines. Further insights into consumer preferences and competitive actions might shed light on these dynamics.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, LowKey has shown a notable upward trajectory, particularly in the early months of 2026. While LowKey started at the 20th rank in November and December 2025, it climbed to the 19th position in January 2026 and made a significant leap to 14th place by February 2026. This improvement in rank is indicative of a positive trend in sales, as LowKey's sales figures increased from $912,323 in November 2025 to $1,131,797 in February 2026. In contrast, 1964 Supply Co and Good Supply both experienced a decline in sales over the same period, with Good Supply dropping from 13th to 15th place. Meanwhile, Redecan also saw a downward trend, moving from 10th to 12th place. These shifts suggest that LowKey is gaining traction in the market, potentially capturing market share from these competitors, and positioning itself as a rising player in the Ontario Flower category.

Notable Products

In February 2026, Frost'd Flakes (7g) maintained its position as the top-performing product from LowKey, despite a decrease in sales to 7784 units. Cookie'z (7g) consistently held the second rank across the months, with sales figures showing a steady decline to 5167 units in February. Larry (7g) improved its position to third place after dropping to fifth in January, indicating a positive shift in consumer preference. El Jefe (7g) saw a slight dip from third to fourth place compared to the previous month, suggesting a competitive market among flower products. Notably, Frost'd Flakes (28g) entered the rankings for the first time in February, debuting at fifth place, highlighting an expanding product line for LowKey.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.