Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

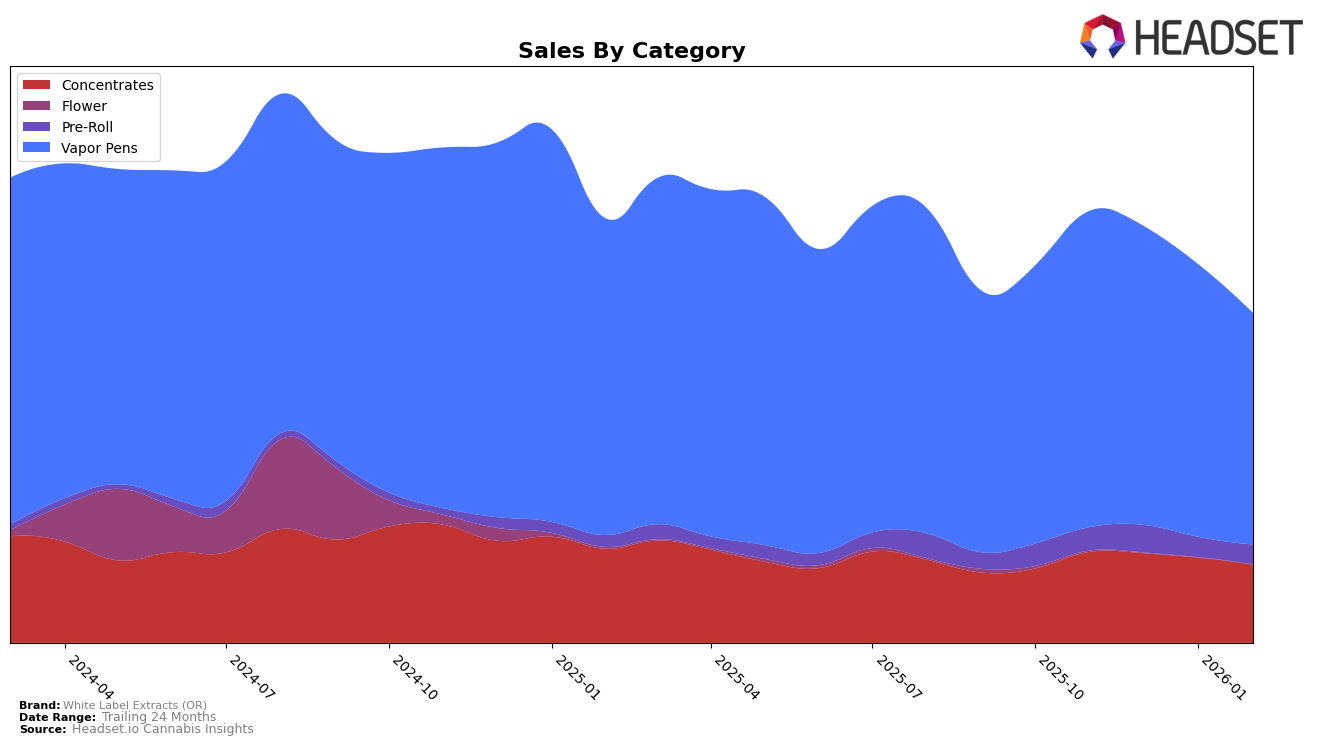

White Label Extracts (OR) has maintained a consistent performance in the Oregon cannabis market, particularly in the Concentrates category where it has held steady at the 4th position from November 2025 through February 2026. This stability in ranking suggests a strong brand presence and customer loyalty in the Concentrates segment, even as sales figures show a gradual decline over the months. In contrast, the Vapor Pens category saw a slight dip in ranking from 9th to 10th place, reflecting a competitive landscape and potential challenges in maintaining market share. Despite these challenges, the brand's sales in this category remain substantial, indicating a robust consumer base.

In the Pre-Roll category, White Label Extracts (OR) has shown a modest improvement, moving from 41st place in November 2025 to 39th by February 2026. While this category does not place the brand in the top 30, the upward movement could signal strategic efforts to enhance market positioning. The sales figures in this category exhibit fluctuations, which may suggest varying consumer preferences or promotional activities influencing demand. Overall, the brand's performance across these categories highlights both areas of strength and opportunities for growth within the Oregon market.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, White Label Extracts (OR) has experienced a relatively stable but slightly declining performance from November 2025 to February 2026. Ranked consistently at 9th place in November and December 2025, White Label Extracts (OR) dropped to 10th place by January and maintained this position in February 2026. This decline in rank coincides with a decrease in sales over the same period, indicating potential challenges in maintaining market share. In contrast, Farmer's Friend Extracts has shown resilience, improving its rank from 7th to 6th place in December 2025, although it slipped to 9th by February 2026. Meanwhile, Loot Bar has consistently outperformed White Label Extracts (OR), maintaining a higher rank throughout the period and even climbing back to 8th place in February 2026. The competitive pressure from these brands, along with the stable performance of Echo Electuary and Higher Cultures, suggests that White Label Extracts (OR) needs to strategize effectively to regain its competitive edge in the Oregon vapor pen market.

Notable Products

In February 2026, the top-performing product from White Label Extracts (OR) was the Sour Candy Lope Cured Resin Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 1012 units. Following closely were the Cherry Exaltation Live Resin Cartridge (1g) and the Triple Burger Live Resin Cartridge (1g), ranked second and third respectively. Notably, the Dream Factory Live Resin Cartridge (1g) dropped from third place in January to fifth place in February, indicating a shift in consumer preferences. The White Tahoe Cooks x Sherbanger 22 Infused Pre-Roll (1g) secured the fourth position, showcasing strong performance in the Pre-Roll category. Overall, Vapor Pens dominated the top rankings, illustrating their popularity among consumers during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.