Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

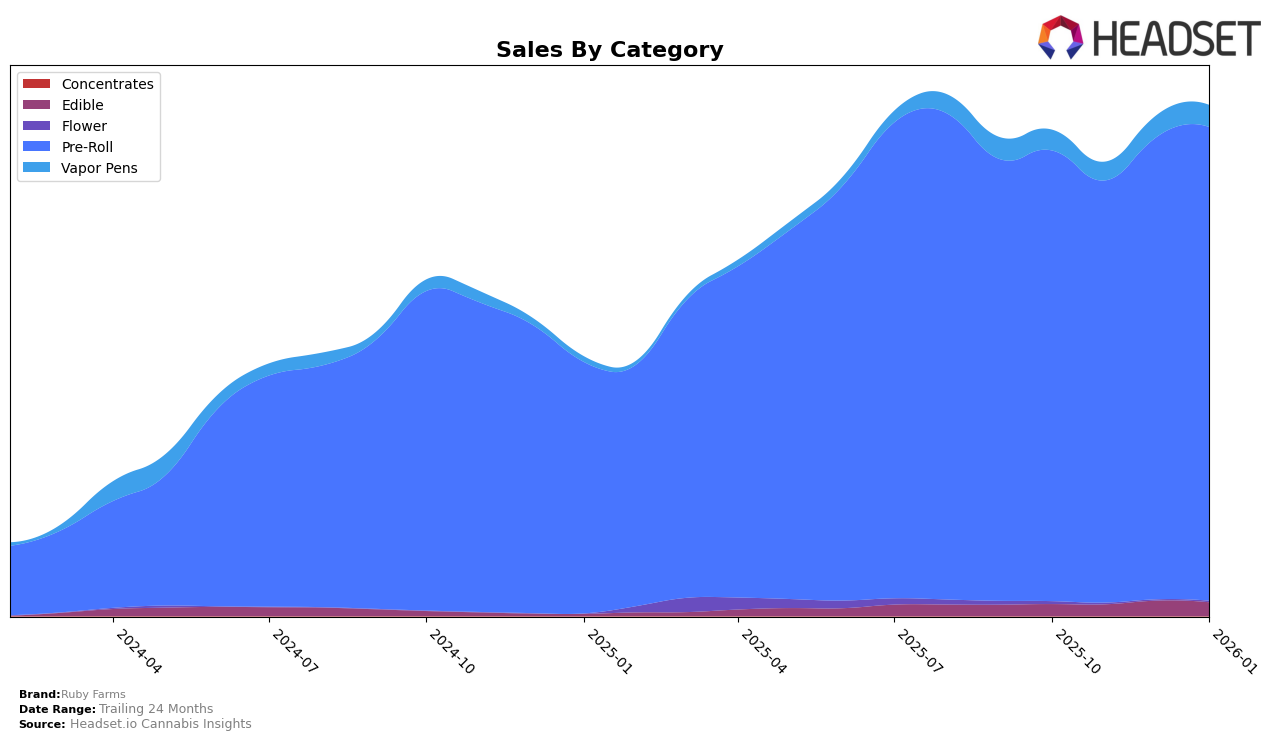

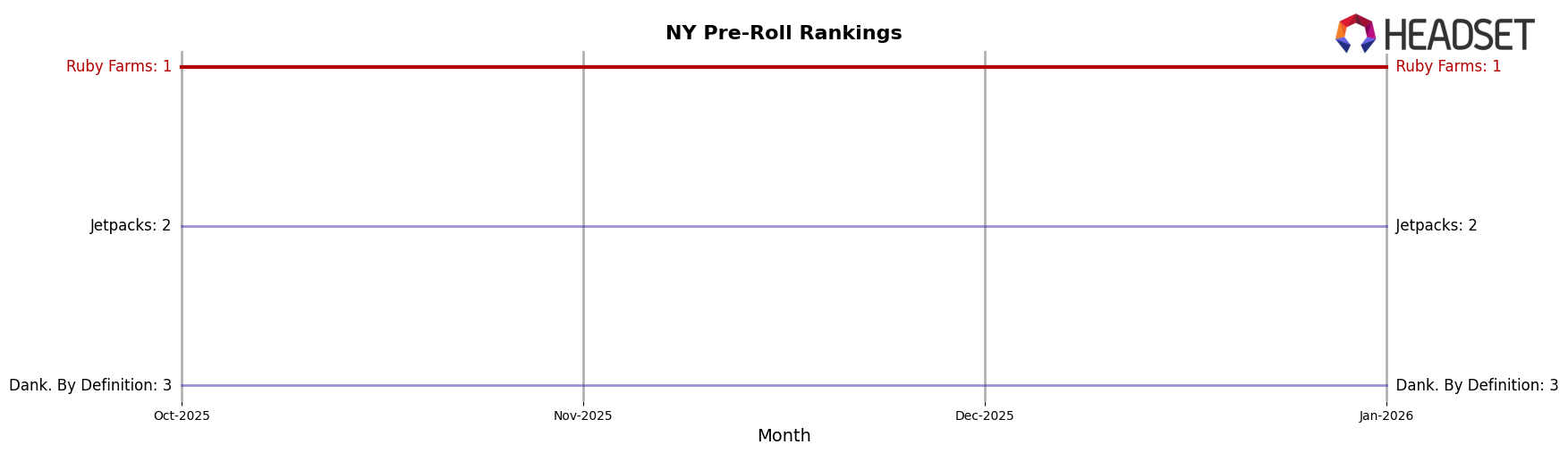

Ruby Farms has demonstrated varied performance across different product categories in New York. Notably, in the Pre-Roll category, Ruby Farms has maintained a consistent top position, ranking 1st from October 2025 through January 2026, which indicates a strong and stable market presence. However, the Edible category shows a less dominant performance with rankings fluctuating between 26th and 28th over the same period. This suggests that while Ruby Farms has a foothold in the Edible market, there's room for improvement to strengthen its position. In contrast, the Vapor Pens category reveals a more challenging landscape, with Ruby Farms not breaking into the top 30 rankings, indicating a potential area for strategic growth or reevaluation.

The sales data for Ruby Farms further highlights these trends. While the Pre-Roll category has seen a steady increase in sales, peaking in January 2026, the Edible category experienced a noticeable sales boost in December 2025 before declining slightly in January 2026. This could suggest seasonal influences or successful promotional activities during the holiday season. Meanwhile, despite being outside the top 30, the Vapor Pens category still shows some sales activity, hinting at a niche market presence that might be capitalized on with targeted strategies. Overall, Ruby Farms' performance across these categories in New York underscores both its strengths and opportunities for growth.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, Ruby Farms has consistently maintained its top position from October 2025 through January 2026. Despite a slight fluctuation in sales, with a dip in November 2025 followed by a recovery in December and January, Ruby Farms has outperformed its competitors significantly. Jetpacks, which holds the second position consistently, has sales figures that are less than half of Ruby Farms'. Meanwhile, Dank. By Definition remains in third place, with sales figures trailing even further behind. Ruby Farms' ability to maintain its number one rank amidst these fluctuations highlights its strong market presence and consumer loyalty in the New York Pre-Roll segment.

Notable Products

In January 2026, Ruby Farms' top-performing product remains the Doobies White Widow Pre-Roll 7-Pack (3.5g) in the Pre-Roll category, maintaining its number one rank for four consecutive months, with sales totaling $8,978. The Doobies Sour Diesel Pre-Roll 7-Pack (3.5g) also held steady in the second position, showcasing consistent demand. The Doobies Blue Dream Pre-Roll 7-Pack (3.5g) continued its streak in the third rank, indicating stable consumer preference. A notable change was the introduction of the Doobies Granddaddy Purple Pre-Roll 7-Pack (3.5g) entering the rankings at fourth place, highlighting its growing popularity. Meanwhile, the Classics White Widow Pre-Roll 7-Pack (5g) maintained its fifth position, showing a slight increase in sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.