Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

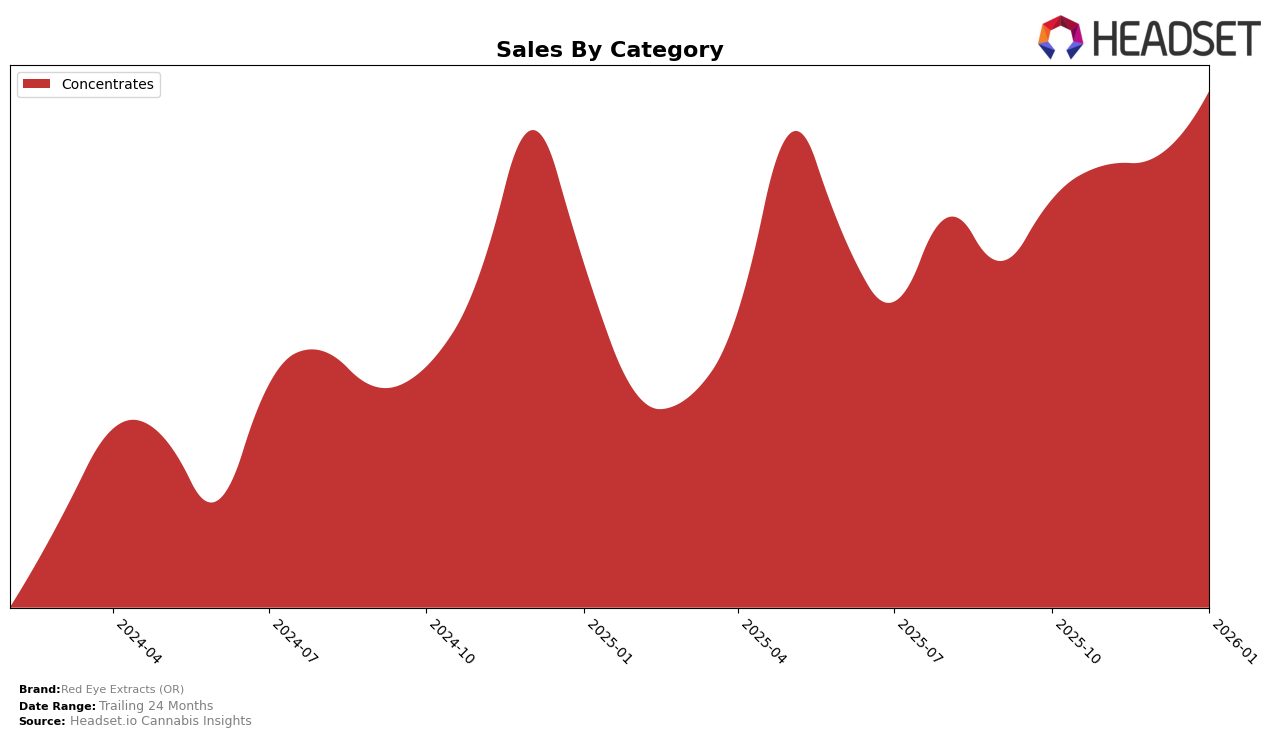

Red Eye Extracts (OR) has shown consistent performance in the Concentrates category in Oregon. For four consecutive months, from October 2025 to January 2026, the brand maintained a solid second place ranking. This stability in ranking reflects their strong presence and consumer loyalty within the state, as they continue to be a preferred choice for concentrates. Despite not reaching the top spot, the brand's consistent sales growth, with an increase from $390,042 in October 2025 to $460,338 in January 2026, indicates a positive trend and potential for future growth.

While Red Eye Extracts (OR) has demonstrated strong performance in Oregon, the absence of rankings in other states suggests that their market presence is limited to this region. Not appearing in the top 30 brands in other states and categories could be seen as a drawback, indicating potential areas for expansion and improvement. This limited reach might be a strategic focus on their home state, yet it also highlights an opportunity for the brand to explore and establish itself in new markets to diversify and increase its consumer base.

```Competitive Landscape

In the competitive landscape of Oregon's concentrates market, Red Eye Extracts (OR) consistently holds the second rank from October 2025 to January 2026, demonstrating a stable position just behind Altered Alchemy, which maintains the top spot. Despite not surpassing Altered Alchemy, Red Eye Extracts (OR) shows a positive sales trajectory, with sales figures increasing steadily over the months, closely trailing the leader. Meanwhile, Oregrown consistently ranks third, but with sales figures significantly lower than Red Eye Extracts (OR), indicating a clear gap between the second and third positions. White Label Extracts (OR) shows improvement by moving from sixth to fourth place, yet its sales remain considerably lower than those of Red Eye Extracts (OR). This stable ranking and upward sales trend suggest that Red Eye Extracts (OR) is well-positioned in the market, with potential to challenge the leading brand if the growth continues.

Notable Products

In January 2026, the top-performing product from Red Eye Extracts (OR) was Mactini Cured Resin (2g) in the Concentrates category, claiming the number one rank with sales of 1125 units. Blue Dream Cured Resin (2g) and Sherbama Cured Resin (2g) shared the second rank, each with notable sales figures. Pink Candy Chem Cured Resin (1g) followed closely in the third position. Mental Bloom Cured Resin (1g) maintained its fourth-place ranking from November 2025, showing consistent performance. Notably, Mactini Cured Resin (2g) rose to the top spot, indicating a significant increase in popularity compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.