Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

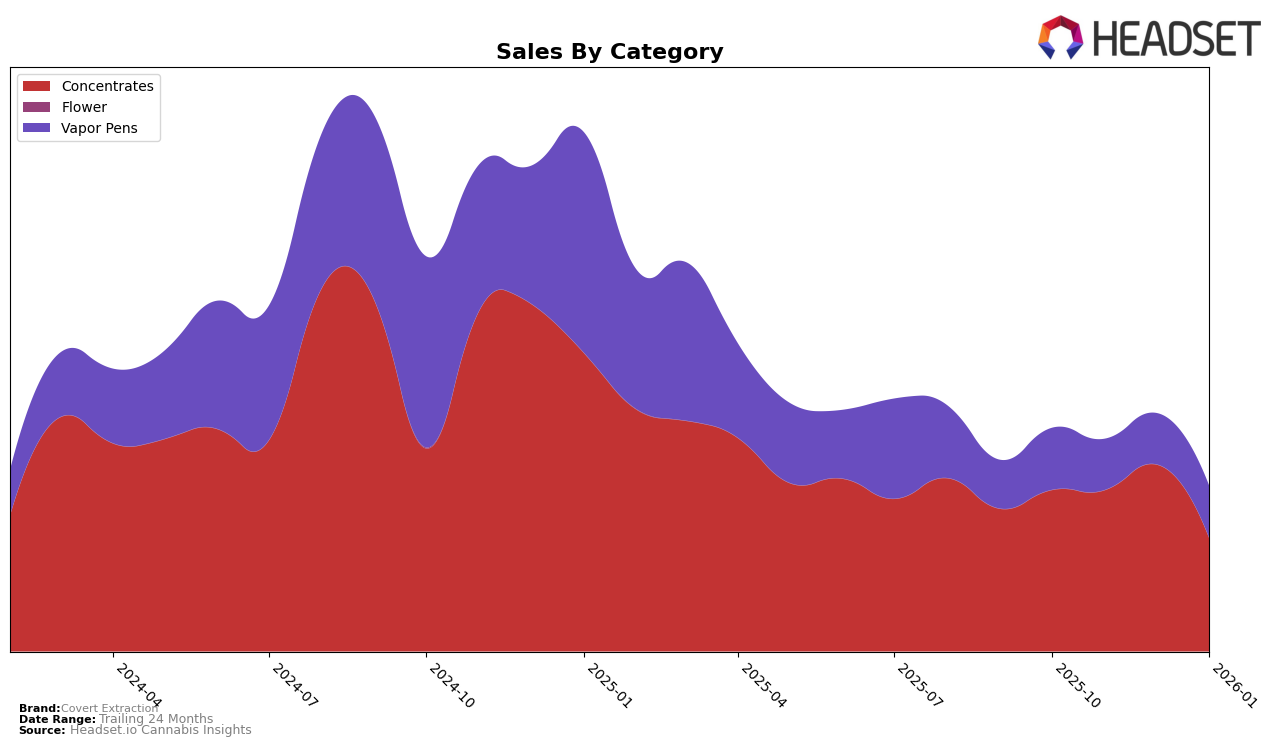

Covert Extraction has shown varied performance across different states and categories. In Missouri, the brand has maintained a steady presence in the Concentrates category, with rankings fluctuating slightly between 25th and 27th place over the four-month period. Despite this stability, the sales figures indicate a slight decline from December to January, which could be a point of concern if the trend continues. In contrast, their performance in the Vapor Pens category has been less impressive, consistently ranking outside the top 30, which suggests that Covert Extraction might need to reassess its strategy in this segment to capture more market share.

Meanwhile, in Oregon, Covert Extraction experienced a significant drop in the Concentrates category, plummeting from 23rd place in December to 46th in January. This sharp decline might be indicative of increased competition or a shift in consumer preferences. The sales data supports this, showing a marked decrease in January. Such a movement out of the top 30 is generally not favorable, as it suggests a loss of competitive edge. Monitoring these trends and identifying underlying causes will be crucial for Covert Extraction to regain its footing and improve its market position in Oregon.

Competitive Landscape

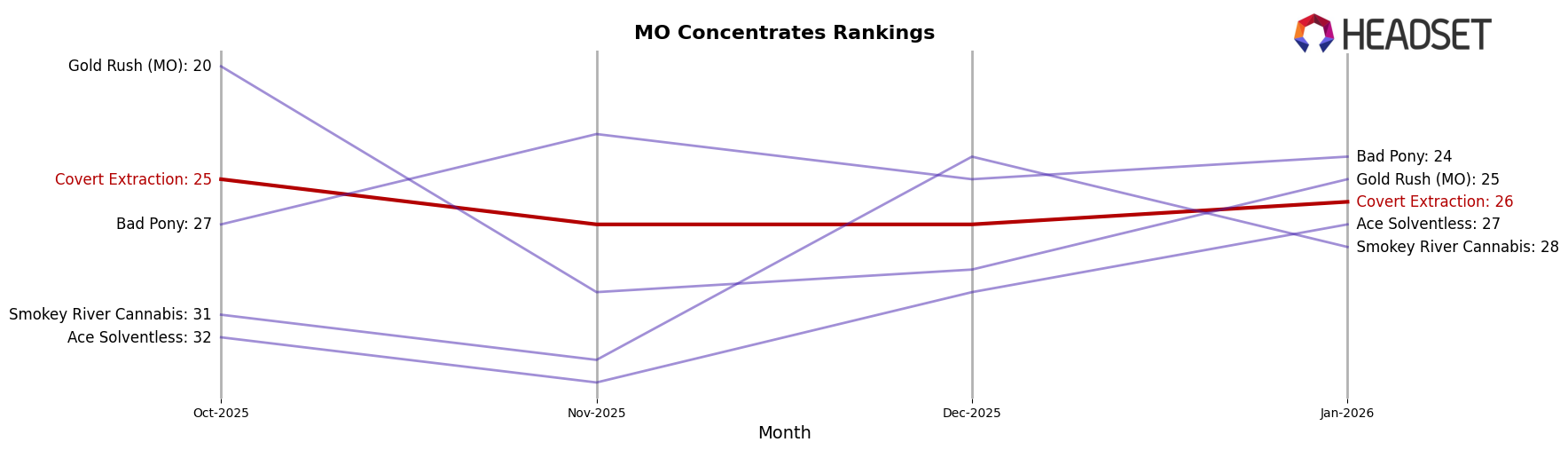

In the Missouri concentrates market, Covert Extraction has shown a consistent presence, though it faces stiff competition from several notable brands. Over the past few months, Covert Extraction's rank has hovered around the mid-20s, with a slight dip to 27th in November and December 2025, before improving to 26th in January 2026. This fluctuation in rank is indicative of a competitive landscape where brands like Gold Rush (MO) and Bad Pony are also vying for market share. Notably, Bad Pony has shown a stronger performance, surpassing Covert Extraction in January 2026 with a rank of 24th. Meanwhile, Smokey River Cannabis experienced a significant jump in December 2025, briefly overtaking Covert Extraction, but then fell back to 28th in January 2026. These dynamics suggest that while Covert Extraction maintains a stable position, it must strategize to enhance its appeal and sales to climb higher in the rankings amidst fierce competition.

Notable Products

In January 2026, Covert Extraction's top-performing product was Gary Payton Live Resin (1g) in the Concentrates category, achieving the number one rank with sales of 458 units. Melted Strawberry Sugar Wax (1g), also in the Concentrates category, was ranked second, having previously held the top position in December 2025. Tropicanna Haze Wax (2g) made its debut in the rankings at third place, indicating a strong entry into the market. Strawberry Kiwi Distillate Cartridge (1g) in the Vapor Pens category secured the fourth position, while Guava Jam Sugar Wax (1g) dropped from its November 2025 first-place rank to fifth. These shifts highlight a dynamic competitive landscape within Covert Extraction's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.