Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

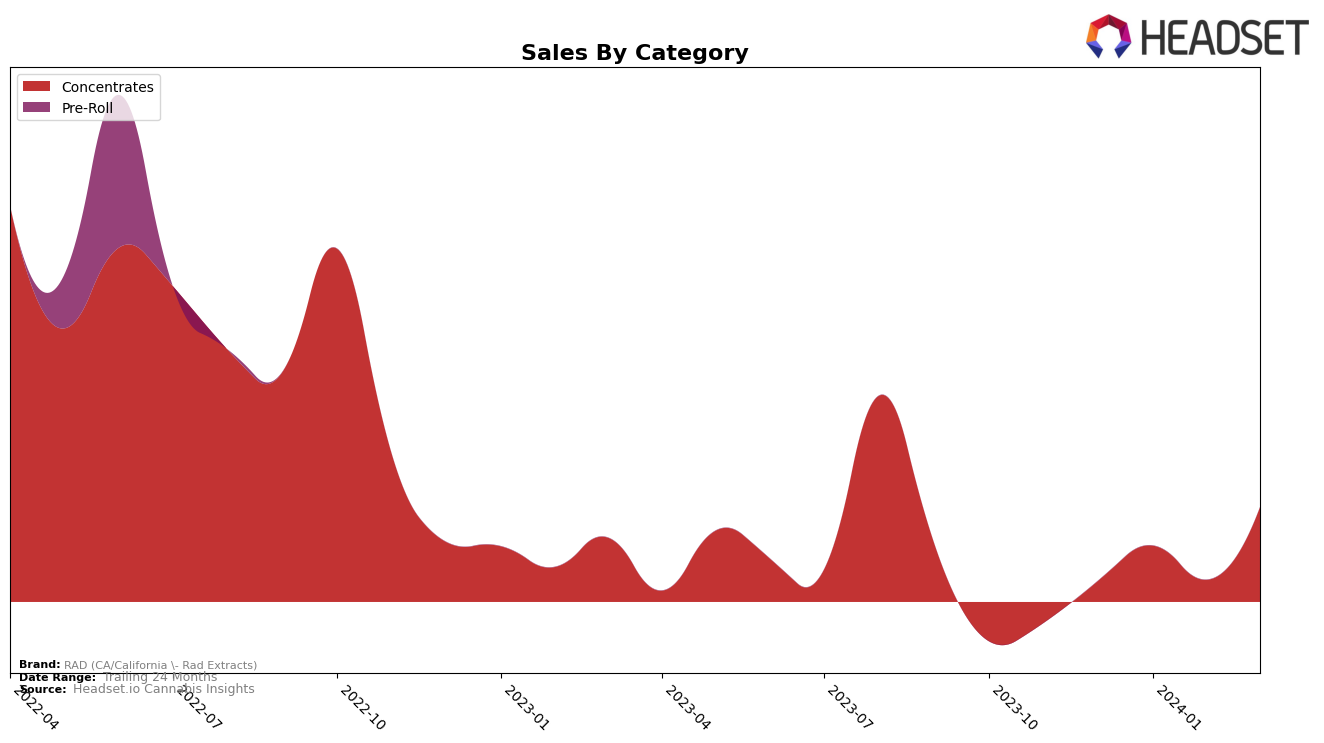

In the competitive landscape of cannabis concentrates, RAD (CA/California - Rad Extracts) has shown a mixed bag of results across different provinces in Canada, indicating a fluctuating performance that merits a closer look. For instance, in British Columbia, RAD made a notable entry into the top 50 in January 2024, climbing from a non-ranking position in December 2023 to rank 47, and then showed a slight dip in February to rank 53, before improving its position to rank 44 in March 2024. This trajectory suggests a growing interest and acceptance of RAD's concentrates in British Columbia, despite the initial absence from the top rankings. However, the sales figures, peaking at 990 in March after a low of 333 in January, indicate a volatile market response that could benefit from strategic adjustments.

On the other hand, RAD's performance in Saskatchewan and Ontario presents a contrasting picture. In Saskatchewan, RAD has demonstrated significant growth, moving from rank 45 in December 2023 to a stronger position at rank 26 by March 2024, with sales peaking impressively at 2871 in March. This positive momentum in Saskatchewan underscores RAD's increasing market share and consumer preference within the province. Conversely, Ontario presents a challenge, with RAD only breaking into the top 100 in March 2024 at rank 97, a clear indicator of the brand's struggles in gaining a foothold in Ontario's competitive market. This discrepancy in performance across provinces highlights the importance of localized strategies and the potential for RAD to leverage its successes in provinces like Saskatchewan to bolster its presence in more challenging markets like Ontario.

Competitive Landscape

In the competitive landscape of the concentrates category in Saskatchewan, RAD (CA/California - Rad Extracts) has shown a notable fluctuation in its market position, missing from the top 20 in February 2024 but making a significant jump to rank 26th by March 2024. This volatility in ranking, however, masks a substantial increase in sales over the same period, underscoring a potential for RAD to further solidify its presence in the market. Key competitors include Greybeard, maintaining a strong presence despite a slight decline to 25th place in March 2024 from a higher rank earlier in the year. Phant and Highly Dutch also represent significant competition, with Phant experiencing a similar rank drop to RAD in March 2024, and Highly Dutch showing a more stable but lower performance. Notably, EarthWolf Farms entered the rankings directly at 24th place in March 2024, indicating a competitive and dynamic market. These movements suggest a fiercely competitive environment for RAD, where brand positioning and sales performance can shift rapidly, highlighting the importance of strategic market positioning and brand differentiation.

Notable Products

In March 2024, RAD (CA/California - Rad Extracts) saw Pink Kush Shatter (1g) from the Concentrates category maintain its position as the top-selling product for the fourth consecutive month, with a significant sales figure of 134 units. This product has consistently outperformed others in its category, demonstrating a strong and steady demand among consumers. The sales figures for Pink Kush Shatter (1g) saw a notable increase from February to March, indicating a growing interest in this particular product. Unfortunately, without additional data on other products, it's challenging to compare its performance directly or to note changes in rankings for other items. However, the sustained top ranking of Pink Kush Shatter (1g) suggests that RAD (CA/California - Rad Extracts) has a flagship product that resonates well within the cannabis community.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.