Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

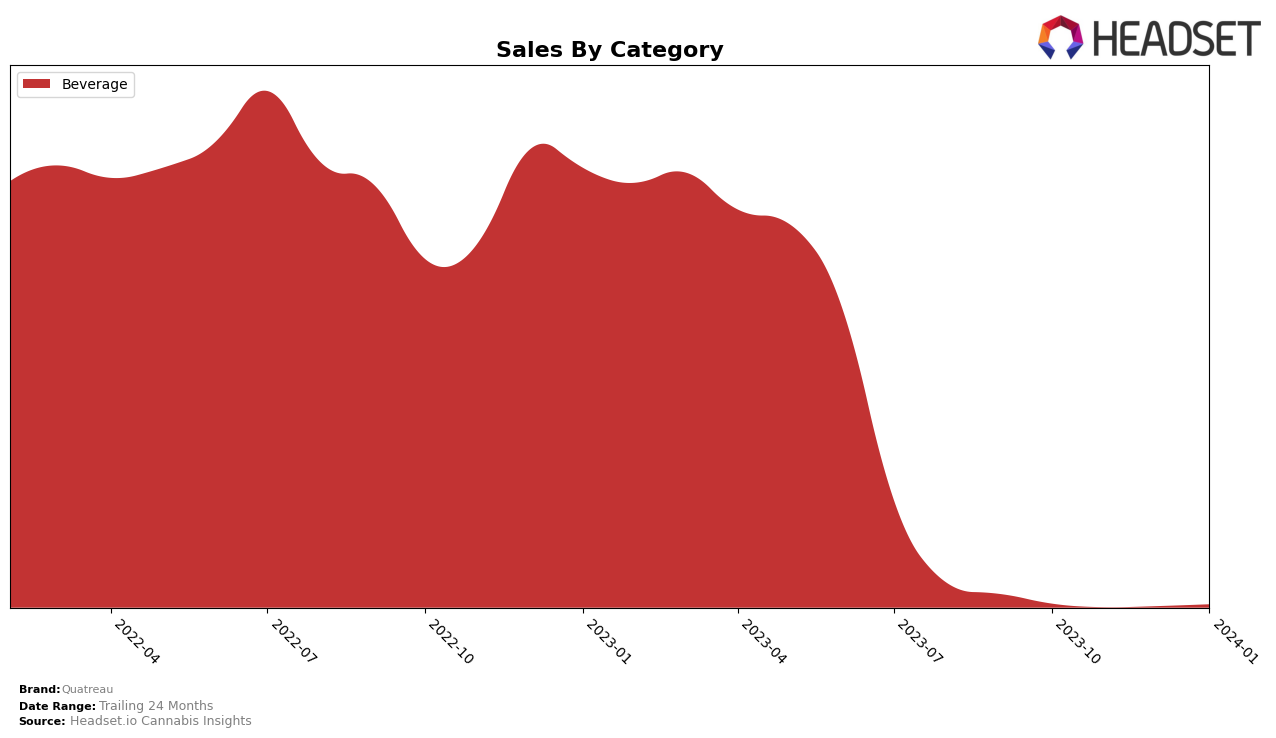

In the competitive cannabis beverage market, Quatreau has demonstrated varied performance across different provinces in Canada, reflecting its fluctuating market position. In Alberta, Quatreau's ranking slipped from 25th in October 2023 to 37th in November, before slightly improving to 27th in January 2024, indicating a struggle to maintain a consistent market presence amidst stiff competition. Conversely, in Saskatchewan, Quatreau showed a positive trend, improving its rank from 22nd in October 2023 to 19th in January 2024, suggesting a growing acceptance and preference for Quatreau's beverage offerings within this province. This upward trajectory in Saskatchewan, combined with the fluctuating performance in Alberta, highlights the brand's uneven yet promising potential across different markets.

Meanwhile, in British Columbia and Ontario, Quatreau's performance tells a story of challenges and missed opportunities. The brand failed to secure a spot in the top 20 rankings for the beverage category in Ontario for the months observed, underscoring significant challenges in penetrating this market. In British Columbia, after not being ranked in October 2023, Quatreau entered the rankings at 33rd place in November but did not maintain a consistent presence, highlighting potential issues with brand visibility or consumer preference in this region. This absence in the top rankings, especially in a large market like Ontario, could be viewed as a setback, emphasizing the need for strategic adjustments to enhance market penetration and brand recognition.

Competitive Landscape

In the competitive landscape of the beverage category in Alberta, Quatreau has experienced notable fluctuations in its ranking over the recent months, indicating a challenging market position. Starting from October 2023, Quatreau was ranked 25th, which then significantly dropped to 37th in November and 35th in December, before slightly improving to 27th in January 2024. This trajectory suggests a struggle to maintain a strong market presence amidst stiff competition. Notably, Little Victory has consistently outperformed Quatreau, despite experiencing its own decline in sales and rank, indicating a broader market trend rather than isolated incidents. Other competitors like Emprise Canada, Green Monke, and Impromptu have also shown fluctuations in their rankings and sales, highlighting a volatile market environment. Quatreau's performance, particularly its rank improvement in January 2024, suggests a potential for recovery, albeit in a highly competitive and changing market landscape.

Notable Products

In January 2024, Quatreau's top-performing product was CBD Passionfruit Guava Sparkling Water (20mg CBD, 355ml) with sales reaching 220 units, maintaining its number one rank consistently from October 2023. Following in second place was CBD/THC 1:1 Ginger & Lime Sparkling Water (2mg CBD, 2mg THC,355ml), climbing from its previous third position in December 2023, showcasing a notable improvement. CBD Cucumber & Mint Sparkling Water (20mg CBD,355ml) secured the third spot, experiencing a slight rank fluctuation over the past months but ultimately rising from its fourth position in December. The CBD/THC 1:1 Blueberry and Acai Sparkling Water (2mg CBD, 2mg THC, 355ml) came in fourth, despite having a significant sales peak in December 2023, indicating a shift in consumer preference. These rankings illustrate a dynamic market for Quatreau's beverage category, highlighting consumer favor towards CBD-dominant products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.