Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

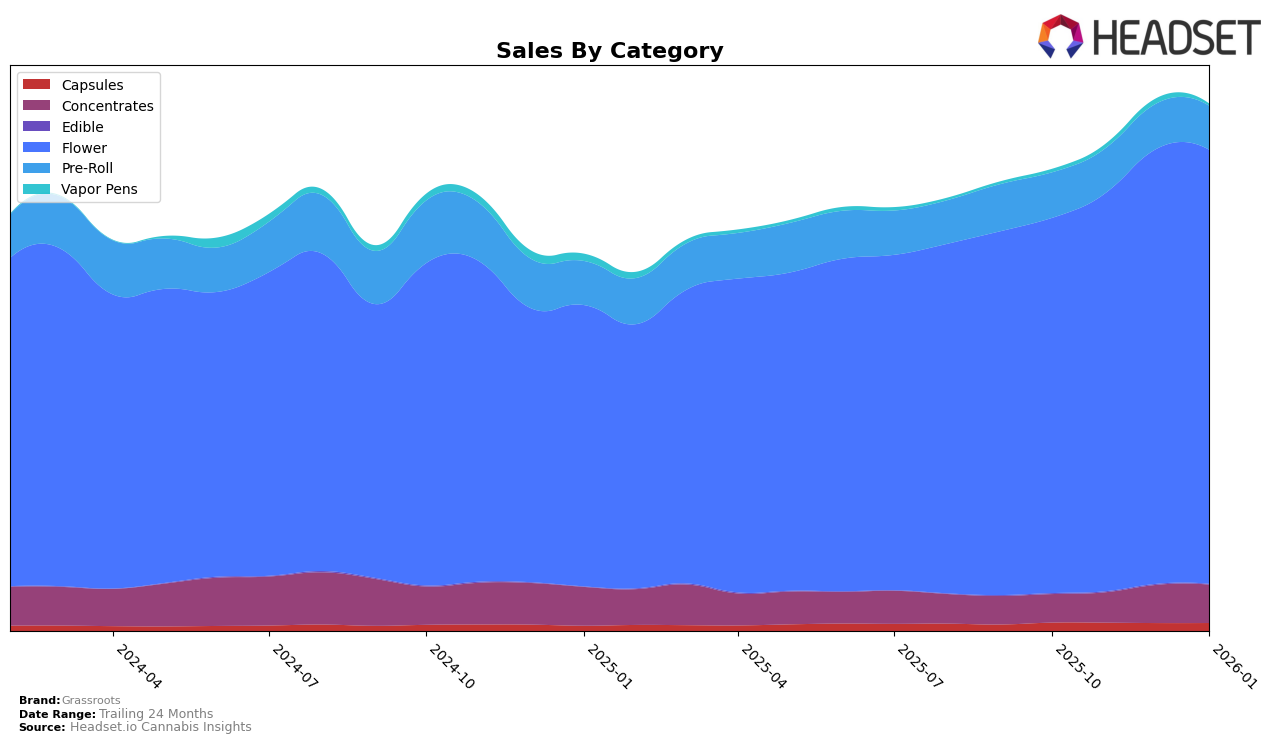

Grassroots has shown varied performance across different states and product categories. In the Arizona flower market, the brand maintained a steady presence, fluctuating between ranks 11 and 15 over the observed months, with a notable sales peak in December 2025. Meanwhile, in Connecticut, Grassroots made its first appearance in the top 30 flower brands in January 2026, securing the 12th position, signaling a positive entrance into the market. In Illinois, Grassroots held a consistent 9th rank in the flower category, but their pre-rolls saw a slight decline, dropping from 14th to 15th place by January 2026. This suggests a stable but competitive presence in the flower market, while pre-rolls face stiffer competition.

In Massachusetts, Grassroots demonstrated upward momentum in the flower category, climbing from 26th in October 2025 to 18th by January 2026, reflecting strong growth potential. In Maryland, the brand excelled in concentrates, moving up to the 2nd position and maintaining it through January 2026, while also showing improvement in the flower category. However, their pre-rolls in Maryland only appeared in the rankings in December 2025 at 15th place, indicating room for growth. New Jersey saw Grassroots entering the rankings in November 2025, gradually improving to 32nd by January 2026, which suggests an increasing acceptance in the flower market. In Nevada, Grassroots made significant strides in the flower category, climbing from 12th to 6th place, showcasing strong market penetration. Meanwhile, in Ohio, the brand saw fluctuations in both flower and pre-rolls, reflecting a dynamic market environment where Grassroots faces both opportunities and challenges to solidify its position.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Grassroots has experienced notable fluctuations in its ranking over the past few months, impacting its sales trajectory. In October 2025, Grassroots held a strong position at rank 4, but by November, it slipped to rank 7, and despite a brief recovery to rank 5 in December, it fell back to rank 7 in January 2026. This decline in rank correlates with a downward trend in sales, from $2,597,973 in October to $2,212,655 in January. Meanwhile, Neighborgoods has shown resilience, maintaining a relatively stable performance, while Eden's Trees surged dramatically from rank 13 in October to rank 2 in December, before settling at rank 6 in January, indicating a significant competitive pressure on Grassroots. Additionally, Savvy has been climbing steadily, reaching rank 9 by December and maintaining it in January, suggesting a growing threat. These shifts highlight the dynamic nature of the market and the need for Grassroots to strategize effectively to regain its competitive edge.

Notable Products

In January 2026, Grassroots saw Foreign Kush Mints (3.5g) rise to the top position in sales, marking a significant jump from its previous ranks of second and third in the preceding months. Triple Stack (3.5g) maintained its second position, despite a slight decrease in sales to 11,756 units. Titan Express (3.5g) slipped from its December lead to third place, showing a decrease in sales performance. Notably, the Titan Express Pre-Roll (1g) entered the rankings at fourth place, indicating growing interest in pre-roll products. Astro GMO (3.5g) debuted in fifth place, suggesting a positive reception for new product entries.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.