Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

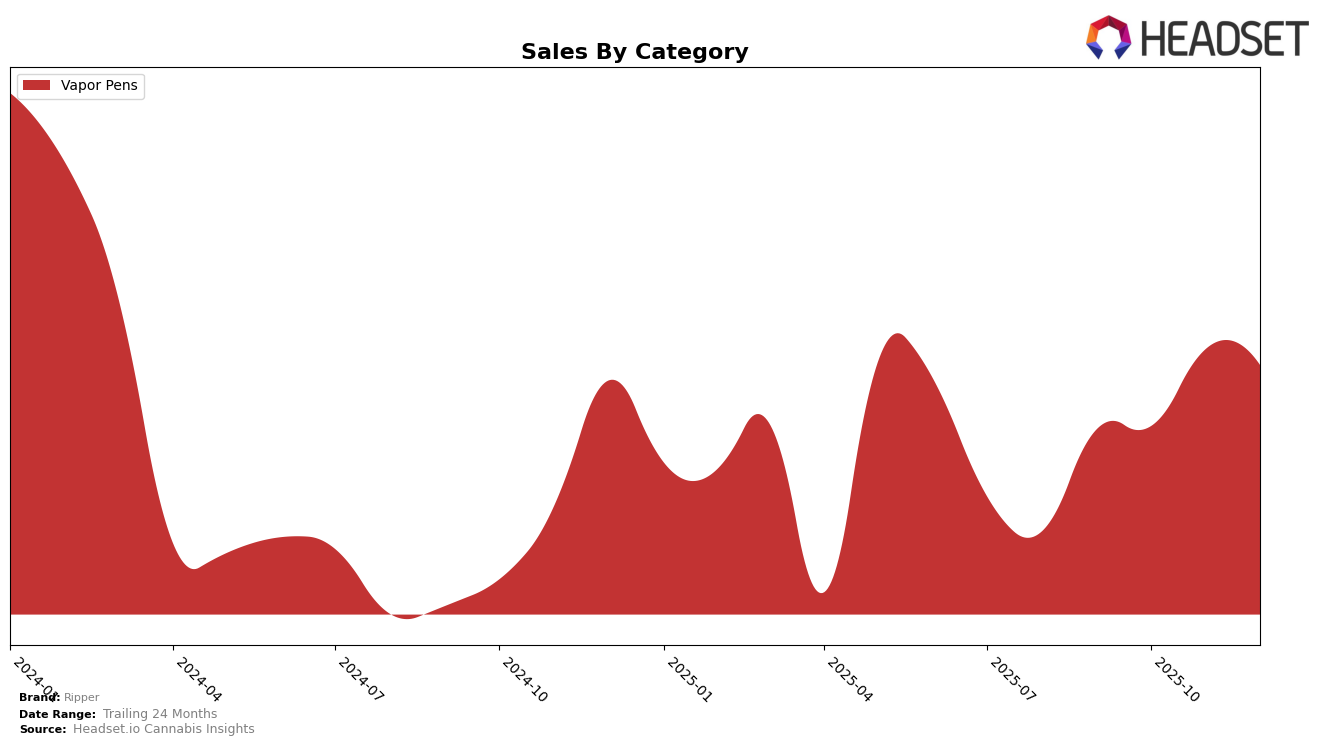

Ripper's performance in the Vapor Pens category across different states has shown some interesting dynamics over the last few months. Notably, in Nevada, Ripper has made a significant comeback. After dropping out of the top 30 in October 2025, the brand regained its footing by November, climbing back to the 27th position and maintaining it through December. This resurgence is underscored by a notable increase in sales, peaking in November before slightly declining in December. The ability to recover and maintain a position in a competitive market like Nevada highlights Ripper's resilience and adaptability in the Vapor Pens category.

However, it's important to note that Ripper's presence in other states and categories remains less prominent, as indicated by the absence of rankings in several regions. This could suggest either a strategic focus on specific markets or challenges in penetrating other areas. The fluctuations in rankings and sales in Nevada provide valuable insights into consumer preferences and market dynamics, but they also raise questions about Ripper's broader market strategy and performance in other states. These insights could be crucial for stakeholders looking to understand Ripper's market positioning and potential growth opportunities.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Ripper has shown a dynamic shift in its market position from September to December 2025. Initially ranked 30th in September, Ripper experienced a slight dip to 32nd in October, before climbing to 27th in both November and December. This upward trend in rank, despite being outside the top 20, indicates a positive momentum in sales performance, contrasting with some competitors. For instance, Matrix NV saw a decline from 20th to 25th, with a notable drop in sales over the same period. Meanwhile, BOUNTI experienced fluctuating ranks, peaking at 18th in November but falling to 28th by December. The entry of Bonanza Cannabis Company into the rankings in December at 26th further intensifies competition. These dynamics suggest that Ripper's strategic initiatives may be effectively capturing market share, even as the competitive field evolves.

Notable Products

In December 2025, the top-performing product from Ripper was the Sugar Tits Live Resin Disposable (0.85g) in the Vapor Pens category, which moved up from fourth place in November to secure the top spot with sales reaching 277 units. The Mclovin Live Resin Disposable (0.85g) debuted strongly in second place, indicating a successful launch. The Lemon Cherry Gelato Live Resin Disposable (0.85g) ranked third, showing consistent performance among the Vapor Pens. GPxAB Live Resin Disposable (0.85g) dropped to fourth place after leading in November, highlighting a shift in consumer preference. The Diamond Bar Live Resin Disposable (0.85g) re-entered the rankings in fifth place, demonstrating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.