Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

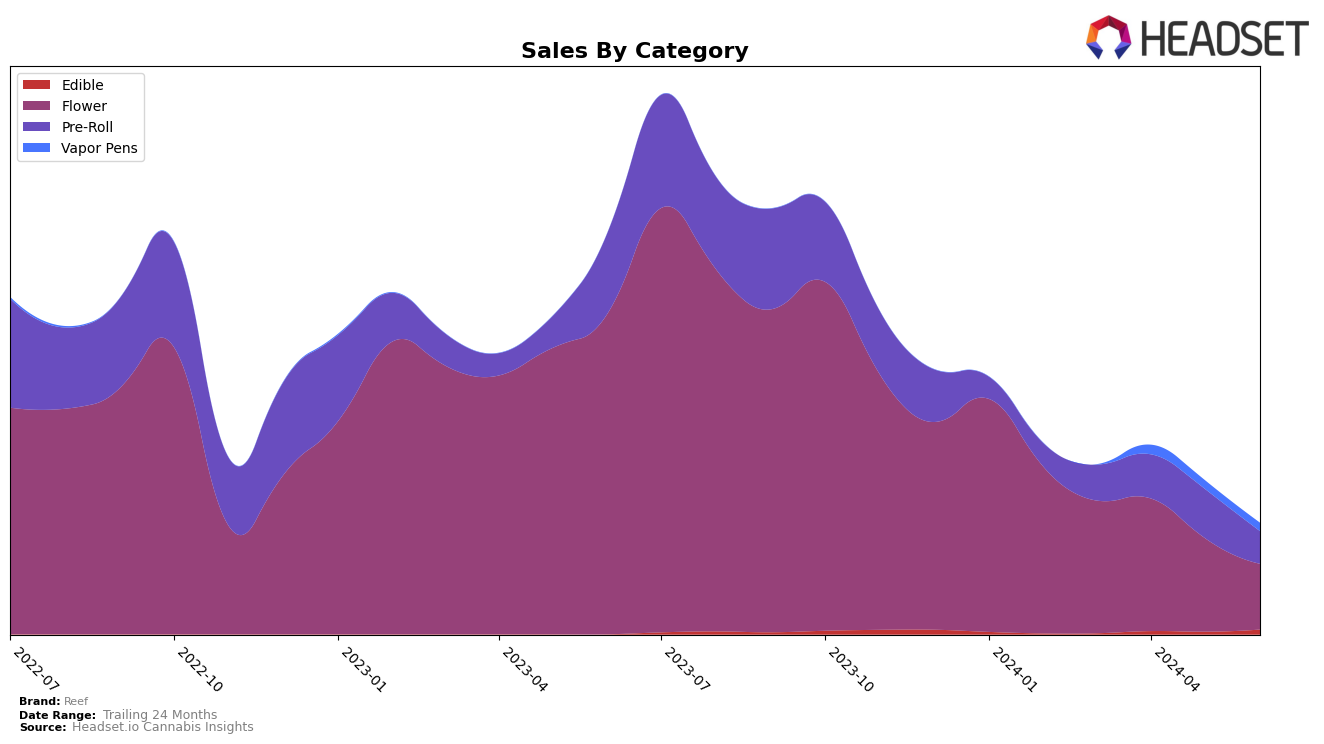

Reef's performance in the Flower category in Saskatchewan has shown notable fluctuations in recent months. As of March 2024, Reef did not make it into the top 30 brands, indicating a challenging market presence. By April 2024, the brand climbed to the 73rd position, which, while still outside the top 30, suggests some positive movement. However, subsequent months show that Reef did not maintain or improve this ranking, highlighting potential issues in sustaining market traction. This inconsistency can be seen as a warning sign for the brand, suggesting the need for strategic adjustments to gain a stronger foothold in the competitive Flower category in Saskatchewan.

Despite these challenges, there are some positive indicators for Reef's overall performance. The sales figures for March 2024 in Saskatchewan were $11,011, showcasing a solid revenue base. However, the absence of rankings for May and June 2024 indicates that Reef did not manage to secure a top 30 position, which could be a cause for concern. This trend suggests that while Reef has the potential to generate significant sales, its market position is not yet stable. Continued monitoring of their performance and strategic efforts to enhance brand visibility and consumer loyalty will be crucial for Reef's future success in Saskatchewan.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, Reef has faced significant challenges in maintaining its rank and sales. Notably, Reef did not appear in the top 20 brands for any month from March to June 2024, indicating a struggle to capture market share. In contrast, brands like DOJA and The Green Organic Dutchman have shown more consistent performance, with The Green Organic Dutchman maintaining a steady presence in the top 31 and even reclaiming its rank of 29 in May 2024. Additionally, Muskoka Grown demonstrated a notable decline from rank 23 in March to 41 in May, yet still remained within the top 50, suggesting some volatility but overall stronger positioning compared to Reef. North 40 Cannabis also showed fluctuations but managed to improve its rank to 62 by May. These trends highlight the competitive pressure Reef faces and underscore the need for strategic adjustments to improve its market standing and sales performance in Saskatchewan's Flower category.

Notable Products

In June 2024, Reef's top-performing product was the Queen Sangria Pre-Roll 3-Pack (1.5g), which climbed to the number one spot from its previous ranking of second place in May. The Queen SanG (3.5g) maintained a consistent performance, holding the second rank for the second consecutive month. The Queen SanG (1g), previously the top product, dropped to third place with sales figures of 398 units. The Queen SanG Pre-Roll (1g) remained steady at fourth place, mirroring its position from May. Additionally, the Strawberry Gummy (10mg) made its debut in the rankings, securing the fifth position with notable sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.