Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

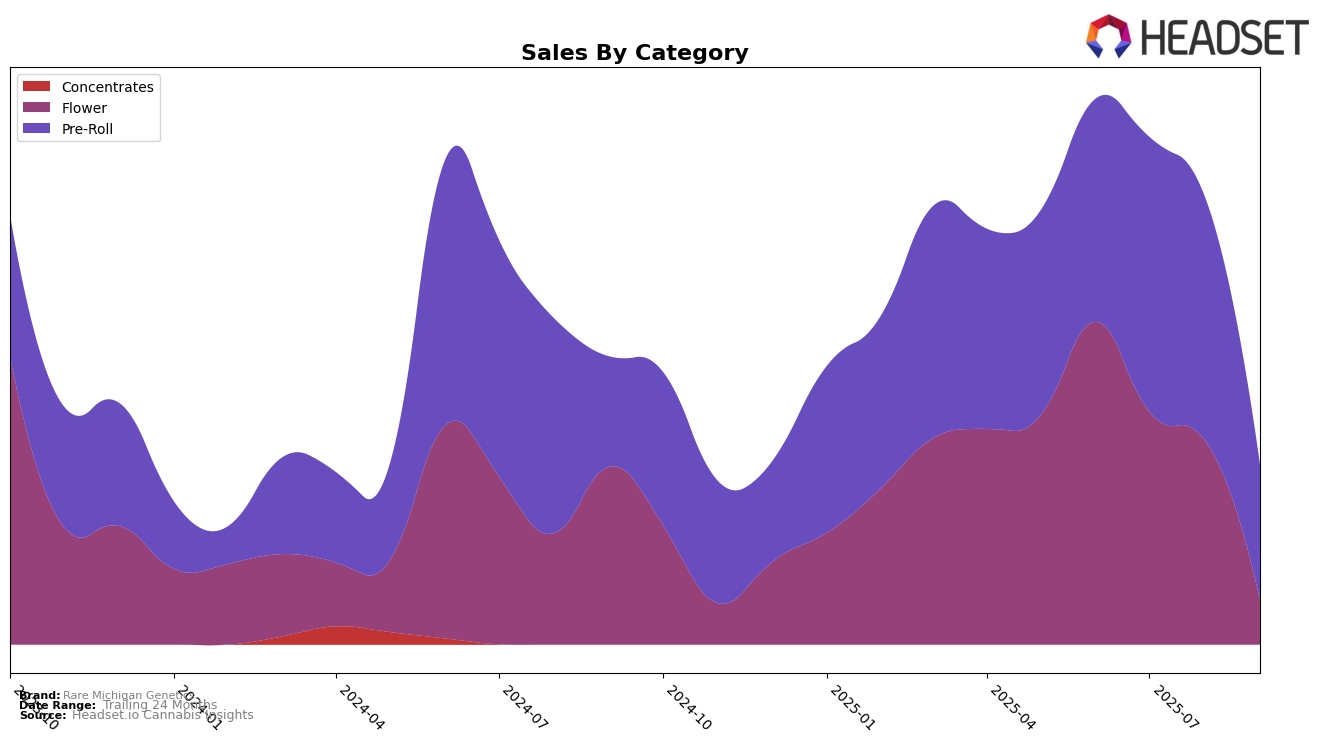

Rare Michigan Genetics has shown a varied performance across different cannabis categories in the state of Michigan. In the Flower category, the brand experienced a decline in its rankings, dropping from 34th in June 2025 to being outside the top 30 by September 2025. This downward trend is reflected in their sales figures, which decreased from $816,554 in June to $516,653 by August, with no data available for September. The absence of a ranking in September indicates that the brand faced challenges in maintaining its competitive position within the Flower category in Michigan, which could be a point of concern for stakeholders looking for stability and growth in this segment.

Conversely, Rare Michigan Genetics performed relatively better in the Pre-Roll category. Despite a slight fluctuation, the brand maintained a presence within the top 30 rankings, starting at 16th in June, improving to 14th in July, and then returning to 16th in August before dropping to 30th in September. The sales figures for Pre-Rolls also showed a peak in July at $695,517, before declining to $342,445 in September. This suggests that while the brand has managed to sustain a competitive edge in the Pre-Roll category, it faces challenges in maintaining consistent growth. The fluctuating rankings and sales indicate a need for strategic adjustments to capture a more stable market position in Michigan's Pre-Roll segment.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll market, Rare Michigan Genetics has experienced notable fluctuations in its ranking and sales over the past few months. Starting at 16th place in June 2025, the brand improved to 14th in July, only to drop back to 16th in August and significantly fall to 30th by September. This decline in rank coincides with a sharp decrease in sales from $617,500 in August to $342,445 in September. Meanwhile, competitors such as Muha Meds and Uplyfted Cannabis Co. have shown more stable or improving trends. Muha Meds improved its rank from 33rd in August to 29th in September, with a slight increase in sales, while Uplyfted Cannabis Co. maintained a relatively stable position, only dropping from 24th to 31st, with sales decreasing less dramatically. Additionally, Cheech & Chong's improved their rank from 25th to 28th, indicating a competitive push in the market. These dynamics suggest that Rare Michigan Genetics may need to reassess its strategies to regain market share and improve its competitive standing.

Notable Products

In September 2025, Rare Michigan Genetics saw Hoof Infused w/kief Pre-Roll (1g) leading the sales as the top-performing product, climbing to the first position with sales of 3822 units. Party Girl Pre-Roll (1g) maintained its strong presence by securing the second spot, although its sales dropped from July. Gack OG Pre-Roll (1g) rose to the third position, improving from its fifth-place ranking in August. Frozen Daiquiri Pre-Roll (1g) held the fourth position, consistent with its previous performance in July. Titty Sprinkles Kief Infused Pre-Roll (1g) emerged as a notable contender by entering the top five for the first time in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.