Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

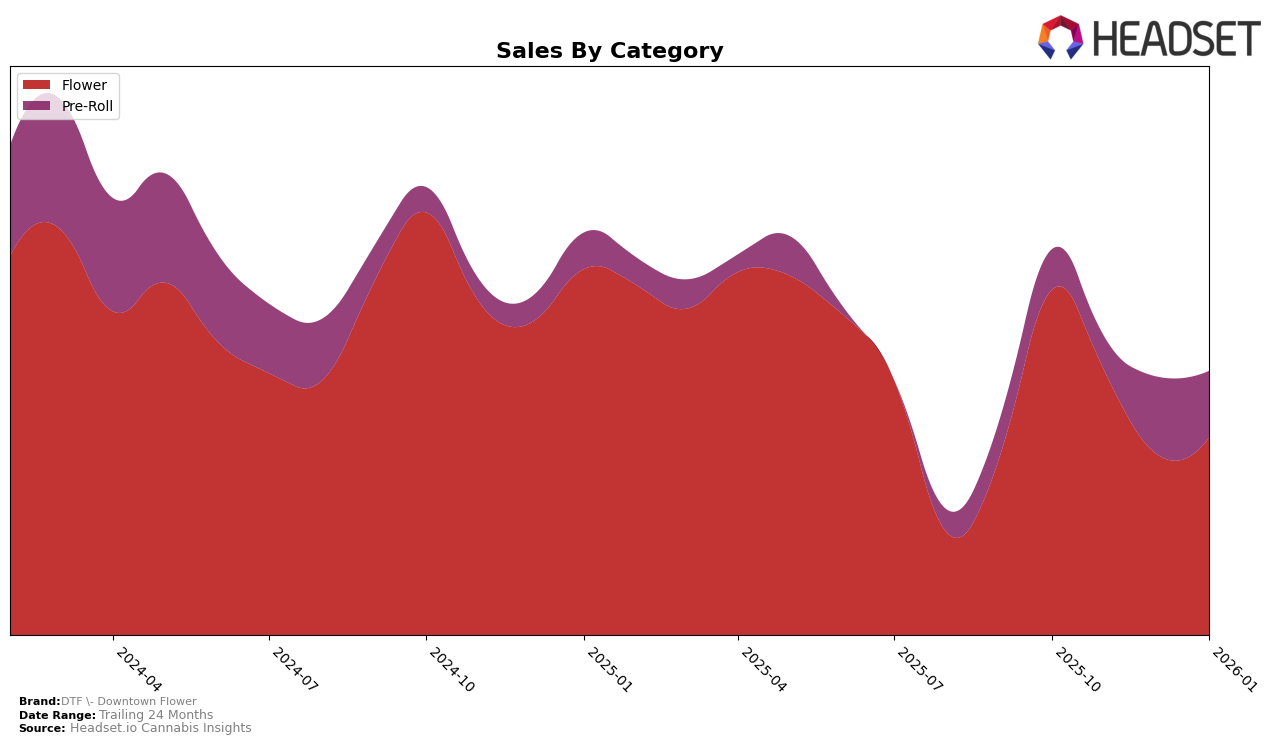

DTF - Downtown Flower has demonstrated varying performance across different categories and states, with notable movements in their rankings. In the Arizona market, the brand's presence in the Flower category has seen a decline from an 11th place rank in October 2025 to 24th in January 2026. This drop in ranking is indicative of a downward trend, which is further supported by a decrease in sales from $628,584 in October 2025 to $416,869 in January 2026. While this decline might be concerning, it's essential to consider the competitive nature of the market and potential external factors influencing sales and rankings.

In contrast, DTF - Downtown Flower has shown resilience in the Pre-Roll category within Arizona. The brand improved its ranking from 17th in October 2025 to 14th in December 2025, before slightly dropping to 15th in January 2026. Despite this minor fluctuation, the brand's sales in this category have remained relatively strong, with a notable increase from $191,260 in October 2025 to $243,827 in December 2025. This upward trend in sales, even amidst a competitive landscape, highlights the brand's potential strength and appeal in the Pre-Roll category, which may offer opportunities for further growth and stabilization in the future.

Competitive Landscape

In the competitive landscape of the Arizona flower category, DTF - Downtown Flower has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 11th in October 2025, DTF saw a decline to 16th in November and further dropped out of the top 20 by December, before slightly recovering to 24th in January 2026. This downward trend in rank is mirrored by a decrease in sales, suggesting potential challenges in maintaining market share. In contrast, Connected Cannabis Co. showed a more stable performance, maintaining a presence in the top 20 until January, when it fell to 22nd. Meanwhile, Savvy experienced a similar decline, dropping from 16th to 23rd over the same period. Brands like Cheech & Chong's and Aeriz consistently remained outside the top 20, indicating a more stable but lower market presence. These dynamics highlight the competitive pressures DTF faces and underscore the importance of strategic adjustments to regain and sustain a higher market position in Arizona's flower category.

Notable Products

In January 2026, the top-performing product from DTF - Downtown Flower was Premium Toasted Swirl Pre-Roll (1g) with a notable sales figure of 9014. Premium - True Mintz Pre-Roll (1g) secured the second spot, followed by Dark Queen Pre-Roll (1g) in third place. Hibiscuits Pre-Roll (1g) and Cali Lightning Pre-Roll (1g) rounded out the top five positions. Compared to previous months, these products were not ranked, indicating a significant surge in popularity and sales for January 2026. The rise in rankings suggests a successful market strategy or increased consumer demand for these pre-rolls during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.