Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

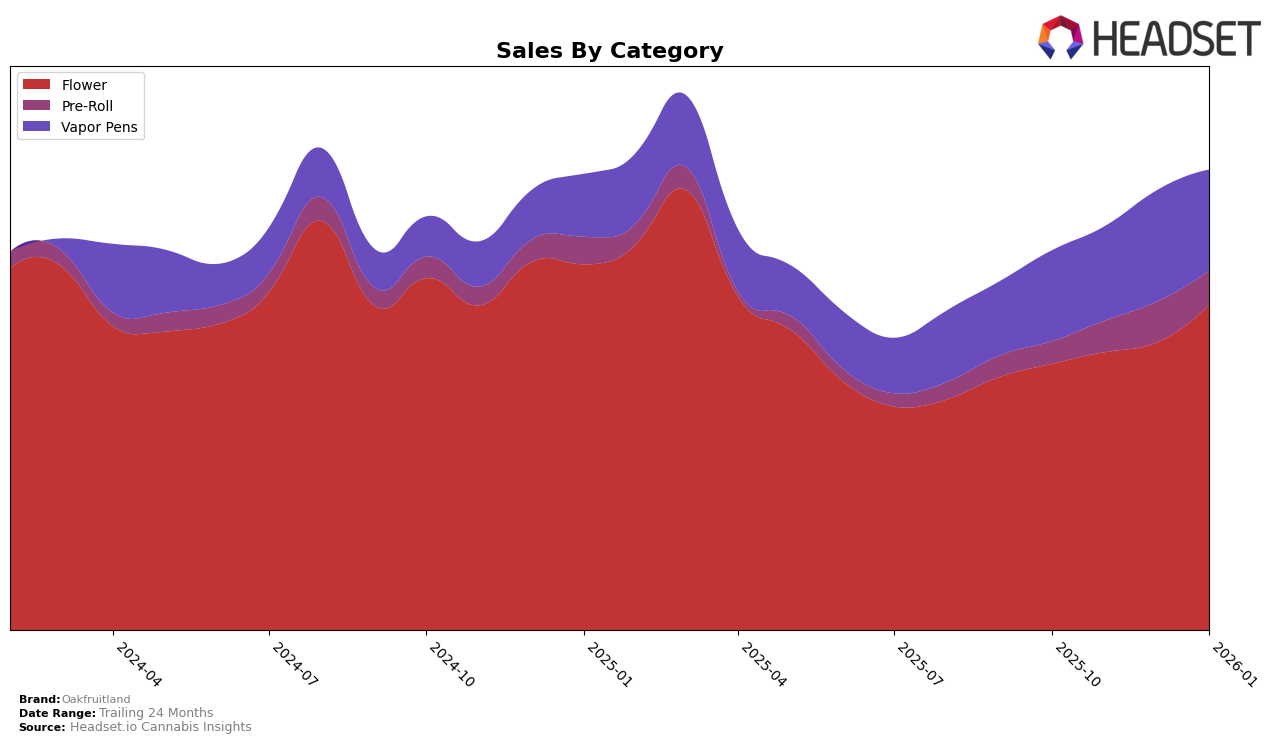

Oakfruitland has demonstrated a noteworthy performance in the California market, particularly within the Flower category. Over the four-month period from October 2025 to January 2026, the brand climbed from the 11th position to an impressive 7th place ranking. This upward trajectory suggests a robust market presence and growing consumer preference. In contrast, their performance in the Pre-Roll category, while improved, did not break into the top 30, indicating potential areas for growth or strategic shifts. The Vapor Pens category also saw positive movement, with Oakfruitland advancing from 30th to 24th place, suggesting a steady gain in market share.

Despite not making the top 30 in the Pre-Roll category, Oakfruitland's sales figures in California reveal a significant increase, particularly from November to December 2025. This suggests that while their ranking may not reflect top-tier status, there is underlying sales momentum that could translate into future improvements in rankings. The Flower category's consistent climb in rankings, coupled with sales growth, highlights Oakfruitland's strength and potential as a key player in the California cannabis market. The Vapor Pens category also shows promise, with a steady rise in rankings suggesting increasing consumer acceptance and market penetration.

Competitive Landscape

In the competitive landscape of the California flower category, Oakfruitland has shown a promising upward trajectory in recent months. From October 2025 to January 2026, Oakfruitland improved its rank from 11th to 7th, indicating a positive shift in market positioning. This rise in rank is particularly notable when compared to competitors such as UpNorth Humboldt, which also improved its rank but remained slightly behind Oakfruitland at 8th place by January 2026. Meanwhile, Fig Farms maintained a stable position, hovering around the 8th and 9th ranks, showing less dynamic movement than Oakfruitland. On the other hand, Blem demonstrated a stronger upward trend, surpassing Oakfruitland by moving from 8th to 5th place. Despite this, Oakfruitland's consistent sales growth, culminating in a notable increase by January 2026, underscores its potential to further climb the ranks and capture a larger market share in the competitive California flower market.

Notable Products

In January 2026, Oakfruitland's top-performing product was Pandora's Box (7g) in the Flower category, maintaining its first-place rank from previous months with a significant sales figure of 9312. Pandora's Box (3.5g) also held steady at the second position, showing consistent demand. Lucky Dragon (3.5g), which was ranked fifth in December 2025, climbed to the third spot in January 2026, indicating a growing popularity. Oak Lato (7g) re-entered the rankings at fourth place, showcasing a resurgence in sales. Pre-98 Bubba Kush (7g) maintained its fifth position, demonstrating stable performance in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.