Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

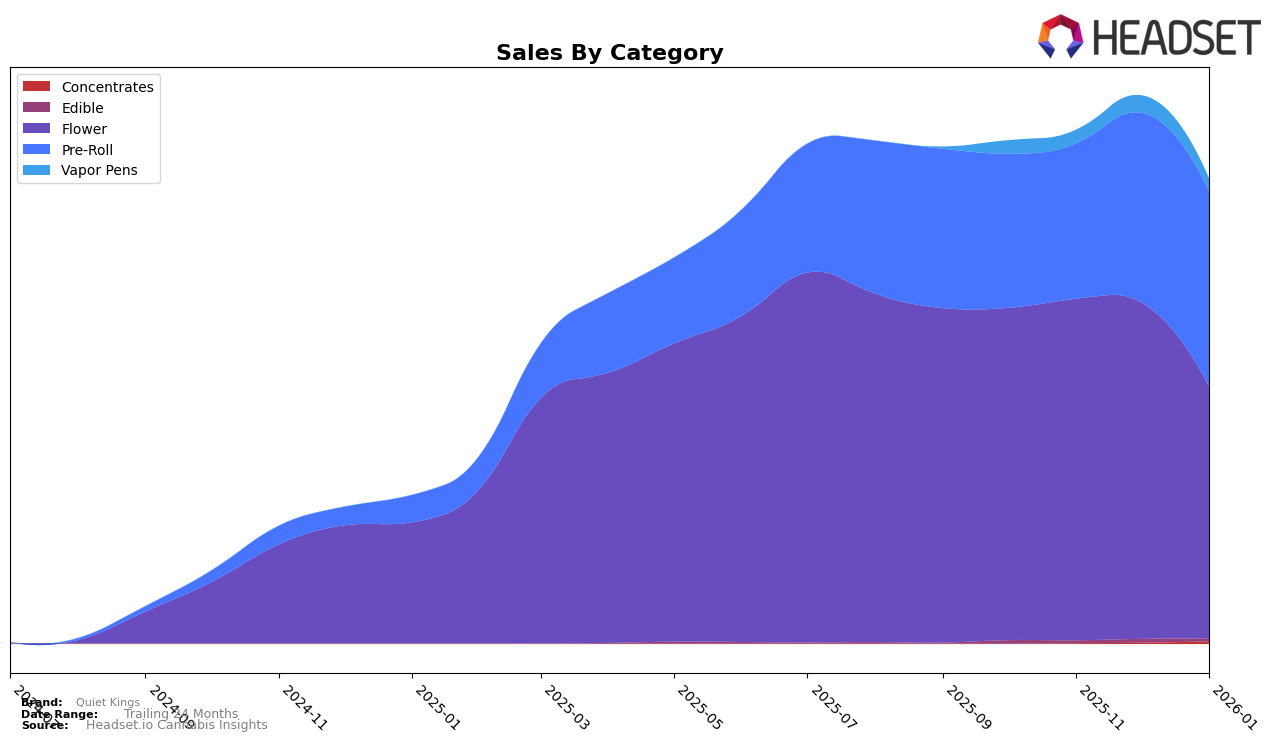

Quiet Kings has shown varied performance across different product categories and states, with notable movements in the rankings over the past few months. In California, the Flower category saw a decline from a rank of 11 in December 2025 to 16 in January 2026, indicating a potential challenge in maintaining market share. Conversely, the Pre-Roll category demonstrated a positive trend, improving from rank 17 in October 2025 to 11 by January 2026, suggesting that this category might be gaining traction among consumers. However, it is important to note that Quiet Kings did not make it into the top 30 for Vapor Pens in October 2025, only breaking into the rankings in November at a distant 100th position, which could be seen as a weak spot in their product lineup.

The sales figures for Quiet Kings in California also reflect these ranking movements. For instance, the Flower category experienced a significant drop in sales from $1,807,068 in December 2025 to $1,353,153 in January 2026, which aligns with their decline in ranking. On the other hand, Pre-Rolls saw a steady increase in sales, peaking at $1,044,952 in January 2026, which correlates with their improved ranking. The Vapor Pens category, while showing some improvement in rankings, still indicates a need for strategic focus, as Quiet Kings was not even in the top 30 before November 2025. These insights suggest that while Quiet Kings has strengths in certain areas, there are opportunities for growth and improvement in others.

Competitive Landscape

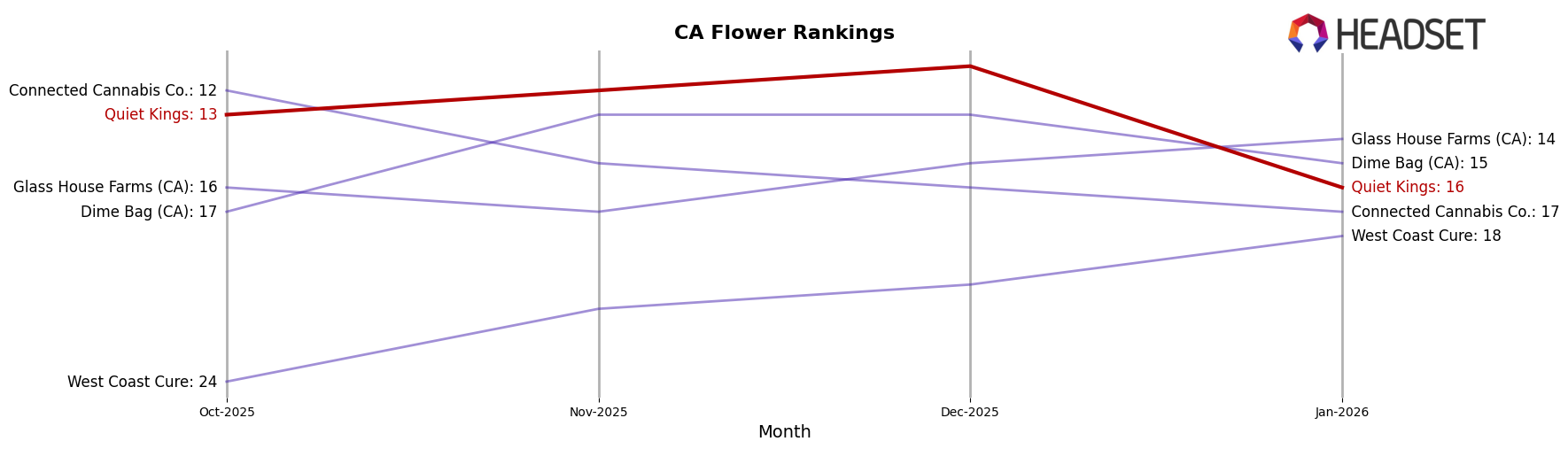

In the competitive landscape of the flower category in California, Quiet Kings has experienced notable fluctuations in its ranking and sales performance over the past few months. Starting strong in October 2025 with a rank of 13, Quiet Kings improved to 11 by December 2025, before dropping to 16 in January 2026. This decline in rank coincides with a decrease in sales, suggesting potential challenges in maintaining its market position. In contrast, Glass House Farms (CA) consistently improved its rank from 16 in October 2025 to 14 in January 2026, maintaining a higher sales volume than Quiet Kings. Meanwhile, Dime Bag (CA) also showed resilience, with its rank fluctuating but ultimately ending higher than Quiet Kings in January 2026. The competitive pressure from brands like West Coast Cure and Connected Cannabis Co., which have shown varying trends, further emphasizes the dynamic nature of the market, urging Quiet Kings to strategize effectively to regain its upward trajectory.

Notable Products

In January 2026, Quiet Kings' top-performing product was Grape Diesel Pre-Roll (1g), which secured the number one rank with sales of 8,934 units. Following closely, Highway Breath Pre-Roll (1g) and Hashbar OG Pre-Roll (1g) ranked second and third, respectively. Peanut Butter Dreams Pre-Roll (1g) and Alien Runtz Pre-Roll (1g) completed the top five, showing robust sales figures. This lineup represents a shift from previous months, where these products did not appear in the top rankings, indicating a significant increase in their popularity. The Pre-Roll category clearly dominated Quiet Kings' sales for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.