Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

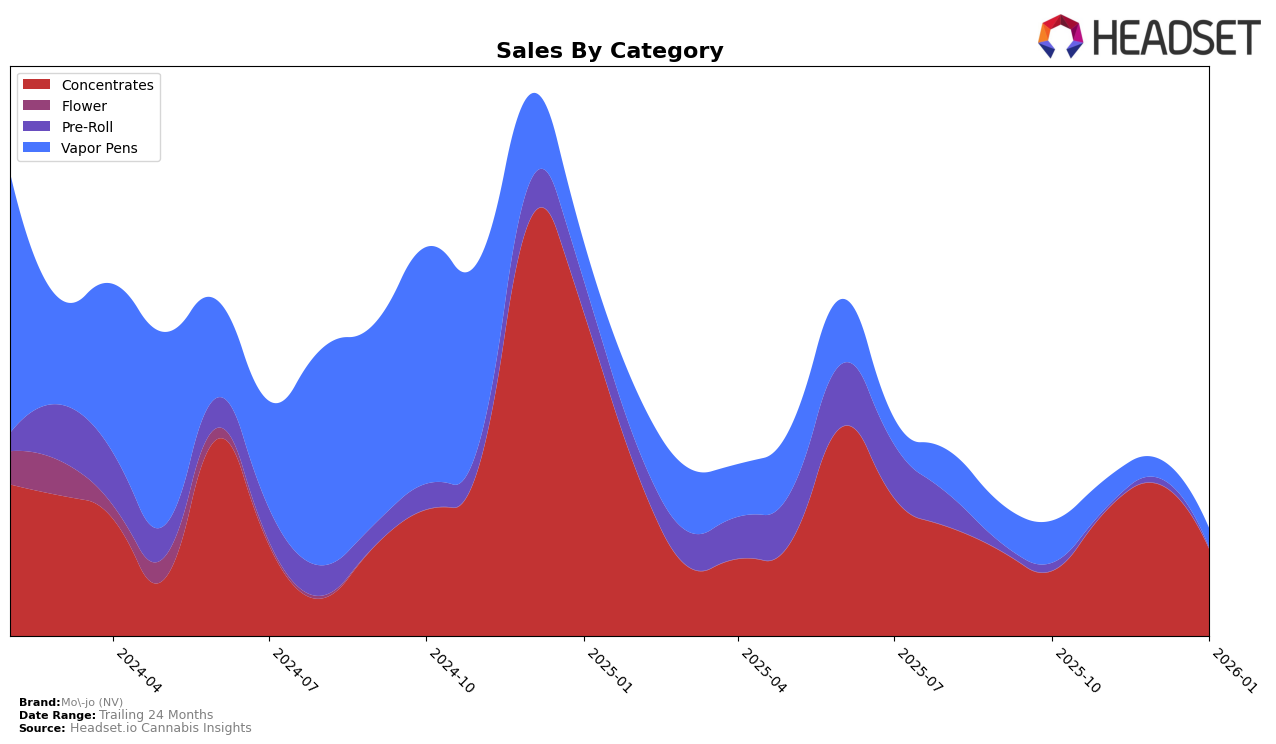

Mo-jo (NV) has demonstrated a notable presence in the Nevada market, particularly within the Concentrates category. Over the four-month period from October 2025 to January 2026, the brand has experienced both upward and downward movements in its rankings. Starting at 20th place in October, Mo-jo (NV) climbed to an impressive 11th position by December, showcasing a strong upward trajectory. However, by January, their ranking slipped slightly to 16th. This fluctuation might suggest competitive pressures or changes in consumer preferences within the category. Despite the ranking drop in January, the brand's sales in the Concentrates category peaked in December, indicating a strong performance during the holiday season.

In contrast, Mo-jo (NV) faced challenges in the Vapor Pens category, where it did not break into the top 30 rankings for November and December 2025, as well as January 2026. The absence from the top rankings during these months highlights potential difficulties in gaining traction or maintaining market share in this category. In October, the brand was ranked 50th, and by November, it had dropped to 55th before disappearing from the top 30 altogether. This trend suggests that while Mo-jo (NV) has found success with Concentrates, there may be strategic considerations or market dynamics impacting its performance in Vapor Pens. Further analysis could provide insights into whether this is due to increased competition, changes in consumer demand, or other factors.

Competitive Landscape

In the Nevada concentrates category, Mo-jo (NV) has demonstrated a dynamic performance over the past few months, with notable fluctuations in both rank and sales. Starting in October 2025, Mo-jo (NV) was ranked 20th, but by December 2025, it had climbed to an impressive 11th place, showcasing a significant upward trajectory in sales. However, by January 2026, it experienced a slight dip to 16th place. This fluctuation is particularly interesting when compared to competitors such as CAMP (NV), which saw a dramatic rise from 23rd in October to 10th in November, before stabilizing around the mid-teens. Meanwhile, Khalifa Kush maintained a relatively stable position, consistently appearing in the top 15, except for December when it dropped out of the top 20. Nature's Chemistry also showed variability, peaking at 11th in October but falling out of the top 20 by December. These trends suggest that while Mo-jo (NV) has been gaining traction, the competitive landscape remains volatile, with brands like CAMP (NV) and Khalifa Kush posing significant competition.

Notable Products

In January 2026, the top-performing product for Mo-jo (NV) was Runtz Cured Resin Badder (1g) in the Concentrates category, achieving the number one rank with sales of 229 units. Following closely, GMO Cured Resin Badder (1g) held the second position, while Z Cake Live Resin Badder (1g) secured the third spot. Jelly Cake Live Resin (1g) and Chem Mintz Live Resin (1g) occupied the fourth and fifth ranks, respectively. This marks a notable debut for these products in the rankings, as they were not listed in the top five in the preceding months of October, November, or December 2025. The shift in rankings highlights a strong start to the year for Mo-jo (NV) with a clear focus on their Concentrates line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.