Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

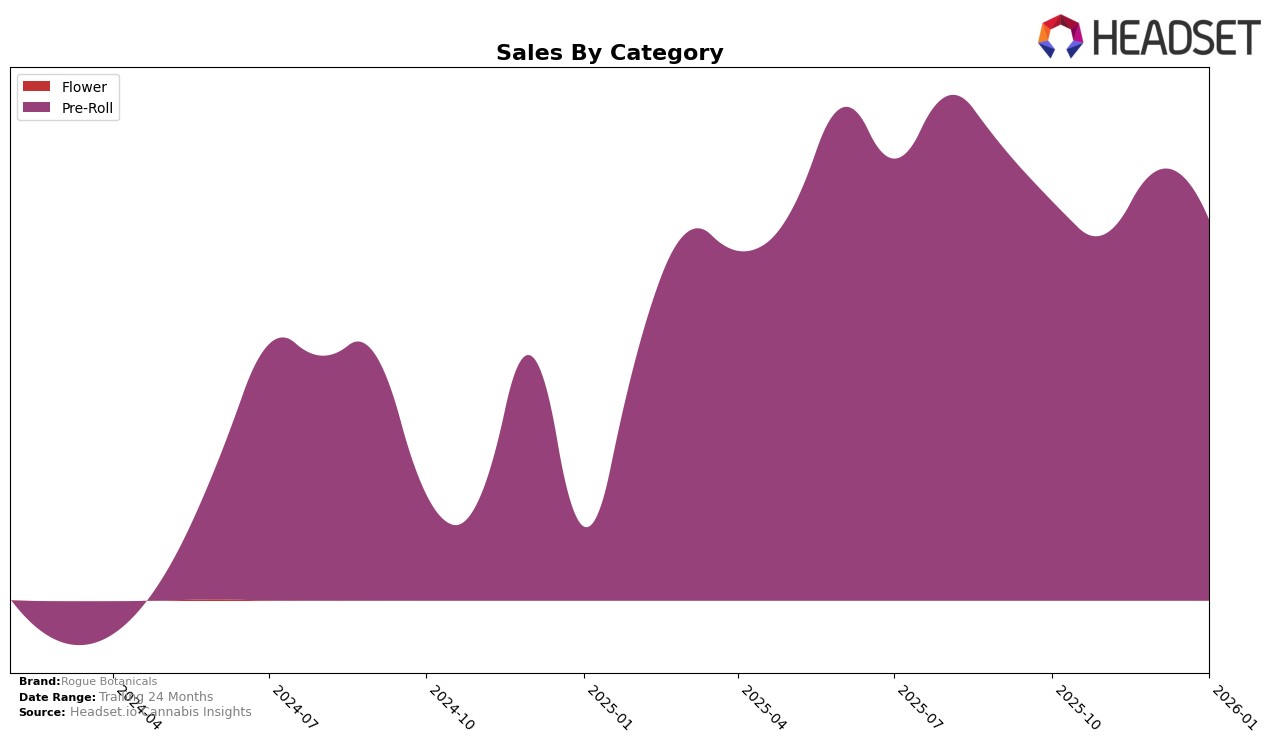

Rogue Botanicals has shown notable performance in the Pre-Roll category in Saskatchewan. Over the four-month period from October 2025 to January 2026, the brand experienced fluctuations in its rankings. Starting at 10th place in October, it dropped to 13th in November, before climbing back to 9th in December and maintaining that position into January. This indicates a resilient presence in the market, with a slight dip in November followed by a recovery. The sales figures reflect this trend, with a peak in December, suggesting strong consumer demand during that month.

Interestingly, Rogue Botanicals consistently ranked within the top 15 brands in the Pre-Roll category in Saskatchewan, which highlights its competitive edge in this market. The brand's ability to stay within the top 10 for two out of the four months suggests a solid consumer base and effective market strategies. However, it is worth noting that if a brand is missing from the top 30 rankings in any category or state, it could indicate areas where there is room for growth or a need for strategic adjustments. Rogue Botanicals' consistent presence in the rankings demonstrates its strong positioning, but understanding its performance in other categories and regions could provide a more comprehensive view of its market dynamics.

Competitive Landscape

In the competitive landscape of the Saskatchewan pre-roll category, Rogue Botanicals has demonstrated resilience and consistency in maintaining its market position. Despite fluctuations in sales, Rogue Botanicals held a steady rank, moving from 10th in October 2025 to 9th by January 2026. This stability is noteworthy given the dynamic shifts observed among competitors. For instance, Jackpot made a significant leap from 32nd to 11th place over the same period, indicating aggressive growth strategies. Meanwhile, Elevator experienced a drop from 9th to 16th in December 2025 before recovering to 10th in January 2026, suggesting volatility in their market approach. Ritual Green / Ritual Gold consistently outperformed Rogue Botanicals, maintaining a top 10 position, while Space Race Cannabis showed strong sales but slipped from 3rd to 7th, reflecting possible market saturation or strategic shifts. These dynamics highlight the competitive pressures Rogue Botanicals faces, yet its ability to sustain a top 10 ranking underscores its effective market presence and customer loyalty.

Notable Products

In January 2026, the Cambodian Pre-Roll 4-Pack (2g) maintained its position as the top-performing product for Rogue Botanicals, continuing its streak from the previous months. This product has consistently held the number one rank since October 2025, demonstrating strong consumer preference. Notably, the sales figures for this pre-roll reached 5,911 units in January, showing a slight decrease from December 2025. Despite this dip, its consistent ranking indicates a stable demand. There were no changes in the top rank for this category, highlighting its dominance in the market over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.