Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

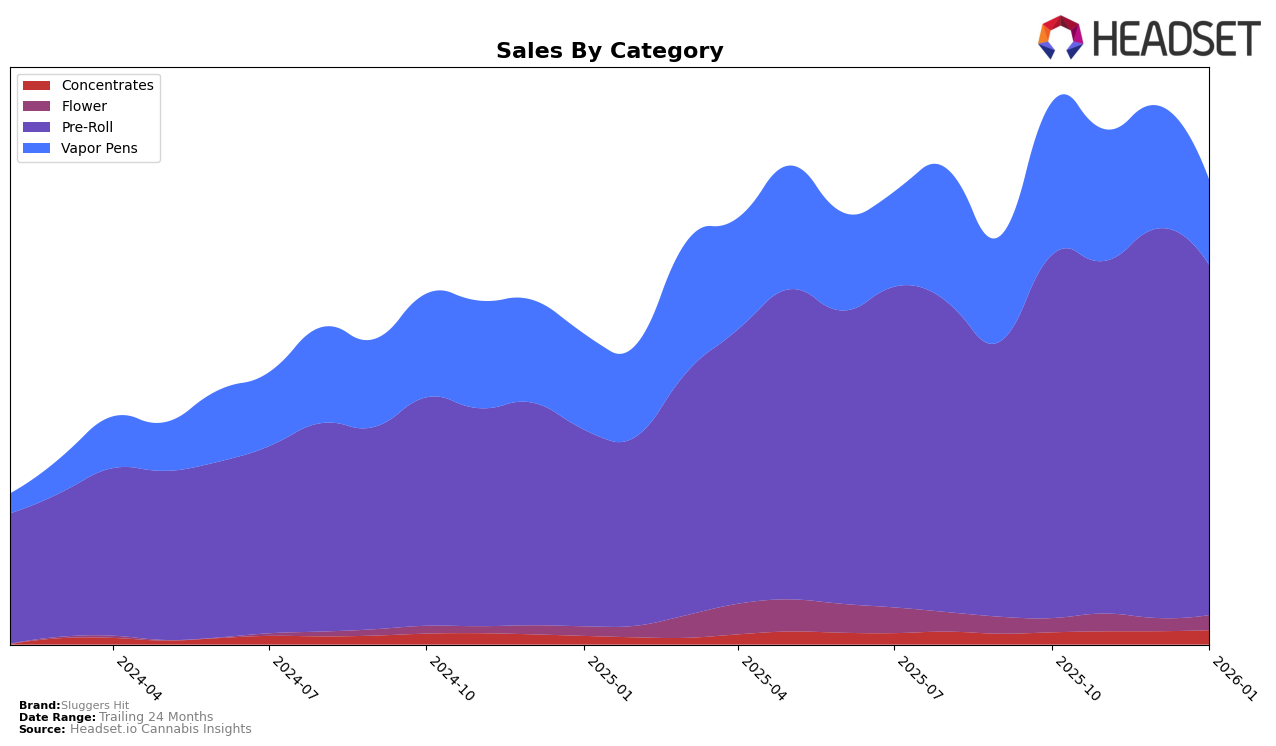

In the competitive cannabis market, Sluggers Hit has shown varied performance across different states and product categories. In Arizona, the brand has maintained a strong presence in the Pre-Roll category, with rankings fluctuating between 10th and 15th place from October 2025 to January 2026. This consistency indicates a solid consumer base, despite a slight dip in November. However, in the Vapor Pens category, Sluggers Hit struggled to maintain a top position, dropping out of the top 30 in January 2026 after climbing to 25th place in December. This suggests potential challenges in maintaining consumer interest or increased competition in this segment.

In California, Sluggers Hit has demonstrated remarkable stability in the Pre-Roll category, consistently holding the 4th position until slipping to 5th in January 2026. This indicates a strong foothold in the market, likely driven by brand loyalty or product quality. Conversely, their performance in the Vapor Pens category has seen a downward trend, with the brand falling from 21st place in October to 33rd by January, highlighting possible challenges in adapting to market demands or shifts in consumer preferences. Meanwhile, in Massachusetts, the brand has shown resilience in the Pre-Roll category, recovering from a rank of 62 in November to reach the top 30 in December, before slipping slightly again in January. This suggests a volatile but promising market presence that could benefit from strategic adjustments to capitalize on growth opportunities.

Competitive Landscape

In the competitive landscape of the California pre-roll category, Sluggers Hit has maintained a consistent presence, although its rank experienced a slight dip from fourth to fifth place by January 2026. This shift is notable when compared to competitors like Presidential, which improved its position from fifth to fourth, and Pure Beauty, which climbed from ninth to sixth place over the same period. Despite the rank change, Sluggers Hit's sales have shown resilience, with a slight decrease in January 2026 compared to December 2025, yet still outperforming Pure Beauty and Pacific Stone. Meanwhile, Kingpen has consistently held the third position, indicating a stable market presence. The overall trend suggests that while Sluggers Hit faces stiff competition, particularly from brands like Presidential, it remains a strong contender in the California pre-roll market.

Notable Products

In January 2026, the top-performing product from Sluggers Hit was the Baby Griselda Infused Pre-Roll 5-Pack (3.5g), which climbed to the number one spot with sales reaching 4210 units. The Euphoria Infused Pre-Roll 5-Pack (3.5g) maintained its position at rank two, showing consistent popularity. Blueberry Banana Infused Pre-Roll 5-Pack (3.5g) moved up to third place from its previous absence in December, indicating a resurgence in demand. Black Cherry Gelato Infused Pre-Roll 5-Pack (3.5g) debuted at rank four, while 33 Live Resin Diamonds Disposable (1g) slipped from third in December to fifth. This shift in rankings highlights a strong performance in the pre-roll category for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.