Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

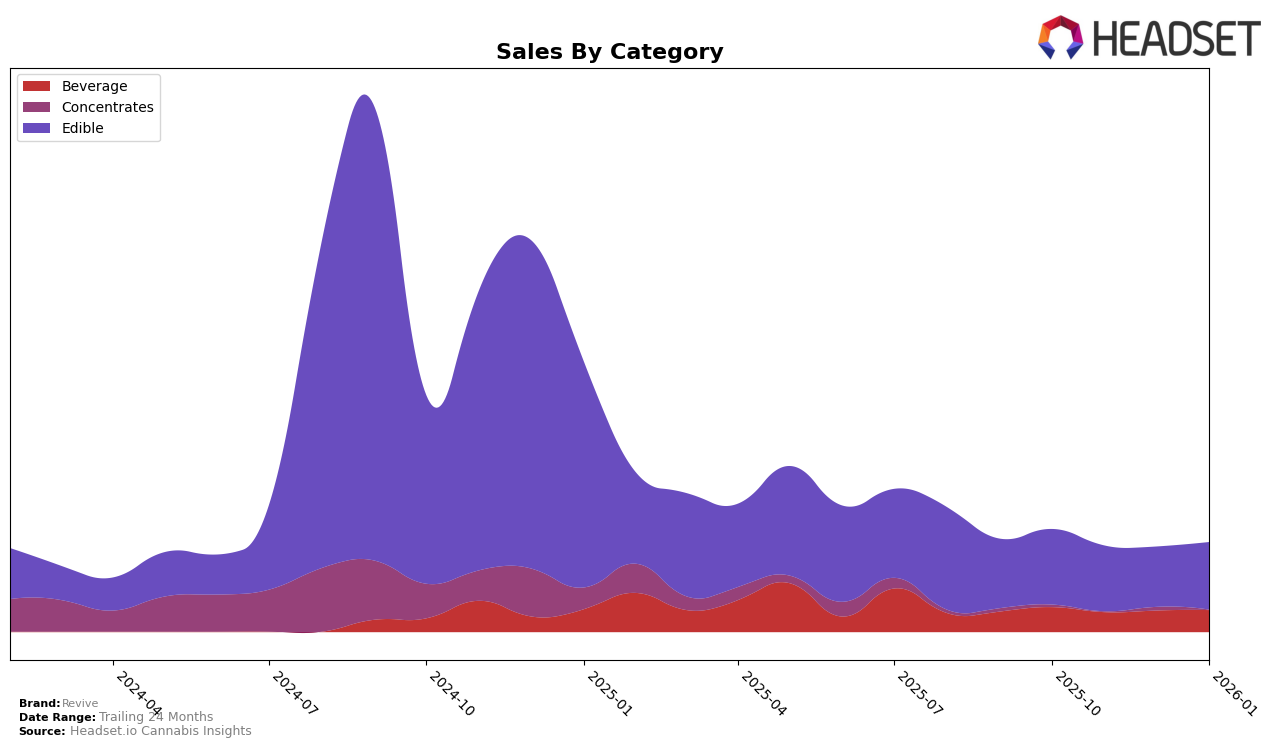

Revive has shown some interesting movements in the Edible category across different states over the recent months. In Ohio, the brand has not managed to break into the top 30 rankings, with its positions hovering around the 50s and 60s. Specifically, Revive was ranked 52nd in October 2025, and by January 2026, it improved slightly to the 55th position. This indicates a consistent struggle to gain a stronger foothold in the Ohio Edible market. The sales figures reflect this challenge, with a noticeable dip in November and December of 2025, followed by a slight recovery in January 2026. Such data suggests that while there is some resilience in Revive's performance, there is substantial room for improvement in this specific state and category.

It's crucial to note that Revive's absence from the top 30 rankings across these months highlights a significant hurdle in its market penetration efforts. This absence could be interpreted as a lack of competitive edge or market presence compared to other brands in the Edible category within Ohio. The fluctuating sales figures, although showing a minor uptick in January, indicate that Revive may need to reassess its strategies to capture more market share. This is particularly pertinent in a competitive landscape where brand visibility and consumer preference can dramatically alter sales trajectories. Understanding the dynamics at play in such markets is vital for Revive's future positioning and growth strategies.

Competitive Landscape

In the Ohio edibles market, Revive has faced notable competition, impacting its rank and sales trajectory. Over the observed months, Revive's rank fluctuated between 52nd and 60th, indicating a struggle to maintain a strong position. In contrast, Kynd Cannabis Company consistently ranked higher than Revive, although it eventually fell out of the top 50 by January 2026. Farmaceutical Rx (Frx) showed a volatile pattern, initially ranking lower but surpassing Revive in December 2025 before dropping significantly in January 2026. Meanwhile, The Goods demonstrated a positive trend, climbing from outside the top 50 to 48th by January 2026, suggesting a growing presence. Terra maintained a relatively stable ranking, consistently outperforming Revive. These dynamics highlight the competitive pressures Revive faces, with its sales remaining lower compared to these competitors, indicating a need for strategic adjustments to improve its market standing.

Notable Products

In January 2026, the Blue Razzberry Fruit Drink (100mg THC, 6.7oz) maintained its position as the top-performing product for Revive, continuing its lead from previous months with sales of 210 units. THC Rich Dark Chocolate (100mg) rose to second place, showing consistent demand with 200 units sold, a slight decrease from its December 2025 sales. The CBC/THC 3:1 Citrus Blossom Gummies 11-Pack held steady at third place, displaying a minor dip in sales compared to December. Strawberry Syrup made its debut in the rankings at fourth place, indicating growing interest in Revive's beverage category. Cookies & Cream Chocolate 10-Pack, although ranked fifth, showed an increase in sales from December, suggesting a potential upward trend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.