Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

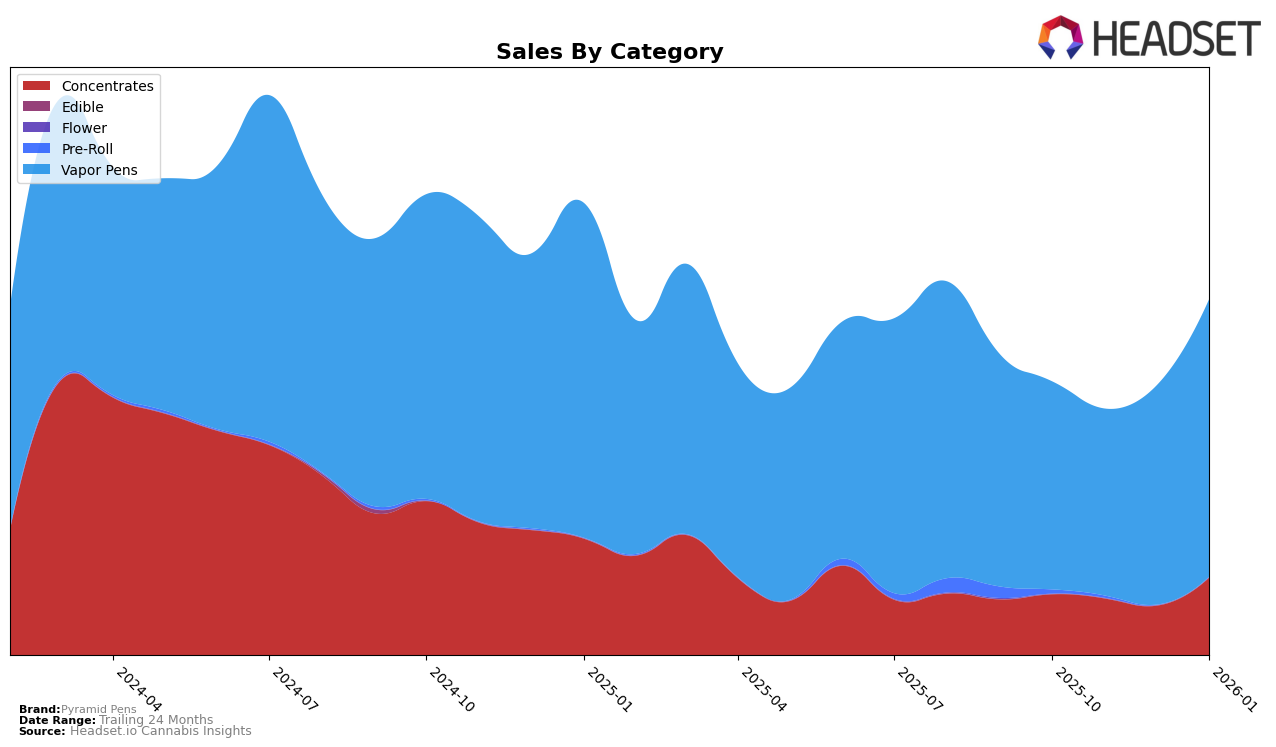

Pyramid Pens has shown varied performance across different states and product categories. In Colorado, the brand has made notable strides in the Concentrates category, moving from outside the top 30 in October 2025 to 39th place by January 2026. This upward trend indicates a growing acceptance and demand for their products in this category. However, their performance in the Vapor Pens category has been relatively stable, with minor fluctuations in rankings, peaking at 43rd place in January 2026. This suggests a consistent consumer base but also highlights room for improvement to climb higher in the rankings.

In New Jersey, Pyramid Pens has maintained a strong presence in both Concentrates and Vapor Pens categories. The brand consistently ranked within the top 15 for Concentrates, reclaiming its 9th position in January 2026 after a slight dip in December 2025. This resilience in the rankings underscores the brand's strong foothold in the state. In the Vapor Pens category, Pyramid Pens has shown impressive growth, climbing from 21st place in October 2025 to 15th by January 2026. This upward trajectory in New Jersey could be indicative of successful market strategies or increased consumer preference for their Vapor Pen products.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Pyramid Pens has shown a promising upward trajectory in rankings over the past few months. Despite starting outside the top 20 in October and November 2025, Pyramid Pens climbed to 18th in December 2025 and further improved to 15th by January 2026. This positive shift in rank is indicative of a strategic push that has resulted in increased sales, contrasting with the downward sales trends seen in competitors like Bloom and Clade9, whose sales have been declining since October 2025. Meanwhile, The Botanist and Savvy have maintained relatively stable positions, though their sales figures have not shown the same growth momentum as Pyramid Pens. This suggests that Pyramid Pens is effectively capturing market share from its competitors, positioning itself as a rising player in the New Jersey vapor pen market.

Notable Products

In January 2026, Prism - Glueball #7 Distillate Cartridge (1g) emerged as the top-performing product for Pyramid Pens, achieving the number one rank with sales of 1678 units. Prism - Orange Poison Distillate Cartridge (1g) maintained its second position from December 2025 with an increase in sales to 1117 units. Burst - Strawnana Flavored Distillate Cartridge (1g) improved its rank from fourth in December to third in January, showcasing a notable upward movement. Burst - Blueberry Distillate Cartridge (1g) also climbed up the ranks, moving from fifth to fourth position. Conversely, Prism - Mars OG Distillate Cartridge (1g) saw a decline, dropping from the top spot in December to fifth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.