Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

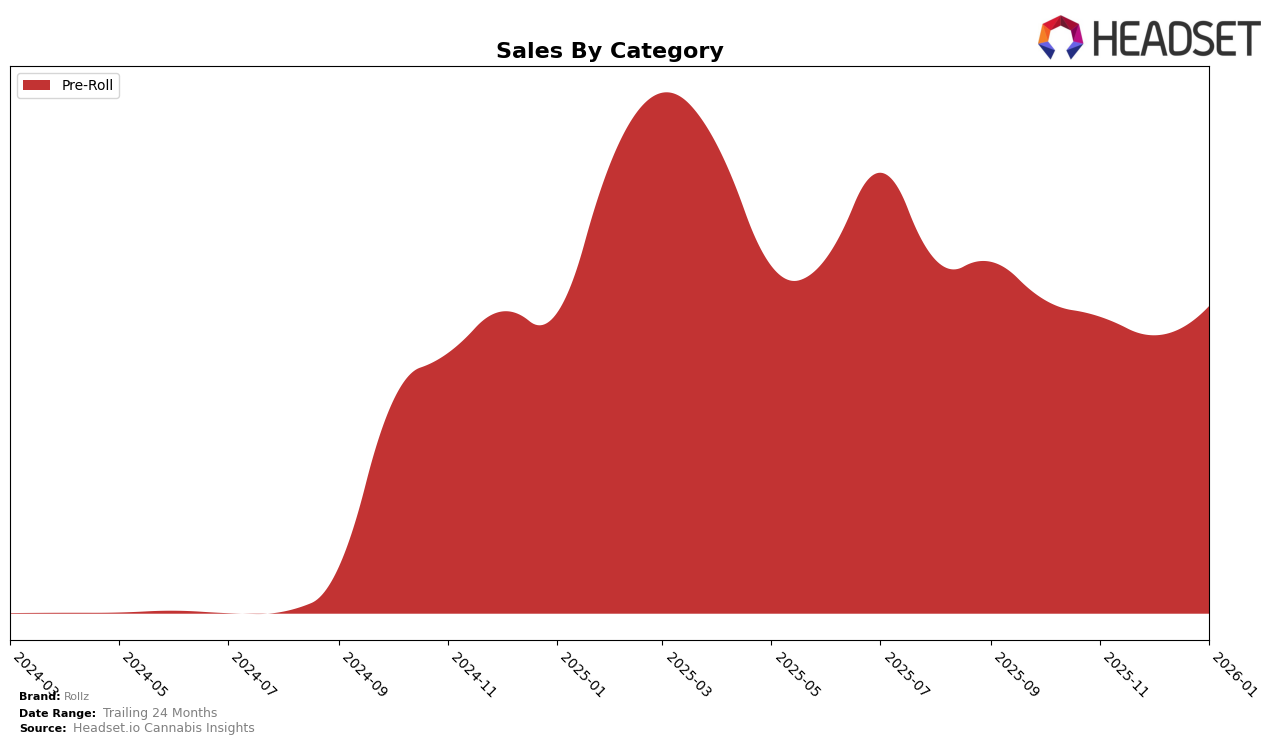

Rollz has shown a notable performance in the Pre-Roll category in Michigan. Over the observed months, Rollz has improved its ranking from 24th in October 2025 to 17th by January 2026. This upward trajectory is indicative of a strong market presence and growing consumer preference in the region. Despite a slight decline in sales from October to December, Rollz managed to reverse this trend by January, showcasing resilience and effective market strategies. The ability to maintain and improve its ranking, even when sales figures showed fluctuations, is a testament to the brand's adaptability and appeal in the Pre-Roll category in Michigan.

However, it's important to note that Rollz's presence in other states or provinces is not evident within the top 30 rankings for the Pre-Roll category during this period. This absence could be seen as a potential area for growth or as a challenge in expanding their market reach beyond Michigan. The lack of ranking in other regions may highlight a need for strategic initiatives to penetrate new markets or strengthen their brand in existing ones. Observing Rollz's performance in Michigan provides valuable insights into their potential strategies and market dynamics, which could be leveraged for broader geographical expansion.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Rollz has demonstrated a notable upward trajectory in its ranking, moving from 24th place in October 2025 to 17th place by January 2026. This improvement in rank suggests a positive reception among consumers, despite facing stiff competition from brands like Seed Junky Genetics, which consistently maintained a top 20 position, reaching 16th place by January 2026. Similarly, High Minded and Road Trip also showed fluctuating ranks but remained competitive, with High Minded climbing to 19th place and Road Trip slightly dropping to 18th place in January 2026. Notably, Swisher has been a strong contender, consistently ranking higher than Rollz, peaking at 14th place in October 2025 and stabilizing at 15th place by January 2026. Rollz's strategic improvements in rank, amidst these competitive pressures, highlight its potential for growth and increased market share in the coming months.

Notable Products

In January 2026, the top-performing product for Rollz was Maui Wowie Infused Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with sales of 19,136 units. Boomsticks - Watermelon Zkittles Infused Pre-Roll (1g) maintained its position at rank two, showing consistency from December 2025. Unicorn Piss Infused Pre-Roll (1g) entered the top three for the first time, ranking third. Boomsticks - Freaky Tiki THCa Infused Pre-Roll (1g) debuted at the fourth position, while Boomstick - Sour Mango Diamond Infused Pre-Roll (1g) dropped from first in December 2025 to fifth in January 2026. These shifts highlight the dynamic changes in consumer preferences within the Pre-Roll category for Rollz.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.