Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

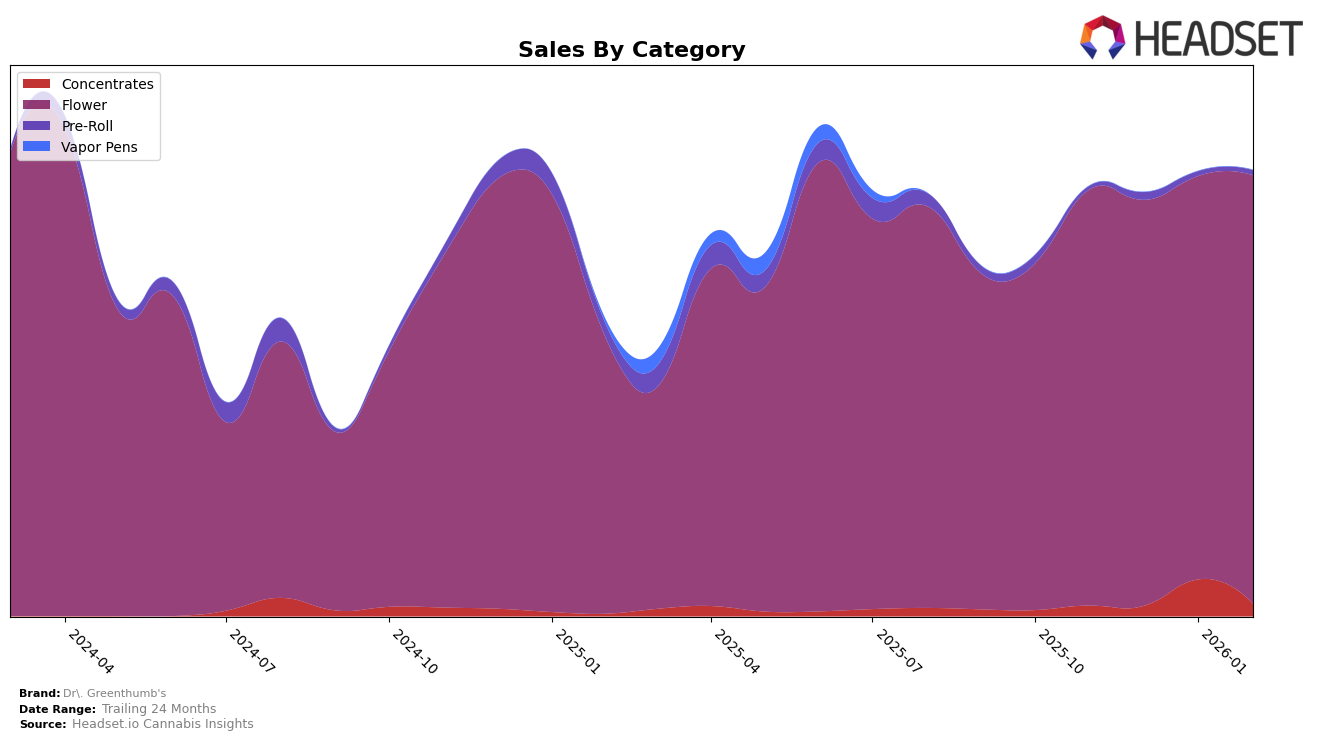

Dr. Greenthumb's has demonstrated varied performance across different categories and states, reflecting both opportunities and challenges in its market presence. In Arizona, the brand's performance in the Concentrates category has seen significant fluctuations, with a notable improvement in January 2026 where it jumped to the 15th position from being outside the top 30 in previous months, although it slipped back to 31st in February. This volatility suggests a competitive landscape where Dr. Greenthumb's is making strides but also facing stiff competition. Meanwhile, in the Flower category, the brand has maintained a strong presence, consistently ranking within the top 10, indicating a robust market position in Arizona's Flower segment.

In contrast, Dr. Greenthumb's presence in Illinois has been less prominent, particularly in the Flower category. The brand did not make it into the top 30 in November 2025, but it has shown some progress, climbing to the 67th position by January 2026. This suggests a gradual, albeit slow, increase in brand recognition and market penetration within the state. The absence from the top 30 in November highlights the competitive nature of the Illinois market, where Dr. Greenthumb's faces significant challenges in establishing a foothold. However, the upward movement in subsequent months could indicate potential for future growth if the brand continues to enhance its market strategies.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Dr. Greenthumb's has experienced a slight decline in rank from November 2025 to February 2026, moving from 6th to 8th place. This shift is notable as competitors like Curaleaf have shown a significant upward trend, climbing from 10th to 6th place, indicating a potential increase in market share and consumer preference. Meanwhile, Fenix has also been a strong contender, peaking at 5th place in January 2026 before settling at 7th in February. Despite these challenges, Dr. Greenthumb's maintains a competitive sales performance, although it has not matched the aggressive growth seen by some rivals. The brand's ability to sustain its position amidst fluctuating rankings suggests a stable customer base, but the rise of competitors like Abundant Organics, which rebounded to 8th place in January, highlights the dynamic nature of the market and the need for strategic adjustments to regain higher rankings.

Notable Products

In February 2026, Master Kush 14g emerged as the top-performing product for Dr. Greenthumb's, maintaining its rank from December 2025 with sales reaching 2,459 units. Lit OG 14g climbed to the second spot, improving from its fifth position in December 2025, indicating a notable sales increase. Mother's Milk 3.5g held steady in third place, showing consistent performance since its introduction in January 2026. Motor Breath 14g secured the fourth position, demonstrating a strong entry in the rankings. Finally, Master Kush 3.5g rounded out the top five, showing a promising debut in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.